EUR/USD Forecast: Corrective pullback seems limited, focus shifts to ECB meeting on Thursday

- EUR/USD witnessed some selling on Monday and retreated further from post-NFP swing highs.

- A goodish pickup in the USD demand was seen as a key factor exerting pressure on the major.

- The downside is likely to remain limited ahead of the ECB monetary policy decision on Thursday.

The EUR/USD pair kicked off the new week on a defensive note and extended Friday's late pullback from levels just above the 1.1900 mark, or the highest since late June. The pullback was sponsored by a goodish pickup in the US dollar demand, though any meaningful corrective slide still seems elusive ahead of the European Central Bank (ECB) meeting on Thursday.

The disappointing headline NFP print for August, to some extent, was offset by an upward revision of the previous month's reading and a further decline in the US unemployment rate. This, along with strong wage growth data kept alive hopes for an imminent Fed taper announcement later this year. Investors now expect the US central bank to begin rolling back its pandemic-era stimulus in December and likely end the QE by the middle of 2022. This was reinforced by a sharp spike in the US Treasury bond yields on Friday, which, in turn, was seen as a key factor that assisted the USD to rebound from one-month lows.

Meanwhile, Monday's release of upbeat German Factory Orders data did little to impress the euro bulls or lend any support to the major. In fact, the latest data published by the Federal Statistics Office showed that contracts for goods ‘Made in Germany’ rose 3.4% in July. This marked a notable drop from the 4.6% increase recorded in July but surpassed consensus estimates by a big margin, which pointed to a 1% decline. Nevertheless, the data suggested that the recovery in the manufacturing sector of Europe’s economic powerhouse is gaining momentum.

This comes on the back of the recent hawkish rhetoric from a host of ECB policymakers, which could act as a tailwind for the shared currency and help limit any deeper losses for the major. The ECB's Klaas Knot said that he expects the central bank to start reducing the pace of its emergency bond purchases at this week's meeting, with a view to ending them in March. Separately, Governing Council member Robert Holzmann noted that the ECB should start debating how it will phase out its pandemic-era stimulus and focus on tools that would help achieve its 2% inflation target sustainably.

Meanwhile, Bundesbank President Jens Weidmann said that Eurozone inflation is at risk of overshooting the ECB’s projections as the temporary factors could seep into underlying price growth. Adding to this, the ECB Vice President Luis de Guindos told a Spanish newspaper that there will logically be a gradual normalization of monetary policy if inflation and the economy continue to recover. This has been fueling bets that the ECB will pare back its purchases of government bonds, sooner rather than later. Hence, the focus will be on the upcoming ECB monetary policy decision on Thursday, which might hold investors from placing aggressive bets and further limit the downside for the major.

Short-term technical outlook

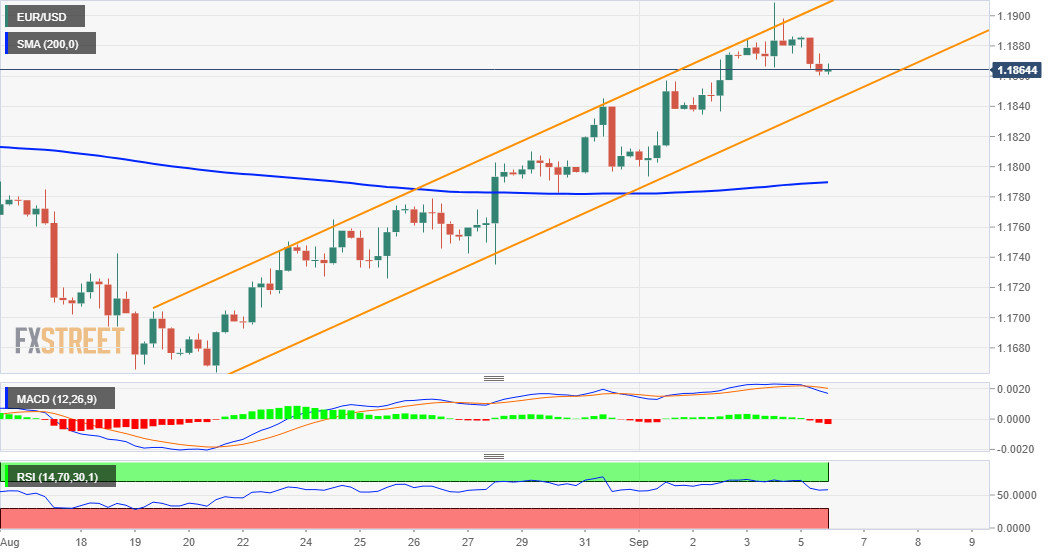

From a technical perspective, the pair’s inability to find acceptance above the 1.1900 mark and a short-term ascending channel resistance warrants some caution for aggressive bullish traders. That said, any subsequent pullback is more likely to find decent support near the lower boundary of the mentioned channel, currently around the 1.1835 region. This should now act as a key pivotal point for traders.

A convincing break below would suggest that the recent strong rebound from YTD lows, around the 1.1665 area has run out of steam and shift the bias in favour of bearish traders. The pair might then accelerate the fall towards the 1.1800 mark. This is closely followed by the 200-period SMA on the 4-hour chart, around the 1.1785 region, which if broken should pave the way for a fall back towards the 1.1700 round figure.

On the flip side, bulls might now wait for some follow-through strength beyond the 1.1900 mark and the mentioned trend-channel resistance before placing fresh bets. The pair might then climb further towards the 1.1940 supply zone, above which the momentum could further get extended towards the 1.1975 region en-route the key 1.2000 psychological mark.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.