Gold Price Analysis: XAU/USD has three ways to go in response to the 2020 Presidential Elections

- Gold prices heavily depend on the fate of fiscal stimulus.

- A blue wave could unleash a golden age for the precious metal.

- If Trump remains is reelected, the reaction could be mixed.

- President Biden with a Republican Senate would cause a meltdown.

Gold could power up if the government prints more money – that is the simple logic that has been rocking the precious metal in recent months. XAU/USD soared to new highs as central banks enhanced their bond-buying programs and as authorities used the funds to shore up the economies amid the coronavirus crisis.

The Federal Reserve, the European Central Bank, and even European governments did "whatever it takes." The US government also played its part early in the crisis with the CARES Act – but most programs have lapsed. Now, markets and gold bulls want more of what Uncle Sam can give.

Democrats and Republicans seemed to hover around a $2 trillion deal but failed to reach an accord ahead of the elections. A decision on more funds – of which some will likely fuel into gold – will wait for the new administration.

There are three main election scenarios that would all yield distinct results for XAU/USD:

1) Blue wave – Golden wave

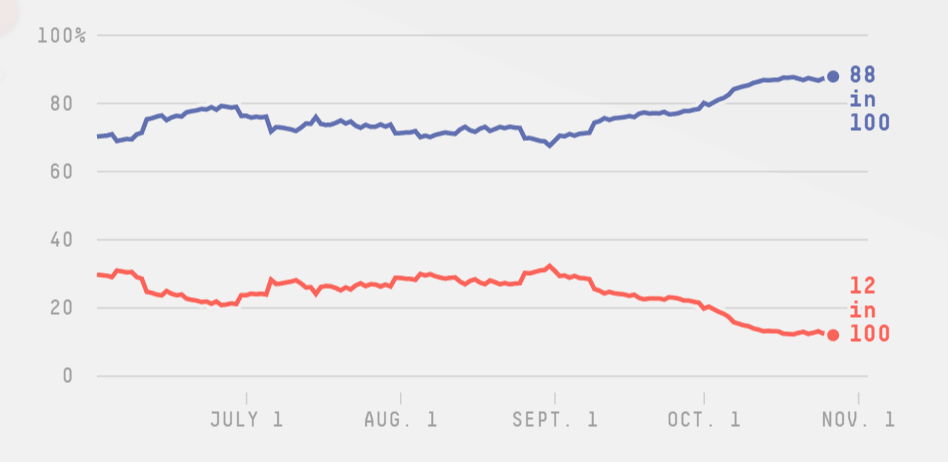

President Donald Trump is trailing rival Joe Biden in national and state polls. According to FiveThirtyEight, he has an 88% chance of winning at the time of writing. Democrats have around 70% probability of winning the House and the Senate.

Source: FiveThirtyEight

In this "blue wave" scenario – which is the likeliest according to the polls – Dems could approve a bill worth $2 trillion as they nearly agreed with Republicans, or even $3.4 trillion as they originally wanted to do back in May.

For the yellow metal, the more the merrier. A break above the all-time highs cannot be ruled out in this scenario.

2) Trump reelected – a mixed reaction

Many still remember 2016 and claim that polls are missing the "shy Trump voter" and that he can still win the electoral college. While surveyors probably fixed some of their problems, there is still a chance that the president squeezes another victory. In that case, Republicans are also likely to cling onto the Senate.

See 2020 US Election: Polling, history and the submerged Trump vote

In this scenario, Trump may feel he has the mandate to impose his will on Republicans –something he struggled with toward the elections – and a stimulus package is likely even during the "lame duck" period.

Gold bulls would likely cheer such a scenario, but any rally would be short-lived, as the total package will probably be smaller than a "blue" one.

3) President Biden, Republican control – meltdown scenario

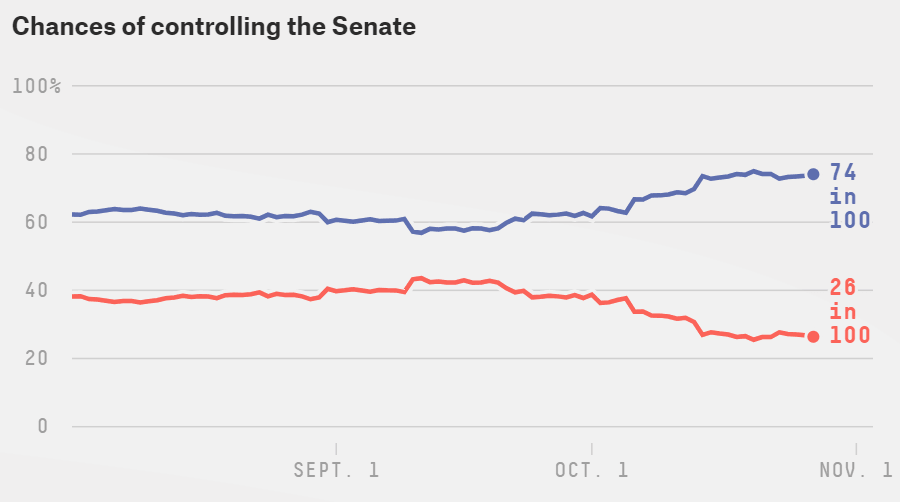

As mentioned above, the chances for Biden to oust Trump are higher than for Dems to beat the GOP in the race for the Senate. If Republicans cling onto the upper chamber, they would probably limit any large package.

Source: FiveThirtyEight

Gold could suffer in response to partisan brinkmanship – especially if the relief deal falls short of the $1 trillion mark. A significant retreat toward pre-pandemic levels is an option as well. Negotiations could be protracted.

Conclusion

Gold heavily depends on stimulus, and the more, the merrier. The optimal scenario is a clean Democratic sweep, followed by a Trump victory. A split between President Trump and the Senate is the worst outcome.

More: 2020 Elections: Seven reasons why this is not 2016, time to focus on the Senate

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.