EUR/USD Forecast: Extra losses are likely as bears remain in control

- EUR/USD refocused on the downside, well below 1.0800.

- The Greenback faded the post-CPI retracement.

- The Fed could cut its interest rates just once this year.

The US Dollar (USD) resumed its bullish stance on Thursday, rapidly leaving behind the post-CPI sell-off seen on Wednesday and regaining balance amidst the prospects of just one interest rate cut by the Federal Reserve (Fed) this year, with December being the most likely candidate.

Against that backdrop, EUR/USD quickly reversed course and dropped markedly to the vicinity of 1.0730, opening the door to a potential visit to the June lows just some pips south from there.

In the meantime, market participants continued to evaluate the FOMC gathering pari passu with rising expectations for an interest rate cut in December, as suggested by the Committee on Wednesday.

In the meantime, it is worth recalling that Chairman Jerome Powell, during his press conference, argued that the Fed does not intend to let the job market collapse as a means of reducing inflation, adding that a single quarter-percentage-point rate cut would not have a significant impact on the economy, highlighting that the overall policy direction is more important.

So far, the CME Group's FedWatch Tool now indicates nearly a 70% probability of lower interest rates by the September 18 gathering.

In the short term, the ECB's recent rate cut vs. the Fed’s on-hold stance has widened the policy gap between both central banks, potentially exposing EUR/USD to further weakness. However, in the longer term, the emerging economic recovery in the Eurozone, combined with perceived slowdowns in the US economy, should help mitigate this disparity, offering some support to the pair.

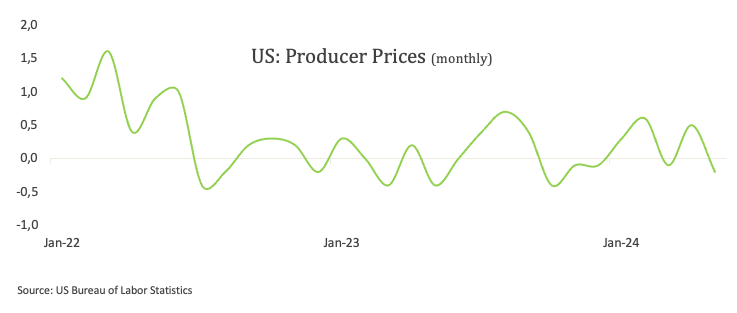

Back on the US docket, producer Prices contracted by 0.2% in May vs. the previous month and rose by 2.2% from a year earlier.

EUR/USD daily chart

EUR/USD short-term technical outlook

If the negative trend continues, EUR/USD may fall to 1.0719 (June 11), then 1.0649 (May 1), and finally 1.0601 (April 16) in 2024.

If bulls recover the lead, there is an immediate up-barrier at the weekly high of 1.0852 (June 12), followed by the June high of 1.0916 (June 4) and the March peak of 1.0981 (March 8). Further north, the weekly high of 1.0998 (January 11) seems ahead of the critical 1.1000 mark.

So far, the four-hour chart suggests a significant U-turn from recent peaks. That said, initial contention comes at 1.0719 before 1.0649 and 1.0601. Bulls, in the meantime, should target 1.0852, followed by 1.0916 and 1.0942. The relative strength index (RSI) fell to around 38.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.