Majors have shown little developments during the Asian session, waiting in cautious mode for the upcoming FOMC decision later on this afternoon. The US Central Bank is expected to maintain its rates on hold this month, and no press conference is scheduled for after the decision. But the market is expecting a generally hawkish tone in where to find clues on the upcoming rate hike anticipated early this year.

September seems to be the date and a change in the wording, welcoming the latest economic progress, will be a way to convince the markets the FED will move in its next meeting. A dovish tone, and no change in the wording, will signal the FED may want to wait further, stretching the date of the lift-off towards December and therefore weigh on the greenback

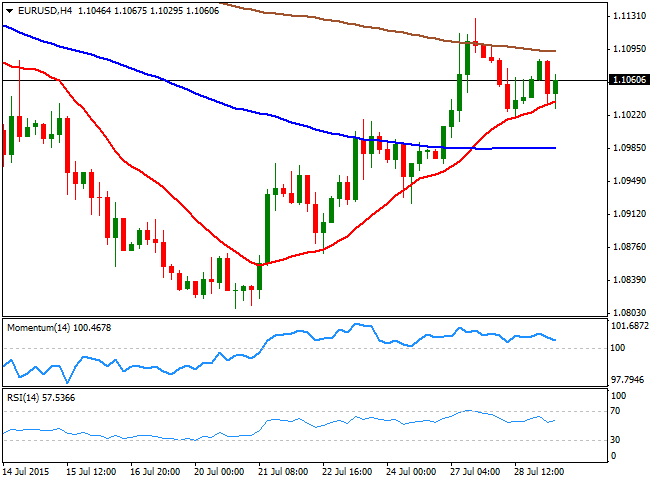

View live chart of the EUR/USD

The EUR/USD pair has been trading in a limited range around the 1.1050 level, now bouncing from a daily low set at 1.1029. The 4 hours chart shows that the price is holding above a bullish 20 SMA, whilst the RSI indicator has resumed its advance above the 50 level, albeit the Momentum indicator has lost its upward strength and turned lower above 100. The critical resistance level for the upcoming hours will be the 1.1120 price zone, this week high and a strong static resistance level, as it will take a break above to confirm additional advances towards 1.1160 and 1.1200.

Below 1.1020 on a strong dollar on the other hand, should see the pair accelerating south, eyeing the 1.0950 region as the probable bearish target.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.