EUR/USD Current Price: 1.1760

- Concerns related to the next US aid package and the spread of coronavirus weigh on mood.

- A scarce macroeconomic calendar leaves major pairs in the hands of sentiment.

- EUR/USD at risk of falling in the short-term but the wider view still favours the upside.

The EUR/USD pair is trading unchanged in the 1.1760 price zone, after a failed attempt to resume its advance. The pair surged to 1.1806 with London opening, but it quickly turned back south, as investors struggle for direction. News that the US Congress is incapable of agreeing on the next coronavirus aid package weighed on investors’ mood, alongside comments from WHO Director Tedros, who said that there might never be a solution for stopping the spread of COVID-19.

The macroeconomic calendar has little to offer today, as the EU published the June Producer Price Index, which rose 0.7% in the month, and declined by 3.7% when compared to a year earlier, better than anticipated. As for the US, the country will publish the IBD/TIPP Economic Optimism Index for August, and June Factory Orders.

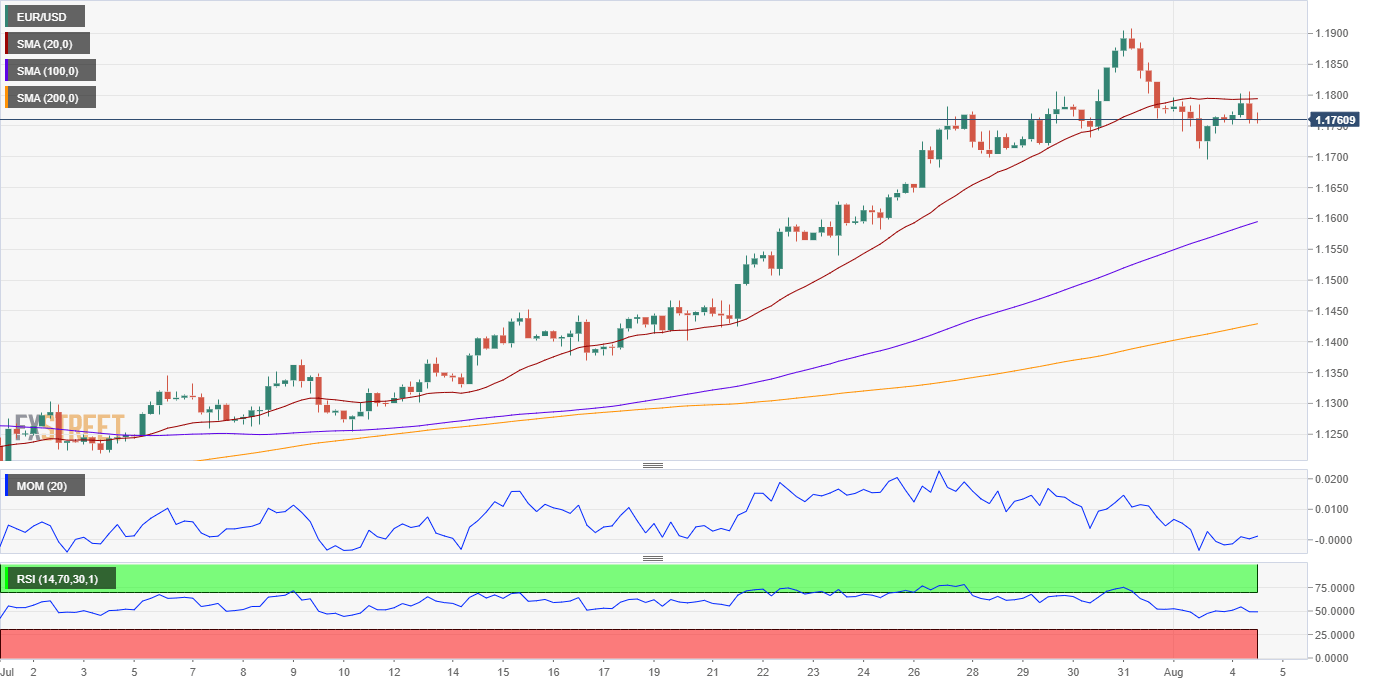

EUR/USD short-term technical outlook

The EUR/USD pair continues to trade above the 23.6% retracement of its July rally at around 1.1735, the immediate support. The 4-hour chart shows that a flat 20 SMA continues to cap advances, while technical indicators head south, the Momentum well into negative territory and the RSI around its midline. Nevertheless, the bearish potential is limited by the lack of dollar’s demand, with declines still seen as buying opportunities.

Support levels: 1.1735 1.1695 1.1650

Resistance levels: 1.1800 1.1845 1.1890

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.