EUR/USD Forecast: EUR/USD pressured near 1.1000 ahead of ECB’s decision

EUR/USD Current price: 1.1020

- The United States Consumer Price Index disappointed those hoping for an aggressive Fed.

- The European Central Bank is expected to announce a 25 basis points rate cut on Thursday.

- EUR/USD flirted with the 1.1000 mark, aims to break below it.

The EUR/USD pair extended its weekly decline to 1.1001 on Wednesday, bouncing just modestly ahead of the close. The pair is heading into the Asian opening trading around the 1.1020 level, with an overall bearish stance.

Financial markets turned risk-averse following the release of the United States (US) Consumer Price Index (CPI), as the figures weighed down the odds for a Federal Reserve (Fed) 50 basis points (bps) interest rate cut when it meets next week. The US Bureau of Labor Statistics reported that the CPI rose by 2.5% on a yearly basis in August, easing from 2.9% in July, while the core annual figure printed at 3.2%, unchanged from the previous month. Additionally, the core monthly index increased by 0.3%, worse than the 0.2% advance anticipated.

Speculative interest hoped for further easing in price pressures and a more aggressive Fed. As a result, stock markets plunged, with Wall Street posting sharp losses after the opening. Nevertheless, the three major indexes recovered ahead of the close and trimmed most of their early losses. The US Dollar, however, retained a good bunch of its gains across the FX board.

Investors will now focus on the European Central Bank (ECB). The ECB will announce its decision on monetary policy early on Thursday, and is widely anticipated to cut the three main interest rates by 25 bps each. Policymakers will act not only because of easing price pressures but also because of mounting concerns about a potential recession in the Eurozone. Of course, officials will not put that in words, but they will repeat that they will remain vigilant and data-dependent.

EUR/USD short-term technical outlook

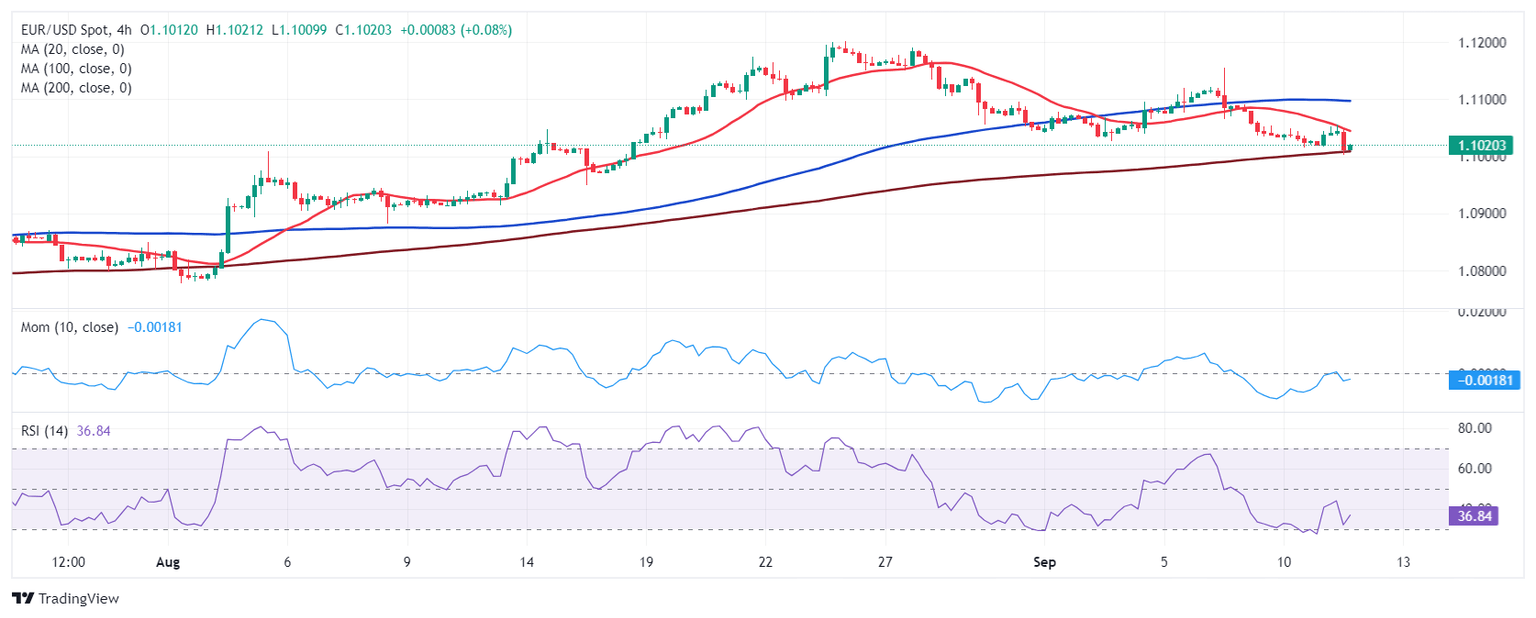

The daily chart for the EUR/USD pair shows that the risk remains skewed to the downside. The pair further extended its slump below a now flat 20 Simple Moving Average (SMA) while the 100 SMA is losing steam a few pips above a flat 200 SMA, both far below the current level. Technical indicators, in the meantime, have pared their slides but remain well into negative levels, far from suggesting downward exhaustion.

Technical readings in the 4-hour chart support another leg south. The 20 SMA gains downward traction below a flat 100 SMA, while EUR/USD bounced modestly after testing the 200 SMA. Finally, technical indicators have bounced from near oversold readings but remain below their midlines and lack directional strength. A break through the 1.1000 level will likely force buyers to give up and encourage sellers, with the pair then aiming to retest the 1.0900 threshold.

Support levels: 1.0990 1.0950 1.0910

Resistance levels: 1.1050 1.1090 1.1140

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.