EUR/USD Forecast: Next on tap… 1.0900?

- EUR/USD extended its recovery above 1.0800.

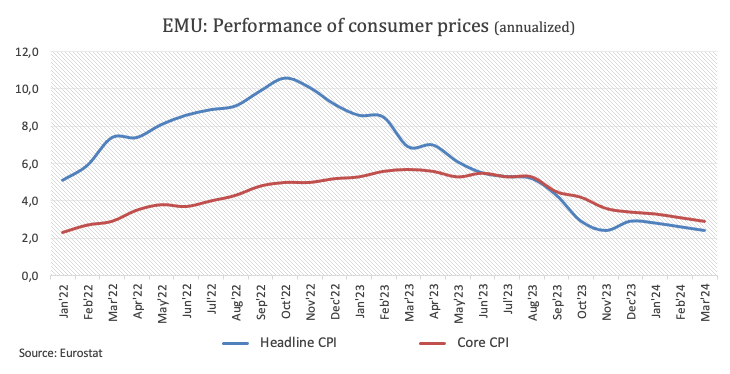

- EMU advanced CPI rose less than estimated in March.

- The US Dollar accelerated its bearish note on weak data.

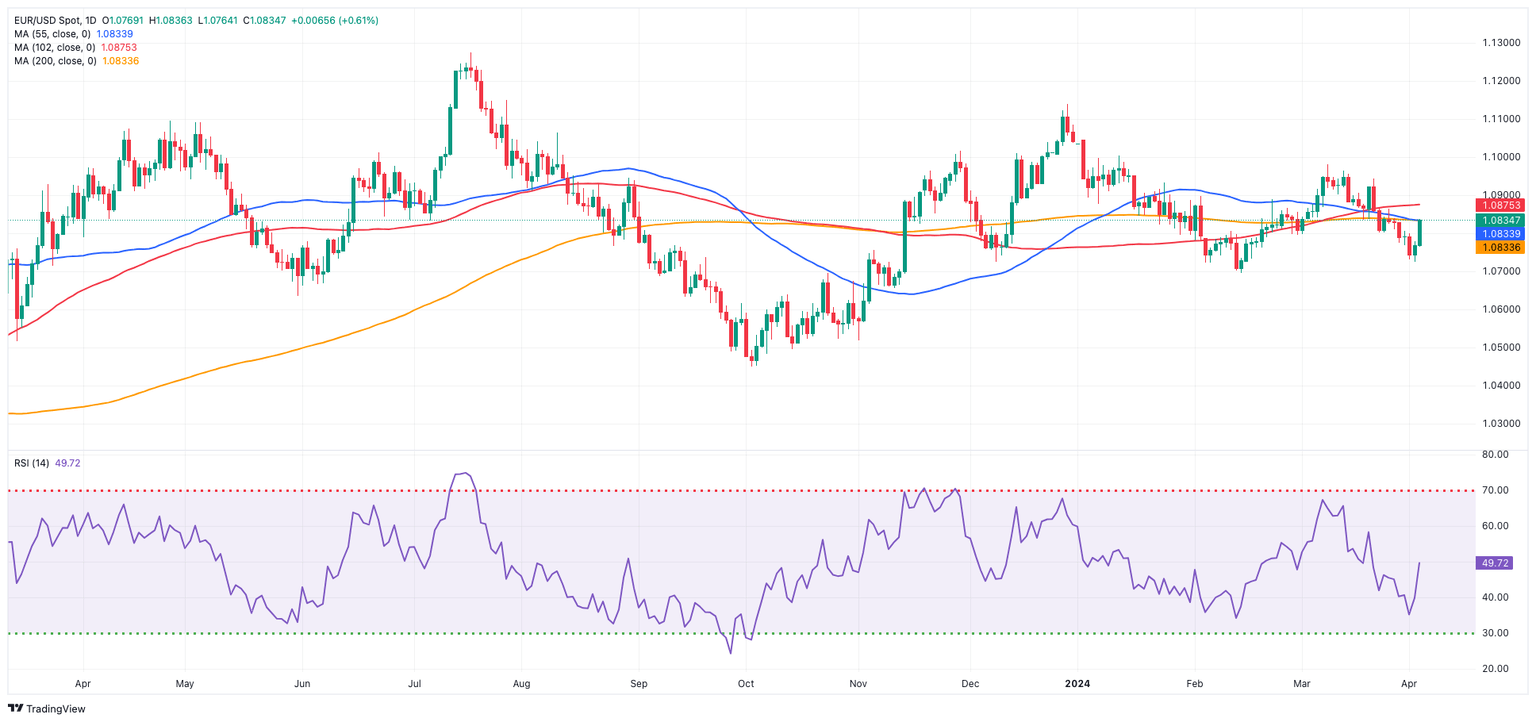

Another marked drop in the Greenback favoured a strong advance in EUR/USD, which managed to not only trespass the 1.0800 yardstick, but also flirt with the critical 200-day SMA in the 1.0830-10840 band on Wednesday.

Price action in spot, in the meantime, were accompanied by further gains in US yields across various maturity periods, vs. a slight drop in German 10-year bund yields, while the monetary policy framework stayed unchanged.

Regarding monetary policy, both the Federal Reserve (Fed) and the European Central Bank (ECB) are expected to begin easing cycles, possibly starting in June. However, the pace of subsequent interest rate cuts may differ, leading to potentially divergent strategies between the two central banks. Nonetheless, it is anticipated that the ECB will not significantly lag behind the Fed.

Early in the session, Atlanta Fed President Raphael Bostic reiterated his view of one rate hike this year, most likely in the fourth quarter. Later, Federal Reserve (Fed) Chair Jerome Powell reiterated that the Fed has the flexibility to carefully consider its inaugural interest rate reduction, citing the robustness of the economy and recent elevated inflation figures.

According to the FedWatch Tool offered by CME Group, the likelihood of a rate cut in June just surpassed 60%.

Around a potential ECB rate cut, flash inflation figures in the broader euro area showed the headline CPI rise by 2.4% in March and the Core CPI gain 2.9% over the last twelve months, both prints coming in below estimates and adding to Tuesday’s disinflationary pressures in Germany, after the CPI rose by 2.2% from a year earlier.

Looking ahead, the eurozone's relatively subdued fundamentals, combined with the growing likelihood of a "soft landing" for the US economy, reinforce expectations of a stronger Dollar in the medium term, particularly as both the ECB and the Fed may implement easing measures almost simultaneously. In this scenario, EUR/USD may have a more dramatic drop, initially targeting its year-to-date low around 1.0700 before perhaps revisiting the lows seen in late October 2023 or early November under 1.0500.

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, EUR/USD is expected to face early resistance at the transitory 100-day SMA at 1.0875, followed by the March high of 1.0981 (March 8), the weekly top of 1.0998 (January 11), and the psychological barrier of 1.1000. Further rises from here may result in a December 2023 peak of 1.1139 (December 28).

On the downside, another test of the April low of 1.0724 (April 2) is not out of the question, as is the 2024 low of 1.0694 (February 14). The November 2023 low is 1.0516 (November 1), followed by the weekly low of 1.0495 (October 13, 2023), the 2023 bottom of 1.0448 (October 3), and

The 4-hour chart shows a strong rebound from recent lows near 1.0720. The initial level of resistance is the 200-SMA at 1.0846 ahead of 1.0864. In the other direction, the next observable downward barrier appears to be 1.0724, followed by 1.0694 and 1.0656. The Moving Average Convergence Divergence (MACD) rebounded and flirted with the positive territory, while the Relative Strength Index (RSI) rose above 67.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.