EUR/USD Forecast: Dollar resumes advance alongside yields

EUR/USD Current Price: 1.2142

- US Treasury yields are standing around fresh one-year highs ahead of the opening.

- German’s Q4 Gross Domestic Product was upwardly revised to 0.3% from 0.1%.

- EUR/USD eases ahead of Wall Street’s opening but holds within familiar levels.

The EUR/USD pair advanced at the beginning of the day, as the greenback remained under pressure following US Federal Reserve chief Powell comments on monetary policy on Wednesday. Stocks are up, although just marginally. Treasury yields are ticking higher ahead of Wall Street’s opening, providing support to the American dollar. The shared currency is still among the weakest across the board, with EUR/USD unable to surpass the 1.2170/80 price zone.

Data wise, Germany published the final version of its Q4 Gross Domestic Product, which was upwardly revised to 0.3% from 0.1%. The US will publish January New Home Sales, foreseen up by 2.1%. Fed’s head Powell will repeat its testimony before a different commission.

EUR/USD short-term technical outlook

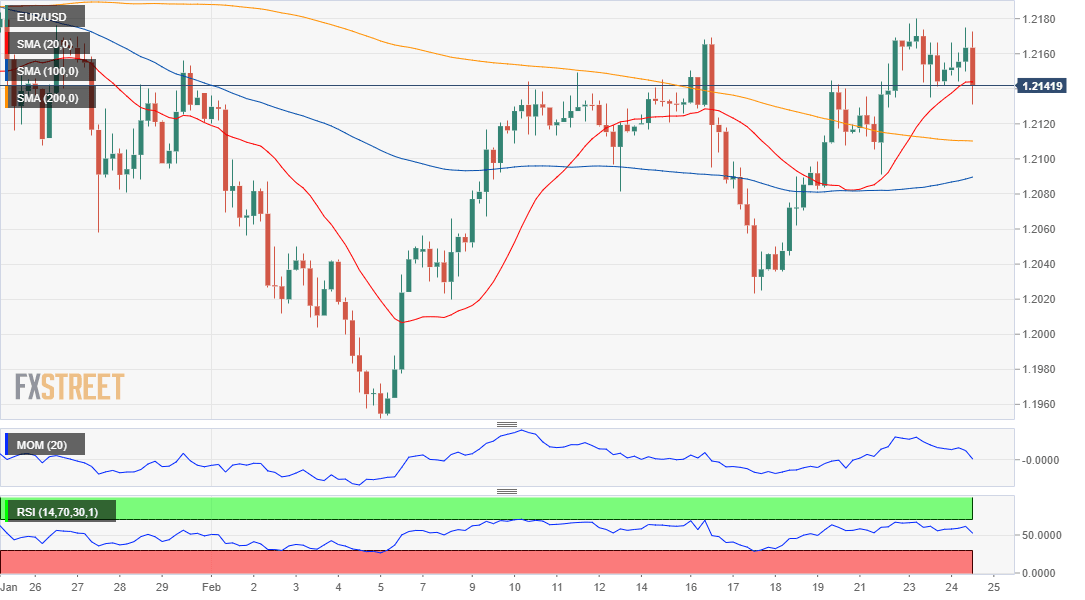

The EUR/USD pair is down ahead of the US opening but trading within familiar levels and confined to a tight intraday range. In the near-term, the pair is piercing its 20 SMA while holding above bearish 100 SMA and 200 SMA. Technical indicators turned south within positive levels, skewing the risk to the downside without confirming a new leg south.

Support levels: 1.2100 1.2060 1.2015

Resistance levels: 1.2175 1.2215 1.2250

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.