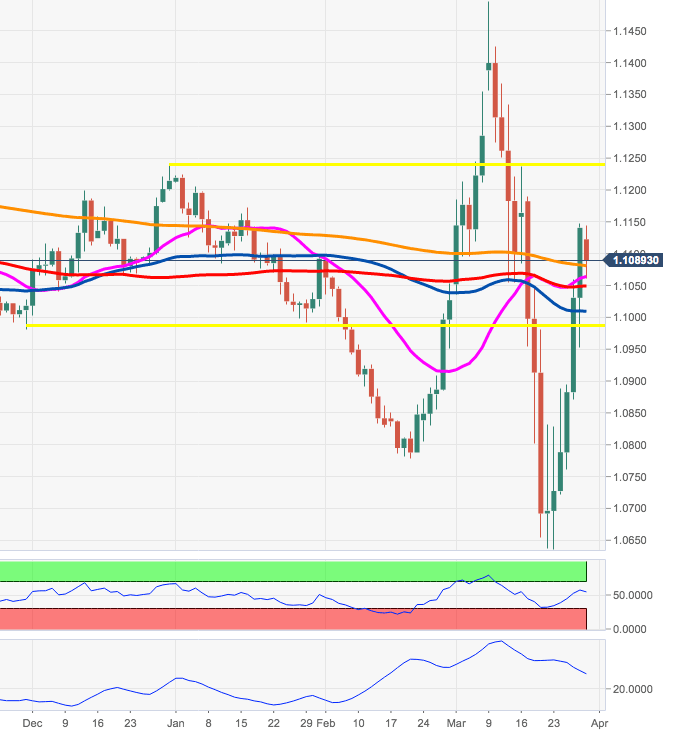

EUR/USD Forecast: Further gains lies above 1.1240

- EUR/USD’s upside momentum faltered in the mid-1.1100s.

- The constructive view stays unchanged above the 200-day SMA.

EUR/USD has started the week on a negative mood and is giving away part of the gains recorded during last week’s sharp rebound. So far, the recovery in the pair appears to have run out of steam in the 1.1150 region, sparking the ongoing correction lower to the 1.1080 area, where is located the critical 200-day SMA and emerges a Fibo retracement of the March drop.

In the meantime, developments around the COVID-19 are expected to remain in the driver’s seat when comes to determine the price action of global assets and risk appetite trends. Against this backdrop, liquidity and volatility are seen playing a crucial role with the greenback in the centre of the debate.

In the weekly data space, preliminary inflation figures in Germany and the broader Euroland should be in the limelight closer to home. Across the pond, poor prints from key Non-farm Payrolls and the ISM Manufacturing (Friday) should be already priced in, although market participants are expected to look beyond the figures in an effort to gauge the extension and duration of the ongoing coronavirus-led crisis.

Short-term technical outlook

A sustainable breakout of the 200-day SMA, today at 1.1081, should open the door to the continuation of the upside momentum to, initially, the December’s 2019 high at 1.1239. Further north, EUR/USD is expected to face interim hurdles at Fibo retracements at 1.1311 and 1.1448, all ahead of the 2020 high in levels just shy of 1.15 the figure. In case sellers regain control of the markets, a move to the 55-day SMA at 1.1008 should return to the investors’ radar ahead of a potential visit to January’s low in the 1.0990 zone.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.