EUR/USD Forecast: Extra losses now appear in the pipeline

- EUR/USD dropped to new multi-week lows around 1.0720.

- The US Dollar gathered extra pace despite declining US yields.

- US CPI and the FOMC event are due on Wednesday.

On Tuesday, the US Dollar (USD) continued its post-NFP strong recovery, motivating EUR/USD to extend its downward momentum to fresh six-week lows near 1.0720.

Other than the Greenback's strong performance, losses in the pair kept looking at the European political arena in the aftermath of the parliamentary elections as well as rising speculation ahead of the French snap elections due on June 30.

In the meantime, the ECB’s Villeroy and Rehn noted that the European Central Bank (ECB) will hit its 2% inflation target by next year, despite anticipated fluctuations in monthly data, suggesting that the bank's monetary policy has effectively mitigated price pressures. Later, chief economist Lane noted that inflation pressures across the euro zone are robust enough for the ECB to maintain interest rates that constrain economic growth.

Regarding the Federal Reserve (Fed), the latest Nonfarm Payrolls report for May (+272K) dampened expectations for immediate interest rate hikes, now pointing to a possible move in November or December.

The CME Group's FedWatch Tool now indicates nearly a 65% probability of lower interest rates by the November 7 meeting and around 51% in September.

In the short term, the ECB's recent rate cut has widened the policy gap with the Fed, potentially exposing EUR/USD to further weakness. However, in the longer term, the emerging economic recovery in the Eurozone, combined with perceived slowdowns in the US economy, should help mitigate this disparity, offering some support to the pair.

Looking ahead, the next significant events for the pair will be the release of US inflation figures tracked by the CPI and the FOMC meeting, both scheduled for June 12.

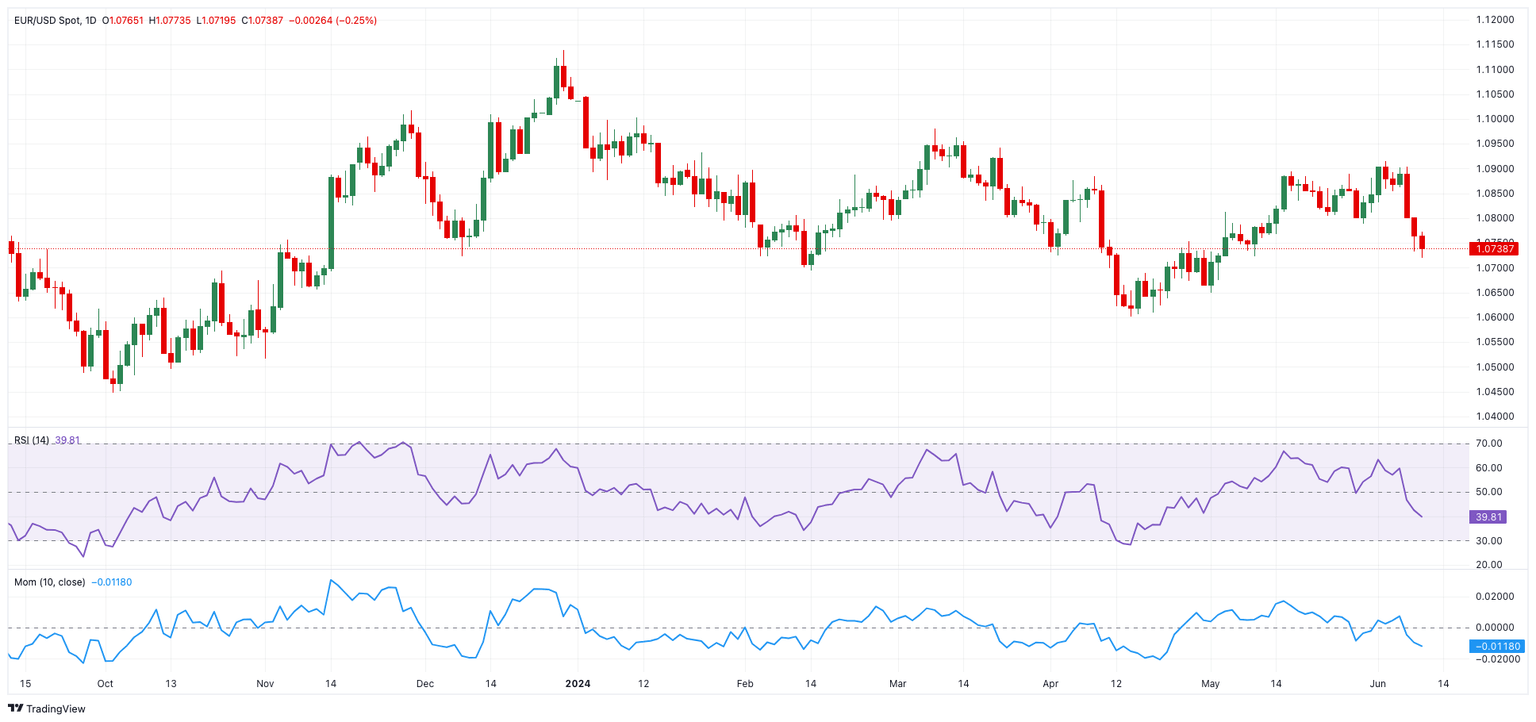

EUR/USD daily chart

EUR/USD short-term technical outlook

If the negative tone holds, EUR/USD may initially target the June low of 1.0719 (June 11), before the May low of 1.0649 (May 1), and the 2024 bottom of 1.0601 (April 16).

If bulls regain some initiative, spot may initially target the key 200-day SMA at 1.0787 prior to the June high of 1.0916 (June 4), and the March top of 1.0981 (March 8). Further north emerges the weekly peak of 1.0998 (January 11), before the crucial 1.1000 mark.

So far, the 4-hour chart reveals some pick-up of the downward bias. That said, next on the downside comes 1.0719 ahead of 1.0649 and 1.0516. Looking north, the next obstacle is the 200-SMA (1.0804), ahead of the 55-SMA of 1.0835. The relative strength index (RSI) settled around 30.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.