EUR/USD Forecast: US Dollar buyers fight back

EUR/USD Current price: 1.0895

- Financial markets keep moving on sentiment related to central banks’ announcements.

- United States Initial Jobless Claims resulted better than anticipated at 233K.

- EUR/USD turns bearish in the near term, aims to extend its slide.

The EUR/USD pair trades around its daily opening in the 1.0920 price zone, showing little directional aims throughout the day. The US Dollar finds modest demand ahead of Wall Street’s opening, as the market sentiment deteriorated following the poor performance of United States (US) indexes on Wednesday. Asian and European shares edged lower, weighing on US futures

Overall, financial markets remain cautious amid increased uncertainty about upcoming central banks’ monetary policy decisions. Tepid macroeconomic data and shifts in policymakers’ tone fueled concerns and resulted in panic-related movements.

The Eurozone did not publish relevant data, while the US just released Initial Jobless Claims for the week ended August 2, which decreased to 233K from a previously revised 250K, also beating expectations of 240K.

EUR/USD short-term technical outlook

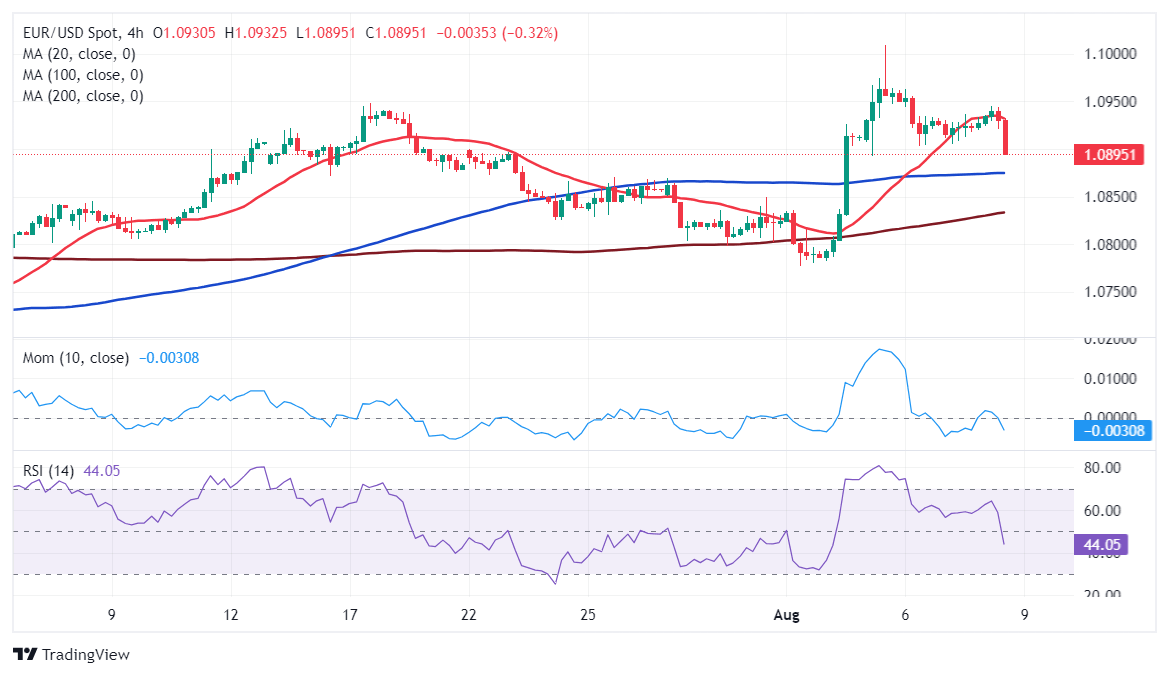

The EUR/USD pair fell following the release of US employment-related data and pierces the 1.0900 mark. The daily chart shows it’s down for a third consecutive day and that technical indicators turned south, in line with the increased selling pressure. At the same time, the pair trades above all its moving averages, although the 20 Simple Moving Average (SMA) has lost its upward strength and turned flat at around 1.0870. The case for a steeper decline seems limited, albeit a break through 1.0890, the immediate support level, could exacerbate the decline.

In the near term, and according to the 4-hour chart, the risk skews to the downside. EUR/USD retreated sharply after repeatedly meeting sellers around a flat 20 SMA, somehow suggesting buyers capitulate. Technical indicators, in the meantime, head firmly south within negative levels, supporting another leg lower.

Support levels: 1.0890 1.0845 1.0800

Resistance levels: 1.0950 1.1005 1.1045

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.