EUR/USD Forecast: Next stop comes at 1.0900

- EUR/USD picked up extra pace and surpassed 1.0800.

- The FOMC Minutes said rate hikes are on the table if inflation increases.

- Markets will now shift their attention to Friday’s NFP.

A marked decline in the US Dollar (USD) caused the USD Index (DXY) to revisit the 105.00 neighbourhood amidst the ongoing multi-session bearish move in the currency.

This strong downtick in the Greenback also kept the bid bias around EUR/USD well in place, lifting spot back above the key 1.0800 barrier as the likelihood of interest rate cuts by the Fed as soon as September gathered renewed impulse in response to dispiriting results from the US docket, especially from the labour market.

Collaborating with the better tone in the pair, market participants continued to assess the latest comments from ECB President Christine Lagarde at the ECB Forum on Tuesday, who emphasized that the euro zone has made significant progress towards disinflation, though economic growth uncertainties persist. At the same event, Chief Jerome Powell indicated that the Fed needs more data before considering rate cuts, aiming to verify if recent low inflation readings reflect sustained price pressures.

Overall, the macroeconomic situation remained stable on both sides of the Atlantic as the European Central Bank (ECB) is considering further rate cuts beyond the summer, with markets expecting two more cuts this year.

In contrast, there is still debate among market participants about whether the Federal Reserve (Fed) will implement one or two rate cuts this year, despite the Fed projecting just one cut, likely in December.

In what was the salient event of the session, the FOMC Minutes said that participants voted to keep the policy rate in the 5.25%–5.50% range. They recognised that progress in lowering inflation has been slower this year than they had anticipated in December. Furthermore, some participants emphasised the significance of patience before considering rate reduction, while others noted the potential need to hike rates again if inflation recovered. In addition to leaving interest rates constant, officials during the June meeting postponed the expected start of rate decreases. On this, new projections indicated that Fed officials, at the median, predicted only one quarter-point rate decrease this year vs. three cuts expected at the March 19-20 gathering.

According to the CME Group's FedWatch Tool, there is about a 73% probability of lower interest rates in September, compared to nearly a 95% chance at the December 18 meeting.

In the short term, the recent ECB rate cut, contrasted with the Fed's decision to maintain rates, has widened the policy gap between the two central banks, potentially leading to further weakness in EUR/USD.

However, the Eurozone's emerging economic recovery and the perceived weakening of US fundamentals are expected to narrow this disparity, possibly providing occasional support for the pair in the near future.

Politically, the next risk event for the euro is the upcoming second round of the French snap elections on July 7.

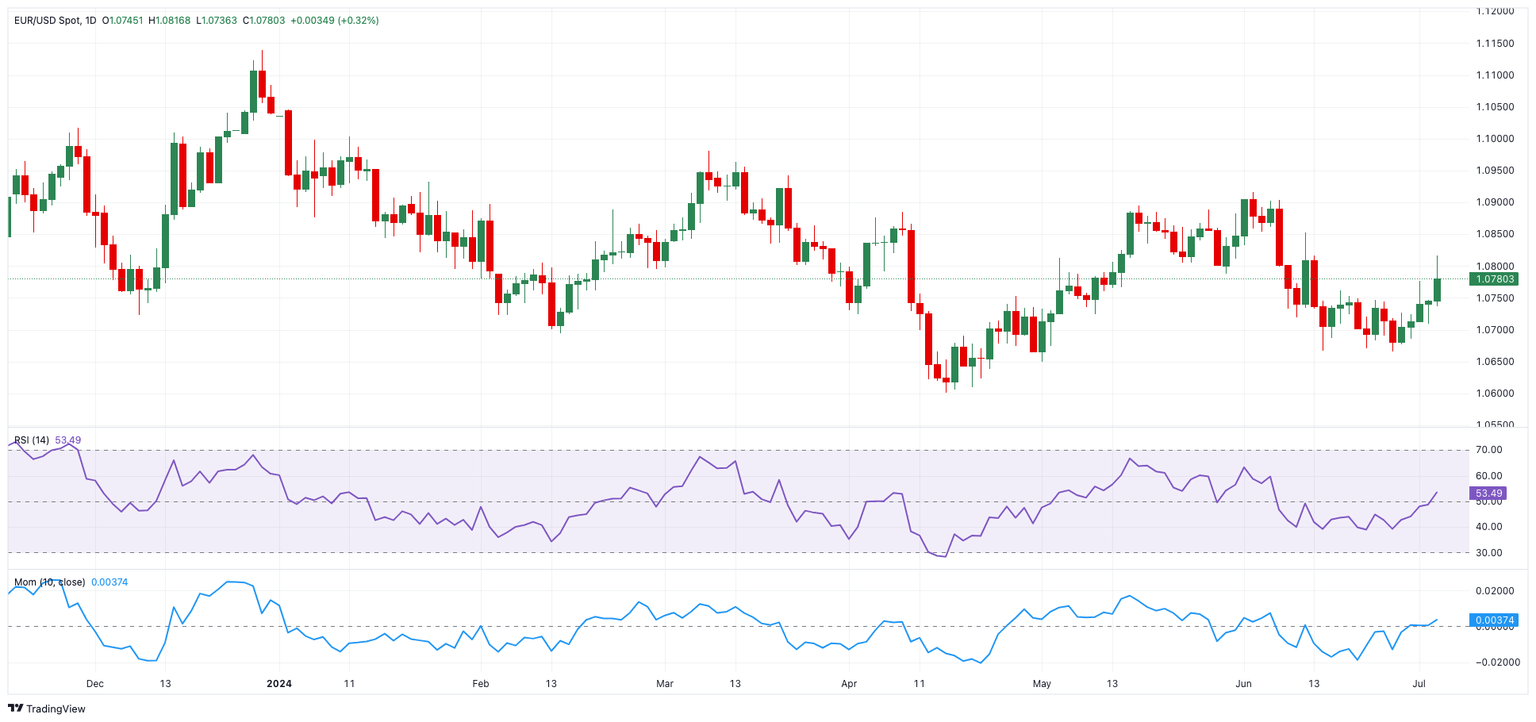

EUR/USD daily chart

EUR/USD short-term technical outlook

Further upside could see EUR/USD revisit the July high of 1.0816 (July 3), before the weekly top of 1.0852 (June 12) and the June peak of 1.0916 (June 4). The breakout of this level might bring the March high of 1.0981 (March 8) back on the radar, ahead of the weekly top of 1.0998 (January 11) and the psychological 1.1000 threshold.

If bears regain control, the pair may hit its June low of 1.0666 (June 26), then the May low of 1.0649 (May 1), and finally the 2024 bottom of 1.0601 (April 16).

So far, the 4-hour chart indicates a resurgence of the upside impetus. The initial resistance level is 1.0816, then 1.0852. The immediate support is at 1.0666, prior to 1.0649 and then 1.0601. The Relative Strength Index (RSI) increased to about 63.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.