EUR/USD Forecast: Euro to bounce with Biden, crash in a contested election, tension is sky-high

- EUR/USD has been rising from the lows as US Election Day dawns.

- Markets prefer a clear outcome over a protracted process.

- Tuesday's four-hour chart is painting a bearish picture.

Election Day is finally here – four more years for President Donald Trump or a victory for rival Joe Biden? Almost 100 million Americans – 72.3% of the total 2016 vote count have already voted and turnout is estimated to top 150 million, a record. The stakes could not be higher.

Financial markets generally prefer business-friendly Republican leaders, yet the incumbent has been disruptive to international trade – and may settle for a minor stimulus package. The Democratic challenger would need to win the White House and also the Senate to pass a generous relief deal.

According to Nate Silver's FiveThirtyEight, Biden has an 89% chance of becoming the 46th President, while Dems have a 75% of controlling the upper chamber. While the former Vice-President has a commanding lead in national polls, the race is closer in swing states – which decide the elections.

See 2020 Elections: Three states traders should watch, plus places that could provide surprises

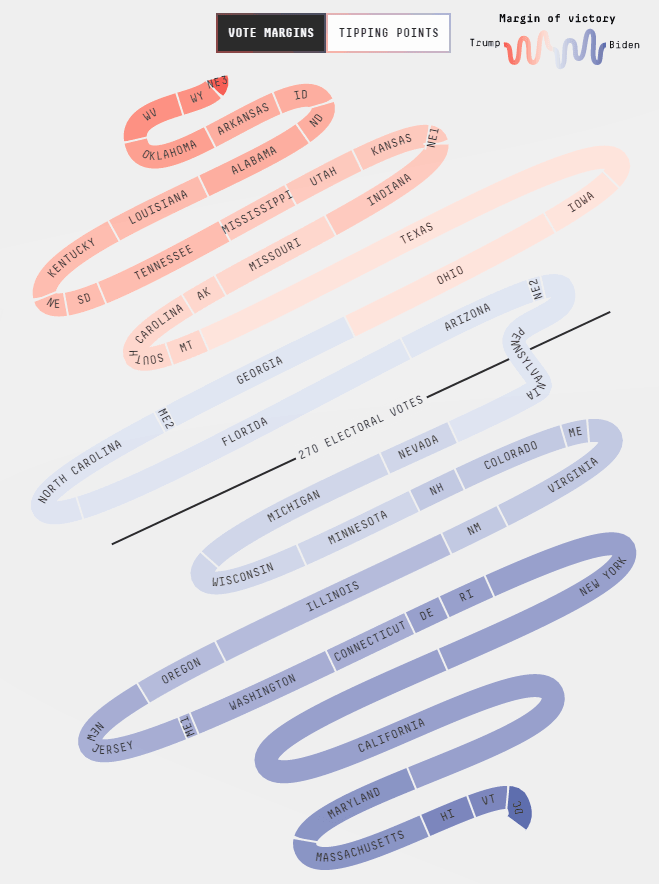

How the states are stacked:

Source: FiveThirtyEight

These battlegrounds can be broadly divided into two groups. The southern states of Florida, North Carolina, and Georgia have seen high turnout – over 90% of the 2016 total vote count. These states have already processed their early ballots ahead of election day and will be able to declare the winner early – if there is a clear one. Surveys have shown a tight race.

The second group includes Pennsylvania, Michigan, Wisconsin, and Minnesota – northern states where Biden has a larger lead in polls, but early voting was at a moderate rate of between 40-60%. Moreover, counting early ballots begins only on election day.

There are two extreme scenarios for markets. The first sees Biden winning an early victory in the south – perhaps even in Texas where turnout surpassed 100% of the 2016 vote. Enthusiasm to vote may signal people want change. That would seal the battle for the White House and probably lead to Democratic control of the Senate, where the race in North Carolina is critical.

A decisive result would weigh on the safe-haven dollar and send EUR/USD surging.

On the other extreme, there is a chance that it all comes down to Pennsylvania. The Keystone State could see Trump leading with Election Day ballots while Biden would eventually close the gap. If Trump declares premature victory, the battle could move from the ballot boxes to the courts.

A contested election raises chances of a constitutional crisis and violence on the streets, sending investors to the safety of the greenback and plunging EUR/USD.

More How three US election outcomes (and a contested result) could rock the dollar

Speculation about turnout and last-minute polls and rumors could trigger volatility ahead of the results. Stay tuned for live coverage of the event.

Other topics will likely be set aside. COVID-19 cases continue rising in the northern hemisphere, with European governments now waiting to see how the new restrictions – including lockdowns in Germany and France – impact the spread of the disease.

US Factory Orders for September will likely show an increase, in line with the upbeat ISM Manufacturing Purchasing Managers' Index for October.

Overall, it is all about the elections.

EUR/USD Technical Analysis

Euro/dollar has exited oversold conditions on the four-hour chart – the Relative Strength Index topped the 30 level. The currency pair continues trading below the 50, 100, and 200 simple Moving Averages and momentum is to the downside. That leaves room for fresh falls.

Support awaits at 1.1650, which was a low point last week. It is followed by Monday's trough of 1.1620, and then by 1.1610, September's bottom. The next levels to watch are 1.1550 and 1.15.

Resistance is at 1.1705, a swing high from last week, followed by 1.1720 and 1.1745.

More:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.