EUR/USD Forecast: Pressure mounts on US stimulus hopes

EUR/USD Current Price: 1.2040

- The European Markit Manufacturing PMIs were upwardly revised in February.

- US Treasury yields are aiming higher after an early slide, backing the greenback.

- EUR/USD trading at fresh two-week lows and bearish.

The EUR/USD pair trades in the 1.2040 price zone after posting a fresh two-week low of 1.2028. Speculative interest keeps buying the greenback as US Treasury yields recover from intraday lows. Equities are up in Europe, pushing US indexes higher ahead of the opening. Mounting hopes about a US $1.9 trillion stimulus package provide additional support to the greenback after the House passed President Joe Biden’s bill on Saturday.

Markit published the final readings of the February manufacturing PMIs for the EU, most of which were upwardly revised. The final EU Manufacturing PMI printed at 57.9 vs the 57.7 expected. According to the official report, data pointed “to the quickest expansion in the eurozone manufacturing sector for three years in February,” adding that there was “severe supply-side disruption amid shortages of raw materials, and as a result input prices rose sharply.”

Markit will publish the US Manufacturing PMI, expected at 58.6, while the country will release the official ISM manufacturing index, expected at 58.8.

EUR/USD short-term technical outlook

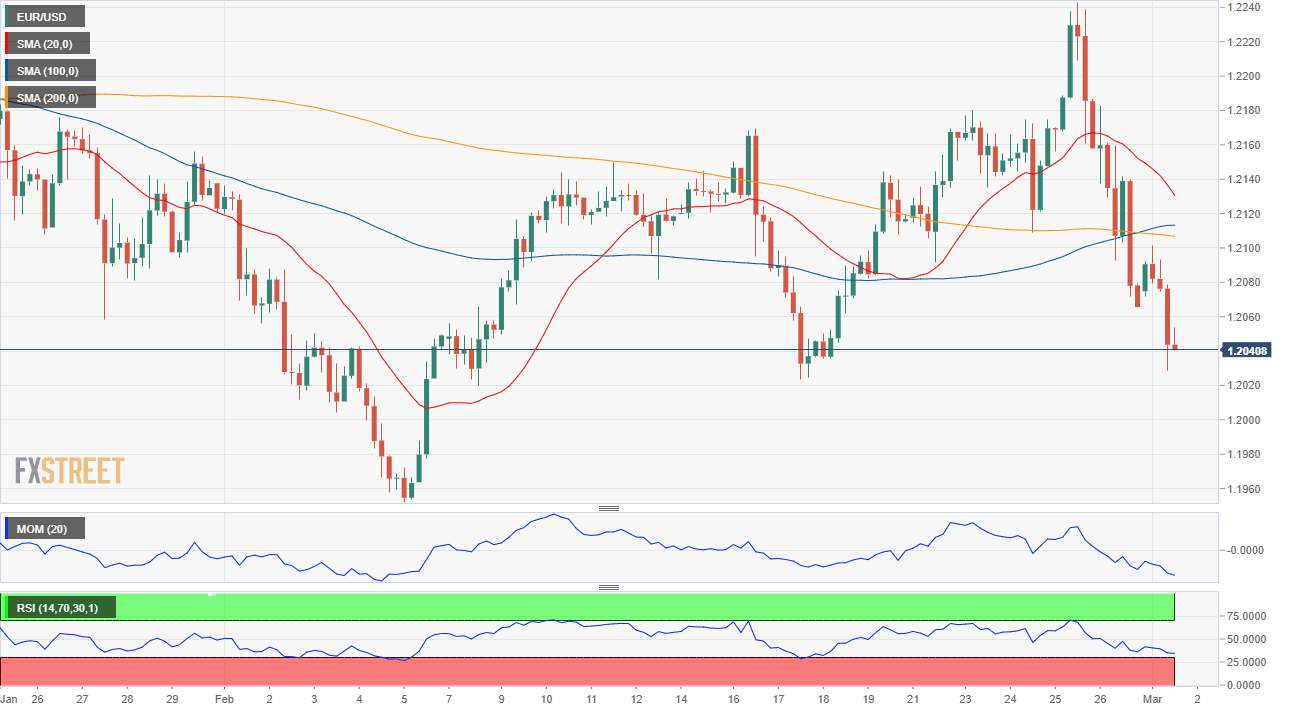

The EUR/USD pair is trading below the 38.2% retracement of its November/January rally at 1.2060, the immediate resistance level. The near-term picture is bearish, as EUR/USD is developing below all of its moving averages, with the 20 SMA accelerating south above the larger ones. Technical indicators hover near oversold readings, partially losing their bearish strength as the pair bounced from daily lows. Nevertheless, the risk remains skewed to the downside, with the next Fibonacci support at 1.1970.

Support levels: 1.2015 1.1970 1.1920

Resistance levels: 1.2060 1.2100 1.2145

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.