EUR/USD Forecast: Sellers looking for fresh multi-week lows

EUR/USD Current price: 1.0796

- Eurozone’s manufacturing sector started the third quarter on the back foot, according to HCOB.

- Tepid United States employment-related figures put modest pressure on the US Dollar.

- EUR/USD under pressure and poised to reach fresh multi-week lows.

The US Dollar changed course on Thursday, trimming the Federal Reserve’s inspired losses and even reaching fresh weekly highs against other major currencies. The EUR/USD pair fell to 1.0776 during European trading hours, its lowest in three weeks. The US Dollar found support in falling Asian equities, with the Nikkei plummeting roughly 1,000 points amid mounting speculation the Bank of Japan (BoJ) will keep tightening its monetary policy.

European stocks also came under selling pressure, providing additional support to the safe-haven US Dollar. Local stocks suffered from discouraging earnings reports and poor Eurozone figures. According to the Hamburg Commercial Bank (HCOB), “the eurozone’s manufacturing sector suffered yet another setback at the start of the third quarter as a steeper reduction in new orders led contractions in output and employment to accelerate.” The Manufacturing PMI was confirmed at 45.8 in July, unchanged from June and slightly better than the flash estimate of 45.6. The EU also reported that the Unemployment Rate increased to 6.5% in July from 6.4% in the previous month.

The United States (US) published Initial Jobless Claims for the week ended July 26, which unexpectedly rose to 249K, worse than anticipated. Additionally, US-based employers announced 25,885 job cuts in July, a 47% decrease from the 48,786 cuts announced one month prior, according to the Challenger Job Cuts report, while hiring fell to its lowest point in over a decade. Finally, Nonfarm Productivity rose 2.3% in the second quarter of the year, while Unit Labor Cost in the same period printed at 0.9%, much lower than the previous 3.8%. The US Dollar edged lower with the news, and EUR/USD recovered the 1.0800 threshold.

After Wall Street’s opening, the focus will be on the July ISM Manufacturing PMI, foreseen at 48.8 after posting 48.5 in June.

EUR/USD short-term technical outlook

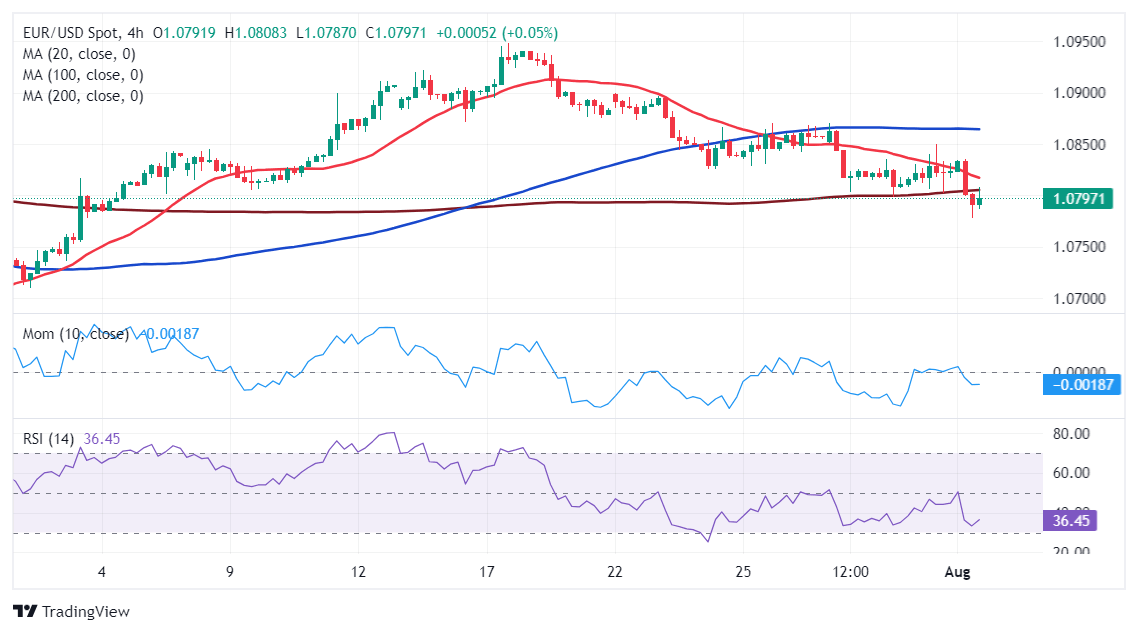

The EUR/USD pair struggles to retain the 1.0800 mark, and the daily chart shows the risk remains skewed to the downside. The pair fell below a flat 200 Simple Moving Average (SMA), while the 20 SMA keeps losing upward momentum above the longer one. Even further, the pair briefly pierced a marginally bearish 100 SMA at around 1.0790. Technical indicators, in the meantime, head firmly south within negative levels, reflecting solid selling interest.

The ongoing recovery seems corrective in the near term, and according to the 4-hour chart. Technical indicators have bounced modestly from their intraday lows but remain within negative levels and lack strength enough to suggest a bottom took place. At the same time, the pair trades below all its moving averages. The 20 SMA gains downward traction, reflecting increased selling, while a flat 200 SMA provides dynamic resistance around the 1.0810 level.

Support levels: 1.0760 1.0720 1.0685

Resistance levels: 1.0810 1.0860 1.0910

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.