Aside from the normal scheduled data, market is being affected late Friday, by news Ukrainian forces attacked in Eastern Ukraine a Russian military convoy to stop humanitarian aid to the region, sending stocks strongly down across the world, and boosting gold and yen. The dollar however, seems to have temporarily lost its safe haven charm, short term down against the EUR.

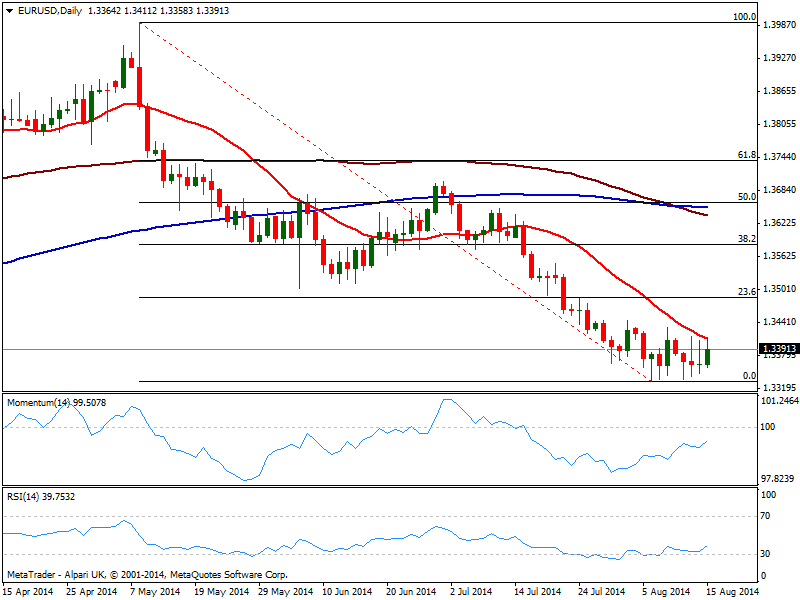

The bigger picture however, is a still bearish for the EUR/USD with the daily chart showing price retraced from a bearish 20 SMA, while indicators corrected oversold readings, but remain in negative territory. The weekly chart presents a clearer bearish tone, with indicators still heading south in negative territory, and candles showing lower highs and lower lows. But with the large amount of shorts in the pair according to latest COT report, the downside has remained limited, as market has been unable to shrug off some of those bears.

At this point, the neutral stance prevail with 1.3440 being the immediate critical resistance level to break, to trigger some upward moves: price has been unable to overcome it ever since late July. If price manages to extend above it, then stops will likely be triggered, favoring an upward continuation towards the 1.3500 price zone. However, it will be above this last that the longer term bearish pressure will begin to ease and not before.

On the other hand, 1.3332 mentioned year low is the key support to break during the upcoming days, to confirm a continuation of the dominant bearish trend: once broken, a quick run towards 1.3295, November 2013 monthly low comes at sight, while once below this last, the bearish move can extend towards 1.3170/1.3200 price zone.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.