The EUR/USD pair is in recovery mode, having advanced up to 1.1124, after being as low as 1.0954 at the beginning of the day. The escalating Greek crisis over the weekend, with Tsipras decision to breakout all negotiations and call for a referendum, Draghi maintaining the ELA at Friday's levels, and Varoufakis imposing capital controls, was behind the bearish opening gap.

Investors run towards safe-havens, with strong demand of JPY and CHF and limited one on Gold, that has jumped towards 1,190 but erased most of its early gains. As for the CHF, the SNB governor Jordan, has announced an early intervention, to prevent further appreciation of the Swissy, backing up the latest EUR demand.

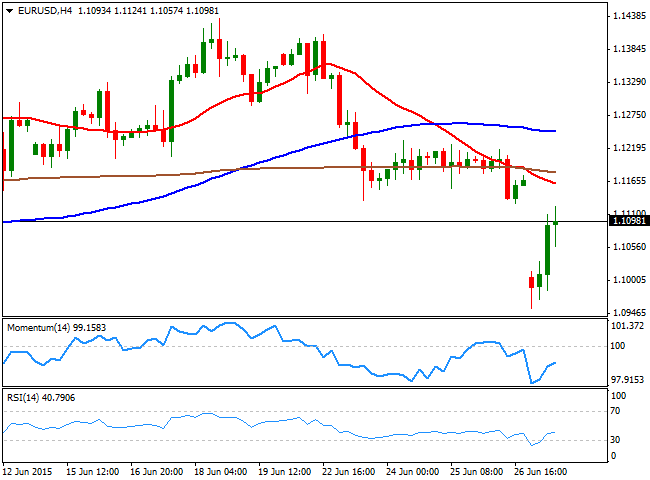

View live chart of the EUR/USD

The 4 hours chart for the pair shows that it is now struggling to hold above the 1.1100 figure, whilst the technical indicators have barely corrected extreme oversold conditions, and are now losing their upward strength well into negative territory. In the same chart, the 20 SMA maintains a strong bearish slope above the current price, limiting advances around 1.1160, Friday's close.

Should the price extend beyond 1.1124, the mentioned daily high, there's a good chance the pair will fill the gap and advance up to the mentioned 1.1160 level, where selling interest is expected to resume. The immediate support on the other hand, comes at 1.1050, with a break below signaling a downward extension towards 1.1000 first, and 1.0960 later on in the day.

Latest updates on the EUR/USD Forecast

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.