- EUR/USD is trading close to two-year highs as weak US data weighs on the dollar.

- Jobless claims, fiscal stimulus updates, and Sino-American tensions are in play.

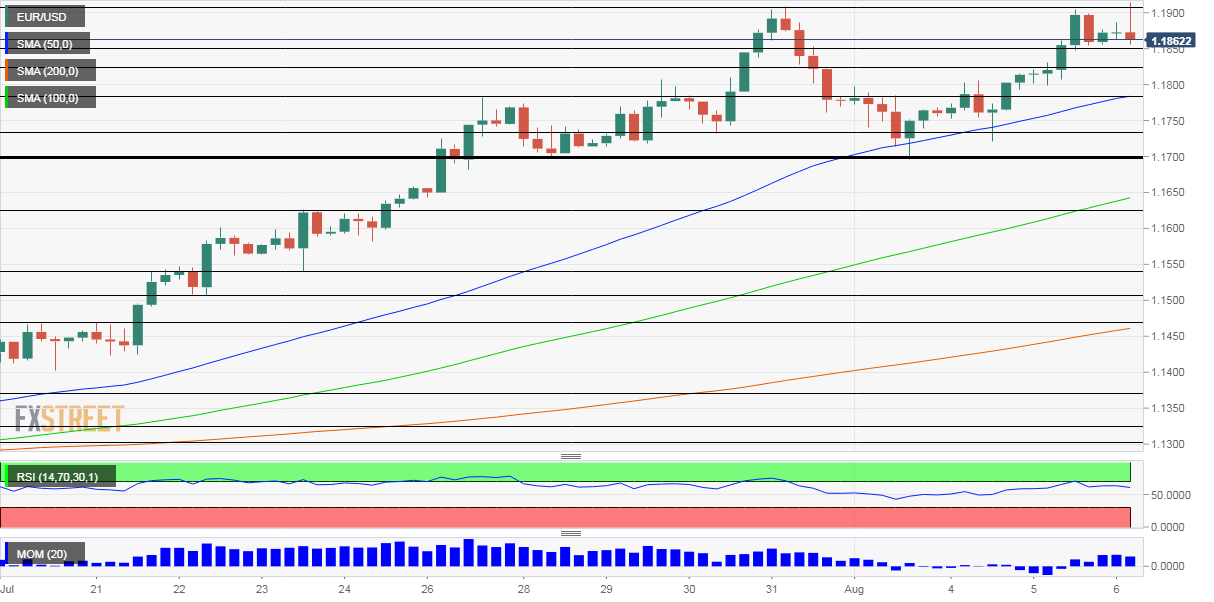

- Thursday's four-hour chart is showing bulls are in control.

Another day, another dose of dollar weakness? Wednesday's dural disappointments have created a double-top and another miss could send EUR/USD beyond the fresh high of 1.1916, a minor breach of the previous 1.1909 peak.

ADP reported an increase of only 167,000 private-sector jobs in July, far below 1.5 million expected. While America's largest payroll provider has found it hard to project the official Non-Farm Payrolls figure, it has been pointing to the direction of travel. The employment component of the ISM Non-Manufacturing Purchasing Managers' Index also pointed to weakness in hiring. That hurt the dollar, despite an upbeat headline number.

See:US Data Analysis: Big jobs number? Negative NFP looks more likely, trends could extend in gold, dollar

The highlight of Thursday's economic calendar is weekly jobless claims. While the figures are for the weeks after the one in which the Non-Farm Payrolls surveys are conducted, investors will want to see if the unsettling uptrend continues. High-frequency figures have been receiving more attention of late and another increase could send the greenback down.

See US Initial Jobless Claims: Can claims and payrolls rise at the same time?

Tension is already rising toward Friday's Non-Farm Payrolls with analysts set to provide updates to their estimates. President Donald Trump touted a "big number" coming, yet he may have not received the data just yet. Presidents often have early access to the NFP statistics late on Thursday. Expectations will likely suffer a downgrade, thus weighing on the dollar.

Looking ahead: US Non-Farm Payrolls Preview: A dual-track labor market or imperfections in the data?

Trump said he would use an executive order to extend federal unemployment claims if Democrats and Republicans fail to reach an agreement on a new fiscal package. Senators are negotiating but it seems that the power lies with the president and also with Nancy Pelosi, Speaker of the House.

Markets are pricing in a multi-trillion boost from the government despite politicians blaming each other for stalled talks. Several programs expired on Friday and those out of work may already be feeling the pinch. Developments on that front are set to move the dollar.

Stocks remain upbeat amid high hopes for a coronavirus vaccine. Anthony Fauci, America's top immunologist, said that tens of millions of doses could become available already this year to Americans. Another encouraging development is that the coronavirus case-curve is falling in the US.

COVID-19 infections are on the rise in the old continent, especially in Spain, France, and Belgium. Markets are shrugging it off, and continue seeing these flareups as local. If worries increase, the euro has room to fall. However, so far things seem under control.

All in all, the wind continues blowing in favor of EUR/USD bulls, at least for now.

EUR/USD Technical Analysis

EUR/USD failure to hold onto the break above 1.1909 does not take away from its bullish bias. Momentum on the four-hour chart remains to the upside and the world's most popular currency pair is trading above the 50, 100, and 200 Simple Moving Averages. Moreover, the Relative Strength Index is below 70, thus outside overbought conditions.

July's high of 1.1909 is still in play and the it is followed by the round 1.20 level. Higher above, 1.2040 and 1.2110 – last seen in 2018 – are the next tentative targets.

Support awaits at the daily low of 1.1855, followed by 1.1780, a temporary peak on the way up. Next, 1.1735 and the robust 1.17 line await EUR/USD.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.