EUR/USD Forecast: Euro looks fragile ahead of ECB decision

- EUR/USD clings to small daily gains above 1.0500 on Thursday.

- The ECB is widely expected to lower key rates by 25 bps.

- The near-term technical outlook points to a loss of bearish momentum.

EUR/USD extended its weekly slide and dropped below 1.0500 on Wednesday. Despite recovering back above this level, the pair struggles to gather momentum as investors await the European Central Bank's (ECB) policy announcements.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the weakest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.43% | -0.26% | 1.71% | -0.08% | -0.50% | 0.52% | 0.38% | |

| EUR | -0.43% | -0.68% | 1.40% | -0.43% | -0.84% | 0.18% | 0.03% | |

| GBP | 0.26% | 0.68% | 1.91% | 0.25% | -0.16% | 0.86% | 0.71% | |

| JPY | -1.71% | -1.40% | -1.91% | -1.80% | -2.08% | -1.29% | -1.23% | |

| CAD | 0.08% | 0.43% | -0.25% | 1.80% | -0.36% | 0.61% | 0.46% | |

| AUD | 0.50% | 0.84% | 0.16% | 2.08% | 0.36% | 1.02% | 0.88% | |

| NZD | -0.52% | -0.18% | -0.86% | 1.29% | -0.61% | -1.02% | -0.16% | |

| CHF | -0.38% | -0.03% | -0.71% | 1.23% | -0.46% | -0.88% | 0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The US Dollar preserved its strength and caused EUR/USD to stretch lower after the US Bureau of Labor Statistics reported on Wednesday that the Consumer Price Index (CPI) and the core CPI both rose 0.3% on a monthly basis in November, matching market expectations.

The ECB is forecast to lower key rates by 25 basis points (bps) following the last policy meeting of the year. In case the ECB opts for a 50 bps cut, the Euro is likely to come under heavy selling pressure with the immediate reaction. Similarly, a 25 bps cut, accompanied by a dovish language that suggests additional rate cuts will be on the table at the upcoming meetings, could cause EUR/USD to turn south.

On the flip side, EUR/USD could extend its recovery in case the ECB approaches further policy easing in a cautious way, voicing concerns over possible inflation shocks next year.

The US economic calendar will feature weekly Initial Jobless Claims and Producer Price Index data for November. Investors, however, are likely to stay focused on the ECB event and ignore these releases.

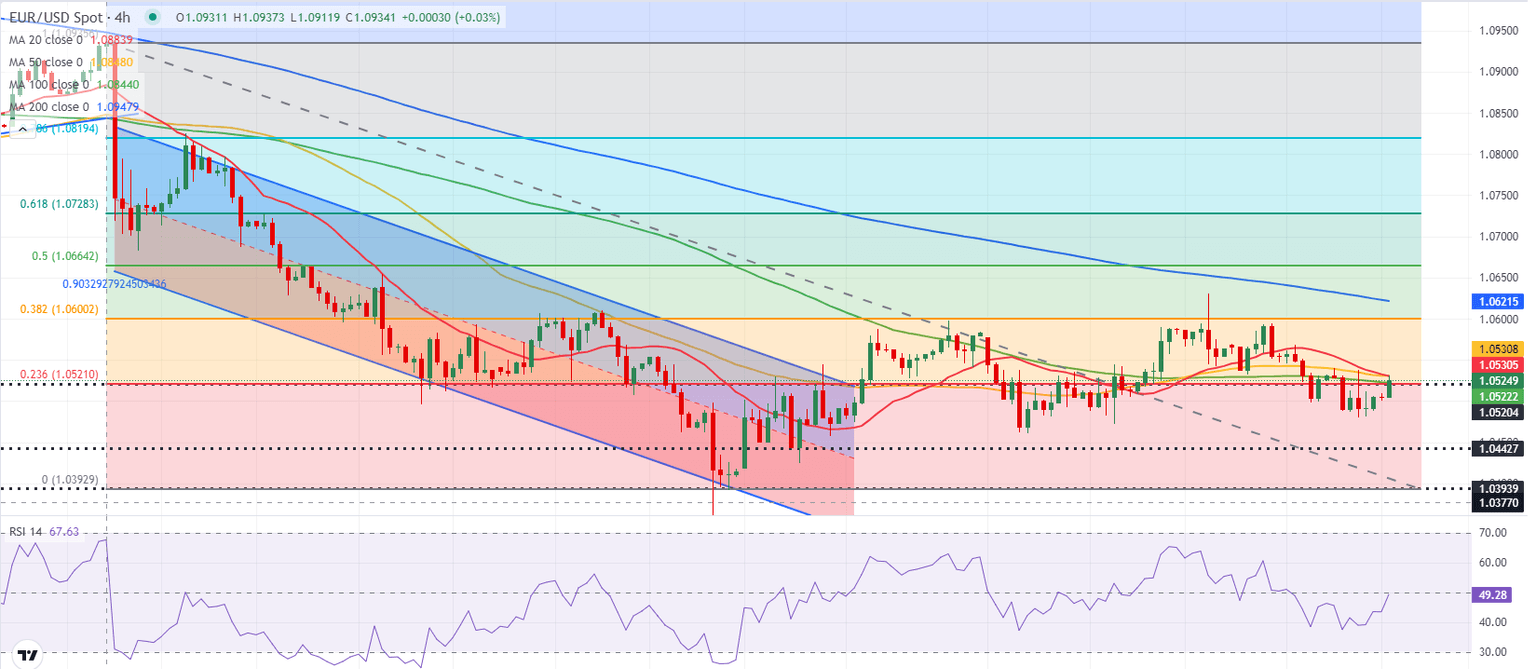

EUR/USD Technical Analysis

EUR/USD was last seen trading near 1.0520, where the 100-period Simple Moving Average (SMA) on the 4-hour chart meets the Fibonacci 23.6% retracement of the latest downtrend. If this level stays intact as resistance, the pair could push lower toward 1.0440 (static level) and 1.0400 (end-point of the downtrend).

In case EUR/USD stabilizes above 1.0520, technical sellers could be discouraged and open the door for a leg higher toward 1.0600 (Fibonacci 38.2% retracement) and 1.0620 (200-period SMA).

ECB FAQs

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy for the region. The ECB primary mandate is to maintain price stability, which means keeping inflation at around 2%. Its primary tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

In extreme situations, the European Central Bank can enact a policy tool called Quantitative Easing. QE is the process by which the ECB prints Euros and uses them to buy assets – usually government or corporate bonds – from banks and other financial institutions. QE usually results in a weaker Euro. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The ECB used it during the Great Financial Crisis in 2009-11, in 2015 when inflation remained stubbornly low, as well as during the covid pandemic.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the European Central Bank (ECB) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the ECB stops buying more bonds, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Euro.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.