EUR/USD Current Price: 1.1310

- EU Sentix Investor Confidence plunged to -18.2 in July, missing the market’s expectations.

- The US ISM Non-Manufacturing PMI jumped to 57.1 in June from 45.4 in the previous month.

- EUR/USD is holding on to higher ground but faltered around a strong static resistance area.

The EUR/USD pair has reached an intraday high of 1.1345, its highest since mid-June, easing towards the 1.1300 region during US trading hours. A rally in Asian equities was the main market driver throughout the first half of the day, amid optimism over an economic comeback among Chinese authorities. The EUR/USD pair advanced, despite discouraging EU data. German Retail Sales plunged by 29.3% YoY in May. The EU sales in the same period, however, declined by 5.1% YoY, better than anticipated. The Union also released the July Sentix Investor Confidence, which came in at -18.2 vs. the -10.9 expected.

The dollar managed to recover some ground on a positive US ISM Non-Manufacturing PMI, which jumped to 57.1 in June from 45.4 in the previous month, largely surpassing the market’s expectations. The Markit Services PMI for the same period was upwardly revised to 47.9 from a preliminary estimate of 46.7. Wall Street eased from intraday highs but closed with substantial gains.

Meanwhile, the number of coronavirus cases remains in the eye of the storm. After reporting over 55,000 new cases in one day last week, new contagions have been decreasing in the US, although they remain above 40,000 per day. On Tuesday, Germany will publish May Industrial Production, see up by 10% in the month, while the US will only release minor figures, the IBD/TIPP Economic Optimism for July and JOLTS Job Openings for May.

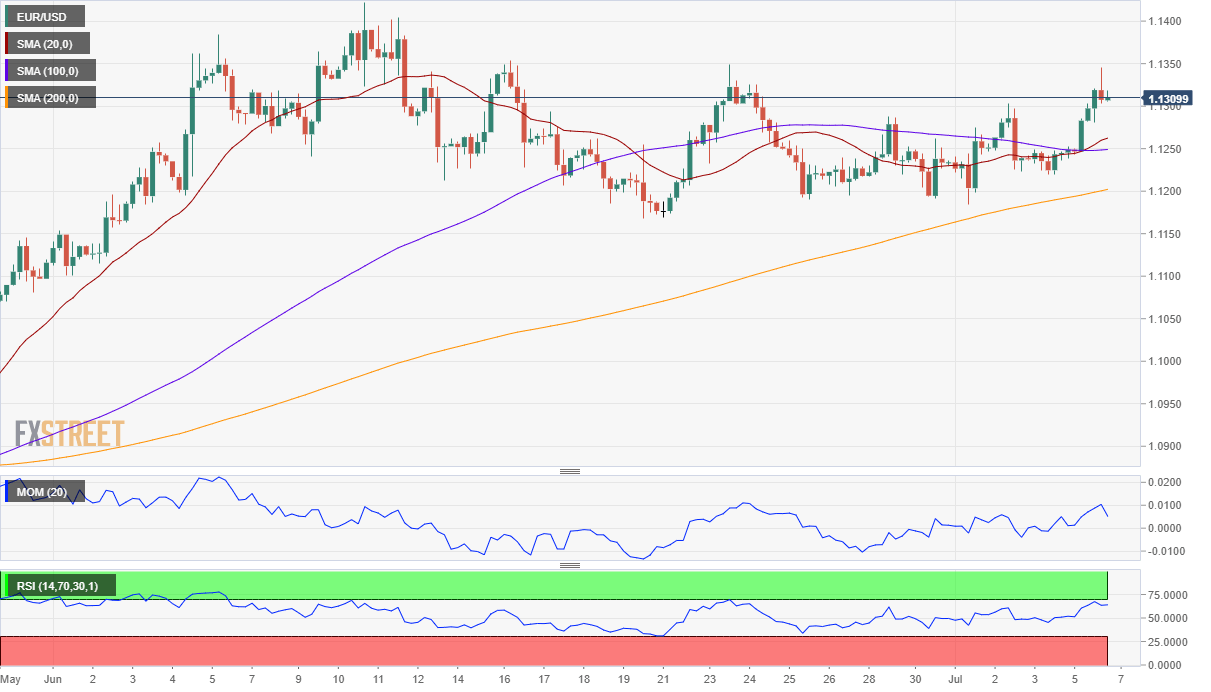

EUR/USD short-term technical outlook

The EUR/USD pair has retreated from the upper end of its latest range, as it briefly surpassed the 1.1330 price zone. Nevertheless, it’s holing above a Fibonacci level at 1.1270, which maintains the risk skewed to the upside. The pair retains its bullish potential in the short-term, and the 4-hour chart shows that the pair is comfortable above all of its moving averages, and with the 20 SMA crossing above the 100 SMA. Technical indicators, in the meantime, remain within positive levels. A break below 1.1270 should put the pair back into neutral ground and diminish the chances of a bullish extension.

Support levels: 1.1270 1.1220 1.1170

Resistance levels: 1.1345 1.1390 1.1425

View Live Chart for the EUR/USD

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.