Federal Reserve Preview: Will Powell power up the dollar? Three things to watch out for

- The Federal Reserve is set to leave policies unchanged but could hint of tightening.

- Language on the improving labor market may rock markets.

- Chair Powell may have a harder time dismissing inflation concerns.

Taper tantrum 2.0? The Federal Reserve has already rocked markets by saying it would reduce the pace of its bond-buying scheme. That was 2013 and the Federal Reserve's Chair was Bernanke. However, history only rhymes, yet never fully repeats itself – and any positive response to an improving economy may be different in scope and in the market reaction.

1) Shining city on the hill needs no bond buys

The US economy is set to grow by the strongest rate since 1984 – the year Ronald Reagan was reelected by a landslide majority. That president described the US as the "shining city on a hill" and there are reasons to celebrate a brilliant economy. The 9.8% roar in retail sales is one of the examples of this upswing:

Source: FXStreet

Markets cheer the vaccine and stimulus-led recovery as near-daily record stock gains show but fear the potential consequences – rising interest rates. Returns on 10-year Treasuries have risen back to pre-pandemic highs and bonds are pricing the first rise in borrowing costs in 2022. The Fed foresees that only in 2024.

According to Jerome Powell, Chair of theFederal Reserve, the bank will first bring its bond-buying scheme to an end, and only then raise interest rates. When will that happen? According to Richar Clarida, Powell's No. 2, the Fed would lay down a plan to taper down purchases in one of the meetings that include new forecasts. The next one is in June.

And in order to avoid a 2013-style market crash, an announcement of when to begin tapering could be preceded by a pre-announcement. Will it come now? Powell would attempt to prevent investors from showing withdrawal symptoms if he indicates such a move is coming.

The Fed's balance sheet continues growing:

Source Federal Reserve

The Fed Chair famously said that he is "not even thinking of thinking of raising rates" – but is he thinking of slimming down bond buys? A non-denial would serve as a signal. For markets, that would mean a stronger dollar – fewer greenbacks printed means a higher value – and perhaps falling stocks.

Conversely, if Powell clearly states that the Fed did not even discuss any such reduction to Quantitative Easing (QE), stocks could continue their festivities and the dollar would suffer. Stressing that tapering is still a long way down the road would further calm the mood.

There is also a middle way between signaling a move and denying it altogether. Markets will watch what the Fed says about its twin mandates of employment and inflation.

2) Millions out of working or millions returning?

America is hiring, but is the pace satisfactory? Powell and his colleagues aim to reach full employment – a somewhat flexible term – but may act beforehand if the labor market zooms toward closing the gap.

The latest two Nonfarm Payrolls reports smashed estimates, showing a quicker return to work. Moreover, when counting upside revisions, one million positions were gained recently. Weekly jobless claims statistics during April also beat estimates and dropped to 547,000 in the last publication – the lowest since March 2020.

If Powell cheers the rapid return to work, markets would see it as a sign of a hawkish shift, sending the dollar up and stocks down.

On the other hand, many are still out of work. While an unemployment rate of 6% would be envied around the world, the Fed sees 8.4 million people who have yet to return to the workforce. The chart below shows the gap remains open.

Source: NYTimes

If the Fed continues stressing that it wants to see many millions more returning before thinking of any sort of tightening, the dollar would soften and stocks could gain ground. It would imply more money-printing for longer.

3) How transitory is inflation

The Fed's second mandate is price stability, and since last year, it clearly prioritizes reaching full employment even at the expense of temporarily rising inflation. That policy review allows for some "catching up," and the price falls seen in the wake of the pandemic last year result in "base effect" – artificially high annual increases. However, it can stick.

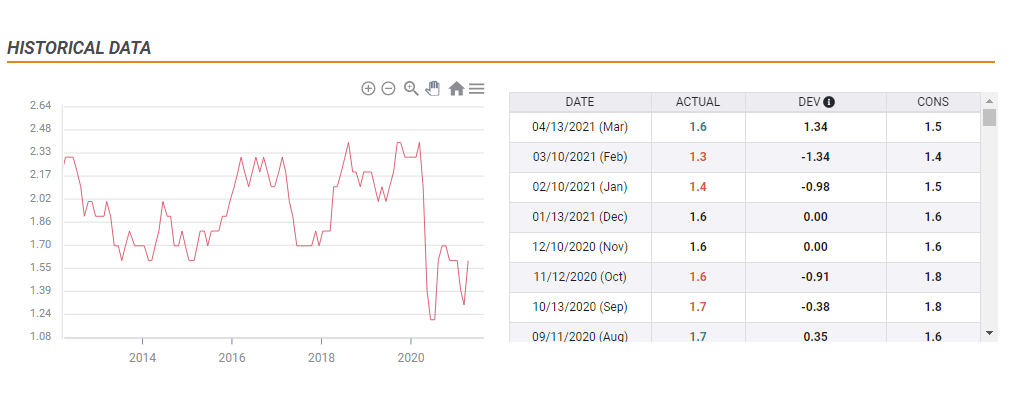

As of March, the Consumer Price Index jumped to 2.6% YoY while Core CPI advanced to 1.6%. At this point, there is nothing alarming to push the Fed into action. There is still room to rise before becoming worried and the Fed may opt to continue dismissing inflation worries. That would boost equities and weigh on the greenback.

Fed officials and economists foresaw a bump-up in year-on-year increases, but not all dismissed it as a transitory effect. The global microchip shortage has not only pushed prices higher but also caused carmakers to halt the production of some vehicles. Additional evidence comes from Procter & Gamble, which announced permanent price hikes for its cleaning products.

Traders are following the phenomenal rise of copper and also soft commodities such as corn and lumber.

Source: Trading Economics

If the Fed acknowledges such developments as potentially lasting for longer, the dollar could rise and stocks would suffer. Vice-Chair Richard Clarida said that if mid-year inflation levels persist through year-end, it could not be seen as transitory anymore.

If Powell provides such guidance, it could put the markets on alert for significant tightening later this year. The timeline could be opening the door to tapering in June and acting in December.

Conclusion

The US economy is booming and the Fed may have to stop shrugging it off and hinting of reducing bond-buying. Any signal – direct via taper talk or indirect by acknowledging heating employment and inflation – would support the greenback. Ongoing caution would do the opposite.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.