EUR/USD Forecast: Caution mounts ahead of Federal Reserve’s announcement

EUR/USD Current price: 1.1124

- Investors maintain the focus on central banks, with the Fed scheduled for Wednesday.

- The German ZEW Survey brought a negative surprise in September.

- EUR/USD retreats from recent highs, but the bearish potential seems limited.

The EUR/USD pair maintains its positive tone on Tuesday, currently retreating from an intraday high of 1.1145, ahead of the United States (US) opening. Financial markets trade with a cautious stance as the US Federal Reserve’s (Fed) monetary policy decision looms. The Fed is expected to trim interest rates on Wednesday after pushing them towards record highs in the aftermath of the pandemic. As a result, the US Dollar remains pressured across the FX board.

Meanwhile, the macroeconomic calendar had some relevant figures to offer. In the Eurozone, Germany released the September ZEW Survey on Economic Sentiment, which showed a sharp, unexpected contraction. Germany’s index fell to 3.6, while the EU's shrank to 9.3, much worse than the 17.1 and 17.6 expected. Even further, the assessment of the current situation in Germany deteriorated to -84.5 from -77.3 in August.

The US published August Retail Sales, which rose a modest 0.1% compared to a 1.1% increase posted in July. The reading, however, surpassed expectations of a 0.2% slide. The Greenback gathered near-term momentum with the news, pushing EUR/USD towards the current 1.1120 price zone. The country will later unveil August Industrial Production and Capacity Utilization for the same month, as well as July Business Inventories.

EUR/USD short-term technical outlook

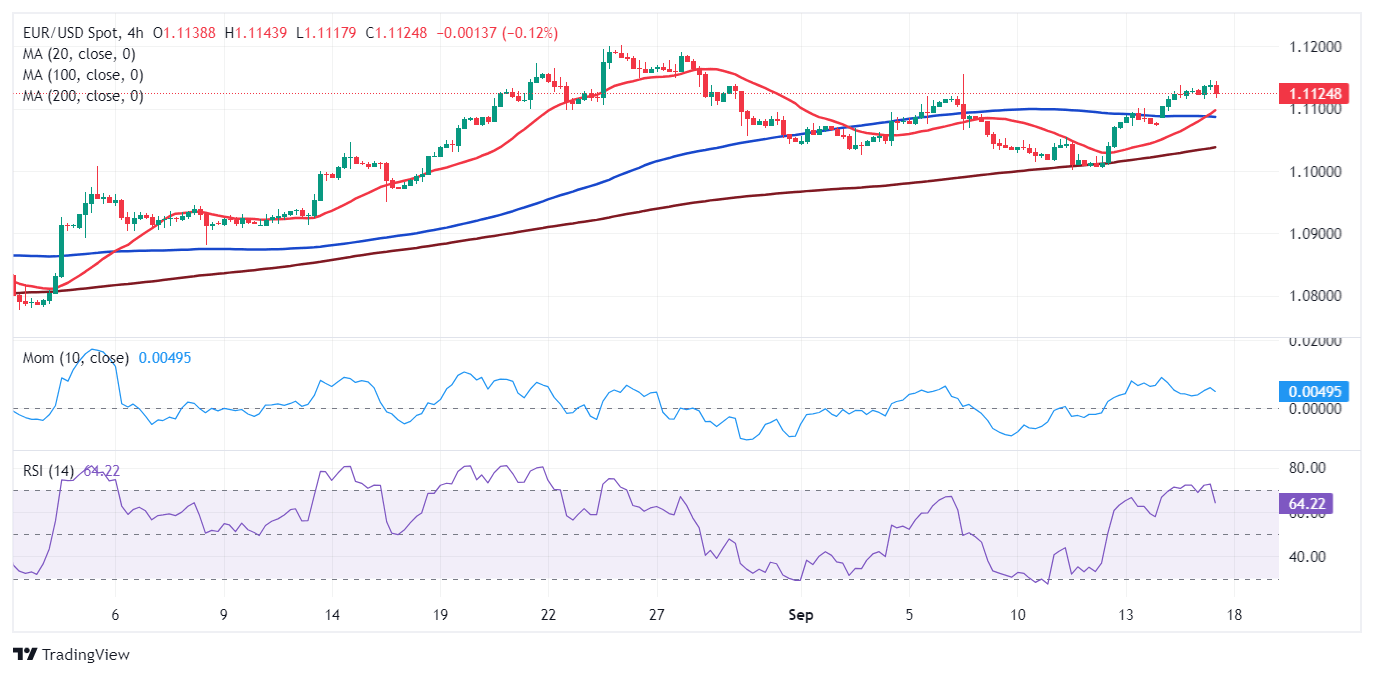

From a technical point of view, the EUR/USD pair offers a neutral-to-bullish bias. In the daily chart, the pair develops above all its moving averages, although the 20 Simple Moving Average has lost its upward strength and turned flat at around 1.1090, providing near-term support. Still, the longer moving averages stand far below the shorter one and gain bullish traction, limiting the bearish potential of the pair. Technical indicators, in the meantime, lack directional strength. The Momentum indicator is stuck at around its midline, while the Relative Strength Index (RSI) indicator hovers around 58, hinting at limited selling interest.

In the near term, and according to the 4-hour chart, EUR/USD could extend its corrective slide. Technical indicators keep retreating from their recent highs, maintaining firm downward slopes, albeit within positive levels. At the same time, a bullish 20 SMA is crossing above a flat 100 SMA, while the 200 SMA gains upward traction below the shorter ones, usually a sign of bulls´dominance.

Support levels: 1.0990 1.0950 1.0910

Resistance levels: 1.1050 1.1090 1.1140

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.