The ongoing crisis in Ukraine escalated over these last few days, and news from the region are pretty confusing. Despite market has been mostly ignoring it, its an increasing risk factor for the FX market, and risk aversion runs should not be dismissed so easily in the days to come.

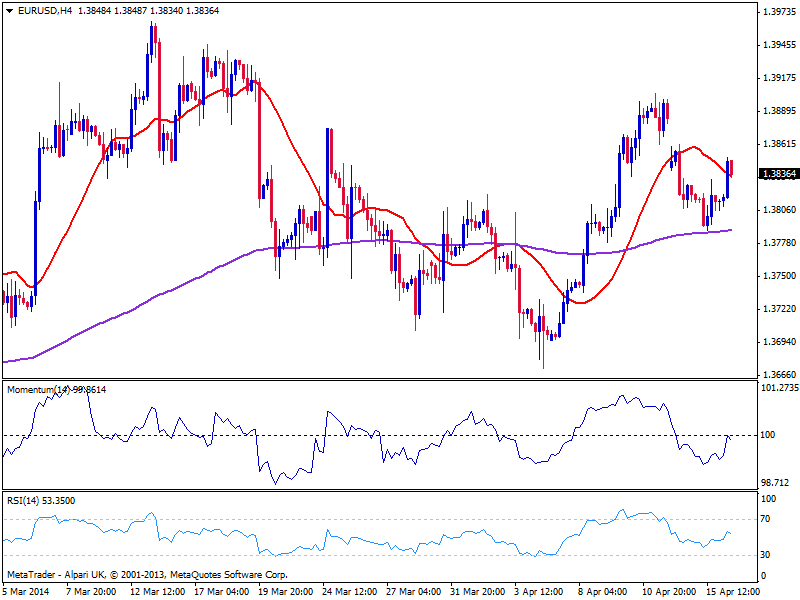

Technically, the EUR/USD 4 hour chart shows price now retracing back to its 20 SMA that maintains a bearish slope, while indicators failed around their midlines and turn slightly south, giving little support to an upward continuation. Immediate support comes around the 1.3810 area, and if below, the pair may attempt to retest the 1.3780/90 area, while only below this last bears will win the intraday battle and be able to push it further down, towards 1.3720/30 price zone.

On the other hand, a price acceleration above daily high should lead to a continued advance up to 1.3890, where the pair will finally fill the weekly opening gap.

View Live Chart for EUR/USD

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.