EUR/USD Forecast: Tepid buying keeps defending the 1.0900 mark

EUR/USD Current price: 1.0942

- The German ZEW survey on Economic Sentiment surprised with quite discouraging figures.

- The United States Producer Price Index rose by less than anticipated in July.

- EUR/USD trades with a modest bullish bias, needs to clearly surpass the 1.0950 resistance area.

The EUR/USD pair remains stuck on Tuesday, trading within a well-limited range around the 1.0920 mark since the day started. The absence of relevant data and upcoming first-tier United States (US) first-tier headlines keeps investors in cautious mode, with little action across the FX board.

Stock markets, however, tell a different story. Speculative interest is still worried and moving away from high-yielding equities, as most European indexes trade in the red and weigh on US futures. Other than that, weaker government bond yields limit US Dollar’s demand. The 10-year Treasury note offers 3.89% after flirting with the 4% level a couple of days ago.

Data-wise, Germany published the August ZEW Survey on Economic Sentiment, which fell by more than anticipated. The country’s index printed at 19.2 following a reading of 41.8 in July, while the Eurozone Economic Sentiment shrank to 17.9 from the previous 43.7. Additionally, the assessment of the current situation in Germany fell to -77.3, worse than the -68.9 posted in July. Across the pond, the US published the NFIB Business Optimism Index, which rose in July to 93.7, beating expectations.

Finally, the US Producer Price Index (PPI) rose 0.1% MoM in July as expected, while the annual increase was 2.2%, below the anticipated 2.3% and the previous 2.7%. Core annual inflation at wholesale levels eased from 3% in June to 2.4%. The encouraging figures put some pressure on the USD, with EUR/USD hovering around 1.0940 ahead of Wall Street’s opening.

EUR/USD short-term technical outlook

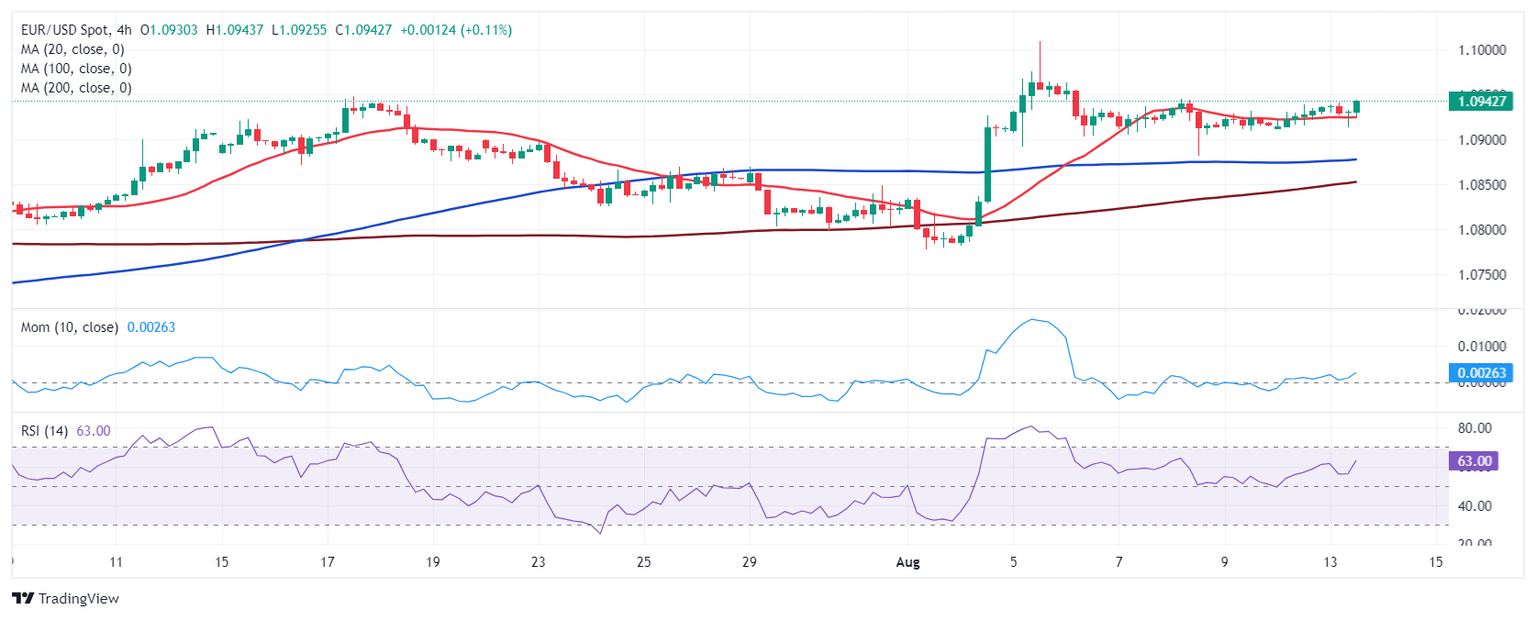

Technically, the daily chart for the EUR/USD pair shows the risk skews to the upside, although the momentum is missing. The pair keeps developing above all its moving averages, with the 20 Simple Moving Average (SMA) gaining upward traction well above the 100 and 200 SMAs. At the same time, technical indicators gyrated north within positive levels, although with tepid slopes.

In the near term, and according to the 4-hour chart, the pair has room to extend its advance. Buyers are defending the downside around a flat 20 SMA while, despite the prevalent range, EUR/USD manages to post sporadic higher highs. At the same time, technical indicators remain within positive levels, although with uneven upward strength.

Support levels: 1.0890 1.0845 1.0800

Resistance levels: 1.0950 1.1005 1.1045

(This story was corrected on August 13 at 14:06 GMT to say that the ZEW's indicator about the current situation in Germany was -68.9 in July, not 68.9.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.