- EUR/USD is holding onto the high ground around 1.16 following upbeat eurozone PMIs.

- Sino-American tensions, US coronavirus figures, and data may cap any gains.

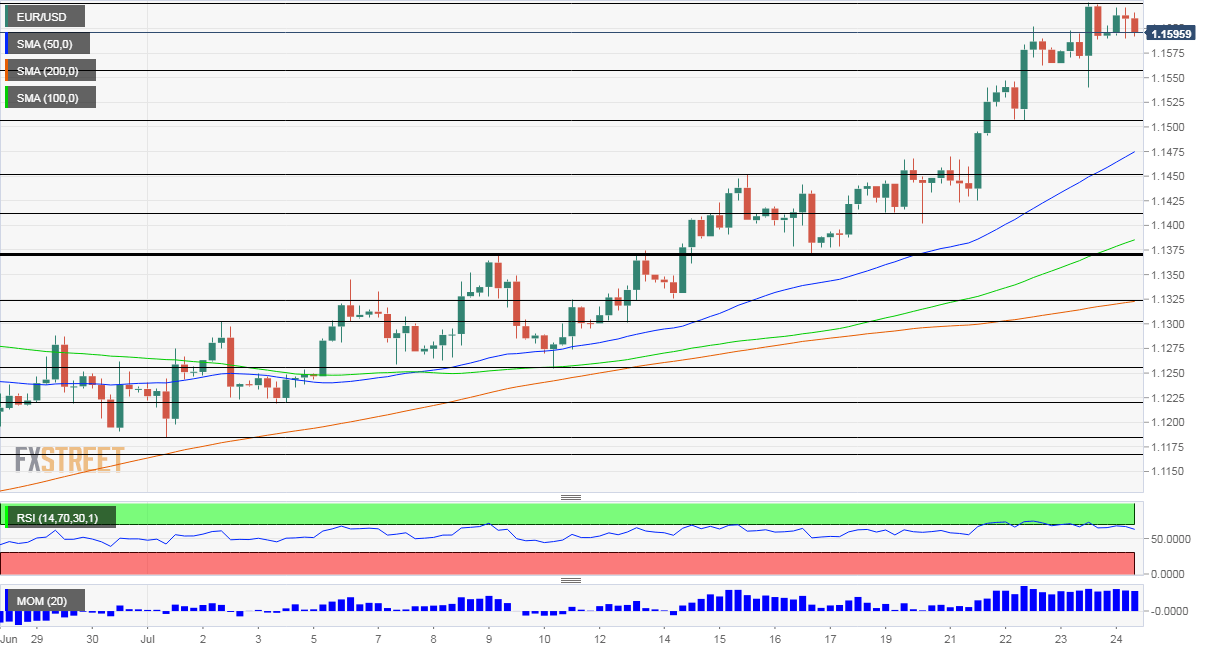

- Friday's four-hour chart is showing the potential for more gains.

Completing a bullish week for the euro – that was the headline of the preview for Friday's data and it turns to reality, keeping the common currency bid. Markit's preliminary Purchasing Managers' Indexes for July all beat expectations, with the rebound in services more pronounced that in the manufacturing one.

The PMI surveys express optimism about the old continent's recovery from the worst days of the pandemic and despite flareups in several countries such as Spain, France, and Belgium. More importantly, the data predates this week's EU agreement on a €750 billion recovery fund.

That agreement – reached after five days of exhausting negotiations – continues underpinning the euro. Demand for bonds – both in creditor countries such as Germany and debtor ones such as Italy – have been rising. That is a show of confidence by investors and could keep the euro bid going forward. The PMIs provide additional support to the major upside driver which is fiscal stimulus.

The risk to EUR/USD's rally comes from the US side. The safe-haven dollar may receive support from intensifying Sino-American tensions. China closed the US consulate in Chengdu, retaliation for America's move against Beijing's office in Houston.

Secretary of State Mike Pompeo delivered a highly critical speech of China, referring to activities in Texas and also to the regime, which he describes as authoritarian and "tyrant." While Pompeo pummeled Chinese President Xi Jinping, he stressed that the trade deal between the world's largest economies remains intact, proving some solace to investors.

Markets have also stabilized thanks to progress on a new fiscal relief package. Republicans have dropped their demand for a payroll tax cut and Democrats will likely ease their demands to extend federal unemployment benefits at their entirety. The jobless receive a weekly top-up of $600 set to expire at the end of the month. That sum could be reduced.

In the meantime, the number of those applying for unemployment benefits is rising. Initial jobless claims increased to over 1.4 million in the week ending July 17, another sign that the resurgence of coronavirus has halted the recovery. That is the same week as Non-Farm Payrolls surveys are taken. Later on Friday, New Home Sales for June are of interest and will likely show a rebound.

See US Existing Home Sales Soar: Housing market metrics improve

The first half of June was upbeat but cases began rising in the latter part of the month and have continued causing concern since then. US infections topped four million and the daily death rate has topped 1,100 once again. Updated COVID-19 figures from states will have the last words of the week.

Overall, developments in the old continent are positive but concerns about the US could boost the dollar and limit gains.

EUR/USD Technical Analysis

Euro/dollar continues benefiting from robust upside momentum on the four-hour chart and trades above the 50, 100, and 200 Simple Moving Averages. The Relative Strength Index is just below 70, thus outside overbought conditions, at least for now.

All in all, there is room for more gains.

Resistance awaits at the new 22-month high of 1.1622. It is followed by 1.1650 and 1.17.

Support awaits at 1.1555, which provided support on Thursday. The next level is 1.1505, another cushion on the way up, and then 1.1450, which capped it last week.

More Hot Summer In Markets: Gold, silver, euro, and dollar volatility explained

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD extends sideways grind below 1.0900

EUR/USD stays in a consolidation phase below 1.0900 following the previous week's rally. In the absence of high-tier data releases, the US Dollar stays resilient against its rivals as investors scrutinize comments from central bank officials.

Gold pulls away from record highs, holds above $2,400

Gold rose sharply at the beginning of the week on escalating geopolitical tensions and touched a new all-time high of $2,450. With market mood improving modestly, XAU/USD erases a majority of its daily gains but manages to hold above $2,400.

GBP/USD holds steady near 1.2700, Fedspeak in focus

GBP/USD fluctuates in a narrow channel near 1.2700 on the first trading day of the week. The cautious market stance helps the US Dollar hold its ground, while market participants assess remarks from central bank officials ahead of this week's key events.

Ripple stays above $0.50 on Monday as firm backs research on blockchain and quantum computing

XRP price holds steady above the $0.50 key support level and edges higher on Monday, trading at 0.5130 and rising 0.70% in the day at the time of writing.

Week ahead: Nvidia results and UK CPI falling back to target

What a week for investors. The Dow Jones reached a record high and closed last week above 40,000, for the first time ever. This is a major bullish signal even though gains for global stocks were fairly modest on Friday, and European stocks closed lower.