EUR/USD Forecast: Consolidative phase continues with bulls maintaining the pressure

EUR/USD Current price: 1.0824

- The US Dollar can not lift its head after Federal Reserve’s Powell resumed the hawkish tone.

- Market participants await a United States inflation update on Thursday.

- EUR/USD trades within familiar levels but bulls remain in charge.

The EUR/USD pair trades uneventfully at around 1.0820 on Wednesday, still confined to a tight intraday range, with the US Dollar maintaining the soft tone across the FX board. Financial markets were unable to take directional clues from Federal Reserve (Fed) Chairman Jerome Powell’s testimony before Congress. Powell´s words on monetary policy resumed the hawkish tone that he partially abandoned in Sintra, triggering a short-lived USD run.

Still, market participants remain unconvinced, awaiting a clue that does not seem to come. Everything about the United States (US) economy seems to be moving in the right direction—growth, employment, and inflation—but at a pace that does not require the Fed’s intervention.

Additional hints will come on Thursday when the US will publish Consumer Price Index (CPI) figures. Annual inflation is foreseen up 3.1% in June while the monthly increase is expected to be 0.1%. Finally, the core annual CPI is foreseen unchanged at 3.4%.

Meanwhile, today's focus will be on speeches from Fed policymakers, including Chair Powell. Powell will repeat its testimony on monetary policy before a different commission in the American afternoon.

EUR/USD short-term technical outlook

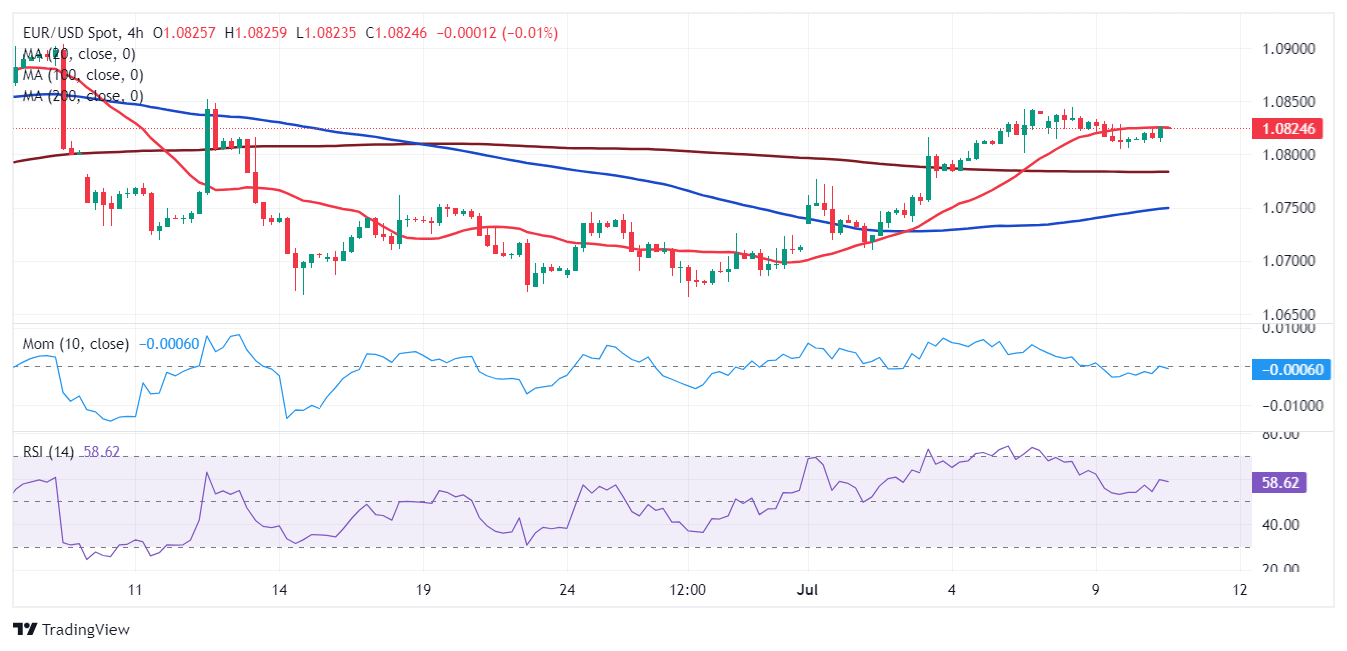

From a technical point of view, the EUR/USD pair is bullish, according to the daily chart. The pair keeps comfortably trading above all its moving averages, with the 100 and 200 Simple Moving Averages (SMAs) converging around 1.0790 and providing support. At the same time, technical indicators aim to resume their advances whitin positive levels, skewing the risk to the upside, although without confirming an upcoming rally.

EUR/USD is neutral-to-bullish in the near term. The 4-hour chart shows a directionless 20 SMA caps advances, although the longer moving averages tick marginally higher, well below the current level. Finally, the Momentum indicator lacks directional strength around its 100 line, but the Relative Strength Index (RSI) indicator picked up within positive levels, in line with increased buying interest. Bulls will be more comfortable once the 1.0850 area is cleared, while bears can take their chances on a break below 1.0790.

Support levels: 1.0790 1.0740 1.0700

Resistance levels: 1.0850 1.0880 1.0930

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.