EUR/USD Forecast: Euro well-positioned for the Fed, will a dovish Powell unleash the bulls?

- EUR/USD has been drifting lower as the dollar gains ahead of the Federal Reserve's decision.

- If the Fed continues to refrain from hinting of a change, the greenback could plunge.

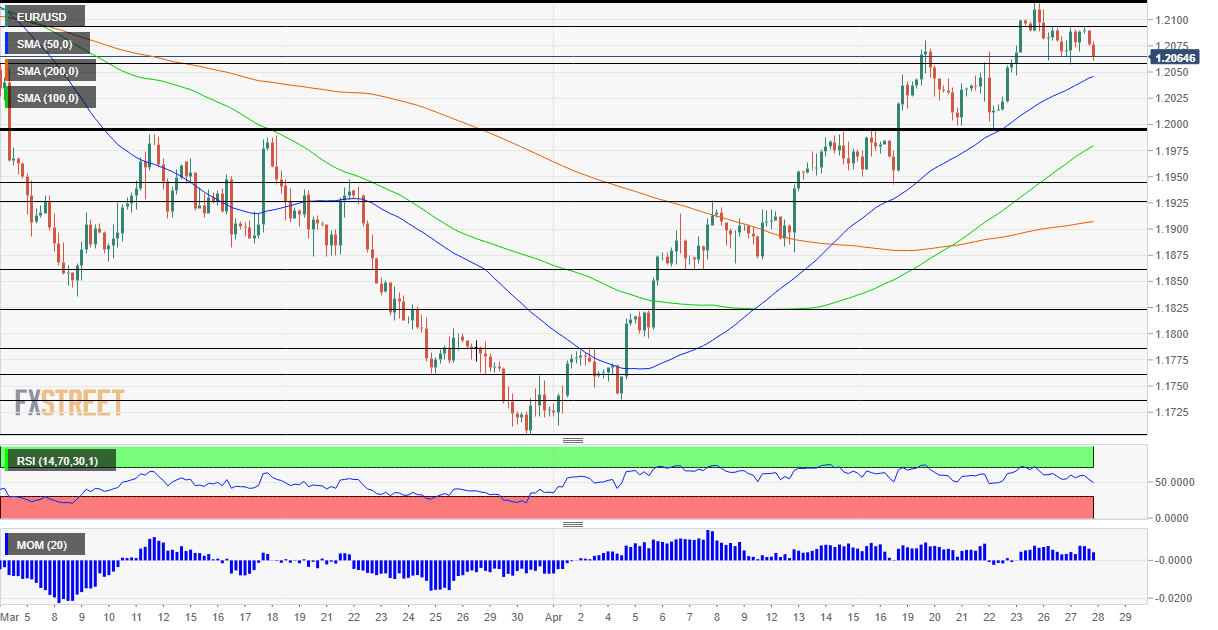

- Wednesday's four-hour chart is pointing to gains for the currency pair.

One step down, now three steps up? EUR/USD has been edging lower, but holding onto most of its recent gains. The main downside driver comes from the US bond market – 10-year Treasury yields have bounced back above 1.60%, sending the dollar marginally higher. This is the calm before the storm.

All eyes are on the Federal Reserve, and the question for investors is – will the Fed hint that it is withdrawing some of its stimuli? The US economy is booming thanks to a quick vaccination campaign and massive fiscal stimulus. While March's inflation figures were moderate, there are growing signs of price pressures. On the other hand, millions of Americans have yet to return to work.

Jerome Powell, Chair of the Federal Reserve, may use the opportunity to pre-announce that the bank would lay down a plan for tapering its bond-buying scheme in June. That is when the Fed publishes new economic forecasts. Signaling a reduction in the current $120 billion/month in dollar printing would cause the greenback to jump.

However, such an indication is far from guaranteed, and if he sticks to the script – inflation is transitory, still slack in the labor market – the US currency could suffer a fresh sell-off. What will the Fed do?

- Federal Reserve Preview: Will Powell power up the dollar? Three things to watch out for

- US Federal Reserve Meeting April Preview: Buying time before the inevitable taper

While traders count down to the decision, due at 18:00 GMT, a look at the euro's positioning provides a positive picture. Europe has finally picked up speed in its vaccination campaign and is also benefiting from falling COVID-19 cases. After Italy and France began easing restrictions, Spain will reportedly return to accepting British tourists in June.

Better prospects for the old continent make it a contender to gain significant ground if the Fed holds off from any tightening move.

Observing the charts also provides an upbeat picture.

EUR/USD Technical Analysis

Euro/dollar continues benefiting from upside momentum on the four-hour chart and is holding above the 50, 100 and 200 Simple Moving Averages. The Relative Strength Index is balanced, far from overbought conditions. All in all, bulls are in control.

Initial resistance awaits at 1.2095, the daily high, and that is followed by April's peak of 1.2117. Further above, 1.2180 is eyed.

Support is at the daily low of 1.2060, followed by the round 1.20 level and hen by 1.1950.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.