EUR/USD Forecast: Get ready for US Q1 GDP and the Fed

EUR/USD Current Price: 1.0838

- US GDP expected to have contracted by 4.0% in the three months to March.

- Risk-appetite led the first half of the day, eased after disappointing US data.

- EUR/USD held within familiar levels, neutral ahead of US critical events.

The EUR/USD pair surged to 1.0888, its highest in a week, but trimmed gains to end the day unchanged in the 1.0830 price zone. The American currency was under selling pressure throughout the first half of the day, as risk appetite dominated financial markets, with equities rallying and the greenback falling on the back of economic re-openings. Things changed with the US session, as equities turned red on the back of poor US data and news that the coronavirus pandemic is still hitting hard the country.

It was a busy day for the US that released its March Goods Trade Balance, which posted a deficit of $64.22B, worse than the $-62.67B expected, and Wholesale Inventories for the same month, which came in at -1.0% beating the market’s expectations. Also, the Richmond Fed Manufacturing Index collapsed in April to -53, while the CB Consumer Confidence Index plunged to 86.9 from 118.8 previously.

Macroeconomic action will kick-start this Wednesday with the US releasing the preliminary estimate of Q1 GDP and the Fed announcing its latest decision on monetary policy. Growth in the country is seen contracting by 4.0% in the three months to March. As for the central bank, policymakers are expected to hold their fire this time after massive stimulus programs were announced on the back of the coronavirus pandemic. The focus would rather be on the assessment of the current situation and whatever tolls the central bank is willing to apply, should the crisis continues.

EUR/USD short-term technical outlook

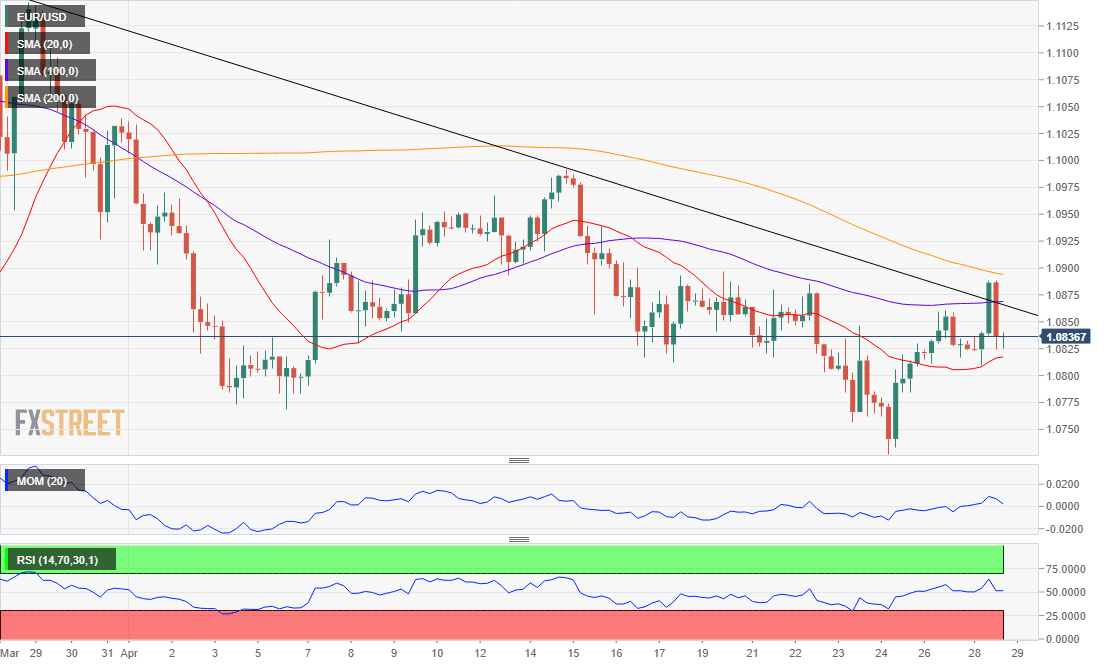

The EUR/USD pair has been unable to sustain gains beyond a daily descendant trend line coming from a late March high at 1.1147. The pair retains its neutral stance, quite normal ahead of the upcoming critical events. In the 4-hour chart, it remains confined between its 20 and 100 SMAM, while technical indicators eased within positive levels, now hovering around their mid-lines. The bullish potential will be clearer on a break above 1.0920, while the bearish case can gain adepts on a break below 1.0750.

Support levels: 1.0790 1.0750 1.0710

Resistance levels: 1.0865 1.0900 1.0940

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.