EUR/USD Forecast: Cautious buying ahead of Fed’s announcement

EUR/USD Current price: 1.0843

- The US Dollar weakens ahead of the Federal Reserve monetary policy announcement.

- The ADP report showed that the US private sector added 122K new jobs in July.

- EUR/USD advances modestly, buyers not convinced just yet.

The EUR/USD pair grinds north in the European session, with the US Dollar weaker against most major rivals ahead of the Federal Reserve (Fed) monetary policy announcement. The United States (US) central bank is widely anticipated to keep rates on hold, although market participants hope Chair Jerome Powell and co will pave the way for a September rate cut. Even further, speculative interest anticipates the central bank may also trim rates in December and will seek confirmation on it.

The Greenback traded mixed during Asian trading hours. The Bank of Japan (BoJ) decided to raise the interest rate by 15 basis points (bps) from the range of 0%-0.1% to 0.15%-0.25%, confirming a rumour that started mid-Tuesday. The Japanese Yen soared, undermining demand for the USD.

Meanwhile, the Eurozone published the preliminary estimate of the July Harmonized Index of Consumer Prices (HICP), which rose by 2.6% YoY, surpassing the expected 2.4%. Given that markets have already priced in a rate cut from the European Central Bank (ECB), the news had no negative impact on the Euro.

Across the pond, the US published the ADP Employment Change report, which showed that the private sector added 122K new jobs in July, missing expectations and below the revised 155K gained in June.

EUR/USD short-term technical outlook

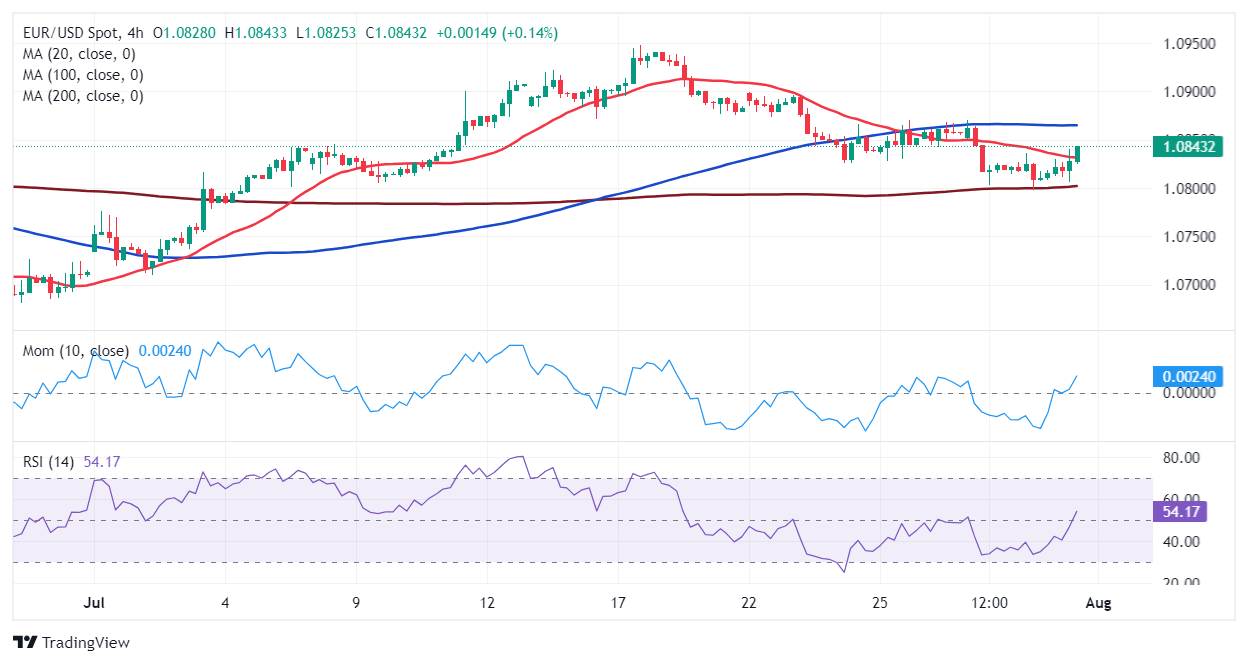

From a technical perspective, the EUR/USD pair is at risk of extending its slide. The daily chart shows that the pair trades in positive territory, but the 20 Simple Moving Average (SMA) has also lost its bullish momentum while providing dynamic resistance at around 1.0860. The 100 and 200 SMAs remain directionless below the current level, although the pair has been testing them in the last couple of days, a sign of mounting bearish determination. Finally, the Momentum indicator offers a modest bearish slope just below its midline, while the Relative Strength Index (RSI) indicator hovers around 50, lacking clear directional strength.

In the near term and according to the 4-hour chart, the upside seems limited. Technical indicators have recovered from their recent lows and aim north but remain within negative levels. At the same time, a flat 200 SMA at around 1.0800 continues providing intraday resistance. At the same time, EUR/USD is battling to overcome a bearish 20 SMA, still falling short of confirming an upcoming upward extension.

Support levels: 1.0800 1.0760 1.0720

Resistance levels: 1.0860 1.0910 1.0950

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.