EUR/USD Forecast: Euro could test 1.0600 resistance on weak US jobs data

- EUR/USD fluctuates above 1.0550 after posting strong gains on Thursday.

- Investors await November Nonfarm Payrolls data from the US.

- Near-term technical outlook remains bullish, with next resistance aligning at 1.0600.

EUR/USD gathered bullish momentum and gained more than 0.7% on Thursday. Before testing 1.0600, however, the pair went into a consolidation phase and was last seen fluctuating at around 1.0570.

Euro PRICE This week

The table below shows the percentage change of Euro (EUR) against listed major currencies this week. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.08% | -0.06% | 0.16% | 0.35% | 1.36% | 1.13% | -0.11% | |

| EUR | -0.08% | -0.18% | 0.11% | 0.28% | 1.37% | 1.04% | -0.17% | |

| GBP | 0.06% | 0.18% | 0.27% | 0.46% | 1.60% | 1.22% | -0.02% | |

| JPY | -0.16% | -0.11% | -0.27% | 0.16% | 1.21% | 0.95% | -0.35% | |

| CAD | -0.35% | -0.28% | -0.46% | -0.16% | 1.17% | 0.76% | -0.47% | |

| AUD | -1.36% | -1.37% | -1.60% | -1.21% | -1.17% | -0.34% | -1.55% | |

| NZD | -1.13% | -1.04% | -1.22% | -0.95% | -0.76% | 0.34% | -1.20% | |

| CHF | 0.11% | 0.17% | 0.02% | 0.35% | 0.47% | 1.55% | 1.20% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The US Dollar (USD) came under bearish pressure and helped EUR/USD push higher on Thursday after the US Department of Labor reported that the number of first-time applications for unemployment benefits rose to 224,000 in the week ending November 30 from 215,000 in the previous week.

Later in the day, November labor market data from the US will be scrutinized by investors. Following the 12,000 increase recorded in October, because of hurricanes and strikes, Nonfarm Payrolls (NFP) are forecast to rise by 200,000 in November.

According to the CME FedWatch Tool, markets are currently pricing in about a 70% probability of a 25 basis points (bps) Federal Reserve (Fed) rate cut in December. A disappointing NFP print of 150,000 or lower could confirm a rate reduction and further weigh on the USD. On the flip side, a reading above 200,000 could cause markets to refrain from pricing in a December cut and trigger a leg lower in EUR/USD.

Later in the American session, several Fed policymakers will be delivering speeches. Since the Fed's blackout period will start on Saturday, these comments could also drive the USD's valuation heading into the weekend.

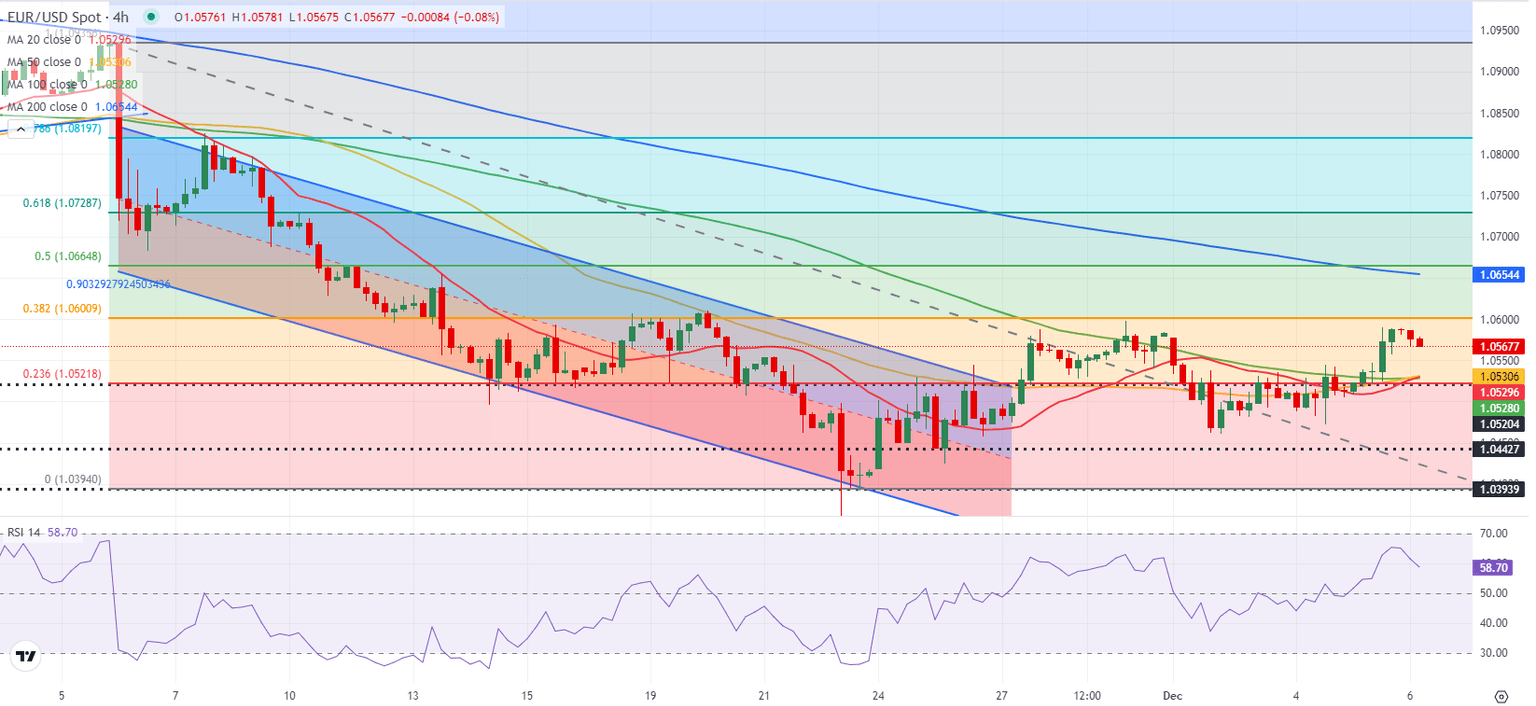

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart retreated toward 60 early Friday, suggesting that the bullish bias remains intact, while EUR/USD stages a technical correction. On the upside, 1.0600 (Fibonacci 38.2% retracement of the latest downtrend) aligns as immediate resistance before 1.0650-1.0660 (200-period Simple Moving Average (SMA), Fibonacci 50% retracement) and 1.0730 (Fibonacci 61.8% retracement).

Looking south, first support could be spotted at 1.0520-1.0530 (100-period SMA, 50-period SMA, 20-period SMA, Fibonacci 23.6% retracement) ahead of 1.0500 (psychological level, static level) and 1.0440 (static level).

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day, according to data from the Bank of International Settlements. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.