EUR/USD Forecast: Euro retreats below key support ahead of US inflation report

- EUR/USD trades in the red near 1.0500 in the European morning on Wednesday.

- The near-term technical outlook points to a bearish tilt.

- November Consumer Price Index data from the US will be watched closely.

EUR/USD closed in negative territory on Tuesday and continued push lower toward the 1.0500 area early Wednesday, pressured by the renewed US Dollar (USD) strength. As market focus shifts to November Consumer Price Index (CPI) data from the US, the pair's technical outlook points to a bearish tilt in the near term.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.72% | 0.04% | 1.14% | 0.23% | 0.59% | 1.22% | 0.75% | |

| EUR | -0.72% | -0.66% | 0.54% | -0.41% | -0.04% | 0.58% | 0.11% | |

| GBP | -0.04% | 0.66% | 1.04% | 0.26% | 0.62% | 1.25% | 0.78% | |

| JPY | -1.14% | -0.54% | -1.04% | -0.95% | -0.48% | -0.06% | -0.32% | |

| CAD | -0.23% | 0.41% | -0.26% | 0.95% | 0.40% | 0.99% | 0.52% | |

| AUD | -0.59% | 0.04% | -0.62% | 0.48% | -0.40% | 0.62% | 0.15% | |

| NZD | -1.22% | -0.58% | -1.25% | 0.06% | -0.99% | -0.62% | -0.48% | |

| CHF | -0.75% | -0.11% | -0.78% | 0.32% | -0.52% | -0.15% | 0.48% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Rising US Treasury bond yields helped the USD outperform its rivals in the American session on Wednesday. Moreover, the risk-averse market environment allowed the currency hold its ground, causing EUR/USD to stretch lower.

The annual CPI inflation in the US is forecast to rise to 2.7% in November from 2.6% in October. On a monthly basis, the core CPI is expected to rise 0.3%, matching October's increase. In case the monthly core CPI reading comes in above analysts' estimate, the immediate reaction could boost the USD and drag EUR/USD lower. On the flip side, a reading of 0.2% lower in this data could have the opposite effect on the pair's action.

On Thursday, the European Central Bank (ECB) will announce monetary policy decisions. Hence, EUR/USD's reaction to US inflation data could remain short-lived.

EUR/USD Technical Analysis

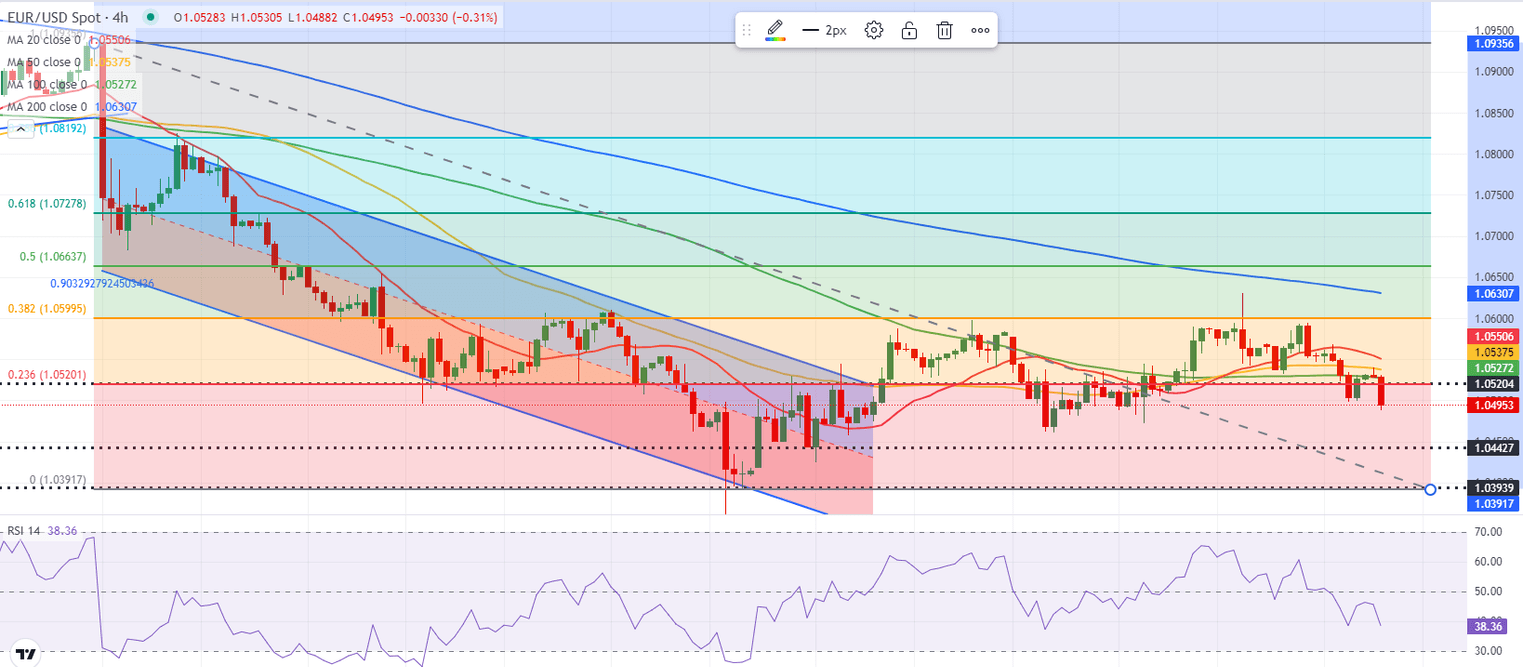

EUR/USD dropped below 1.0520, where the 100-period Simple Moving Average (SMA) on the 4-hour chart meets the Fibonacci 23.6% retracement of the latest downtrend. Meanwhile, the Relative Strength Index (RSI) indicator turned south and fell below 40, reflecting a buildup of bearish momentum.

In case EUR/USD confirms 1.0520 as resistance, technical sellers could remain interested. In this scenario, 1.0440 (static level) could be seen as the next support before 1.0400 (end-point of the downtrend).

On the other hand, sellers could be discouraged if EUR/USD manages to reclaim 1.0520 and allow the pair to extend its recovery toward 1.0600 (Fibonacci 38.2% retracement) and 1.0630 (200-period SMA).

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day, according to data from the Bank of International Settlements. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.