EUR/USD Forecast: Buyers ready to add on dips

EUR/USD Current price: 1.1112

- Upcoming first-tier data and earnings results exacerbate caution on Wednesday.

- The US Dollar found demand after reaching a fresh YTD low at 100.52.

- EUR/USD could extend its slide in the near term, but buyers will likely return at lower levels.

The EUR/USD pair is in retreat mode on Wednesday, as the US Dollar finally found some near-term demand, approaching the 1.1100 threshold ahead of Wall Street’s opening. The USD advance seems to be the result of some profit-taking after the Dollar Index (DYX) neared the 100 level for the first time in over a year.

Market players are turning more cautious ahead of first-tier data and upcoming earnings reports. Both the Eurozone and the United States (US) will release inflation updates by the end of the week, while NVIDIA, the AI giant, will unveil its results after the closing bell.

Meanwhile, the macroeconomic calendar had nothing relevant to offer. The EU released M3 Money Supply figures, which rose 2.3% YoY in July, missing the 2.7% expected. Across the pond, the US published MBA Mortgage Applications for the week ended August 23, up 0.5% after declining 10.1% in the previous week.

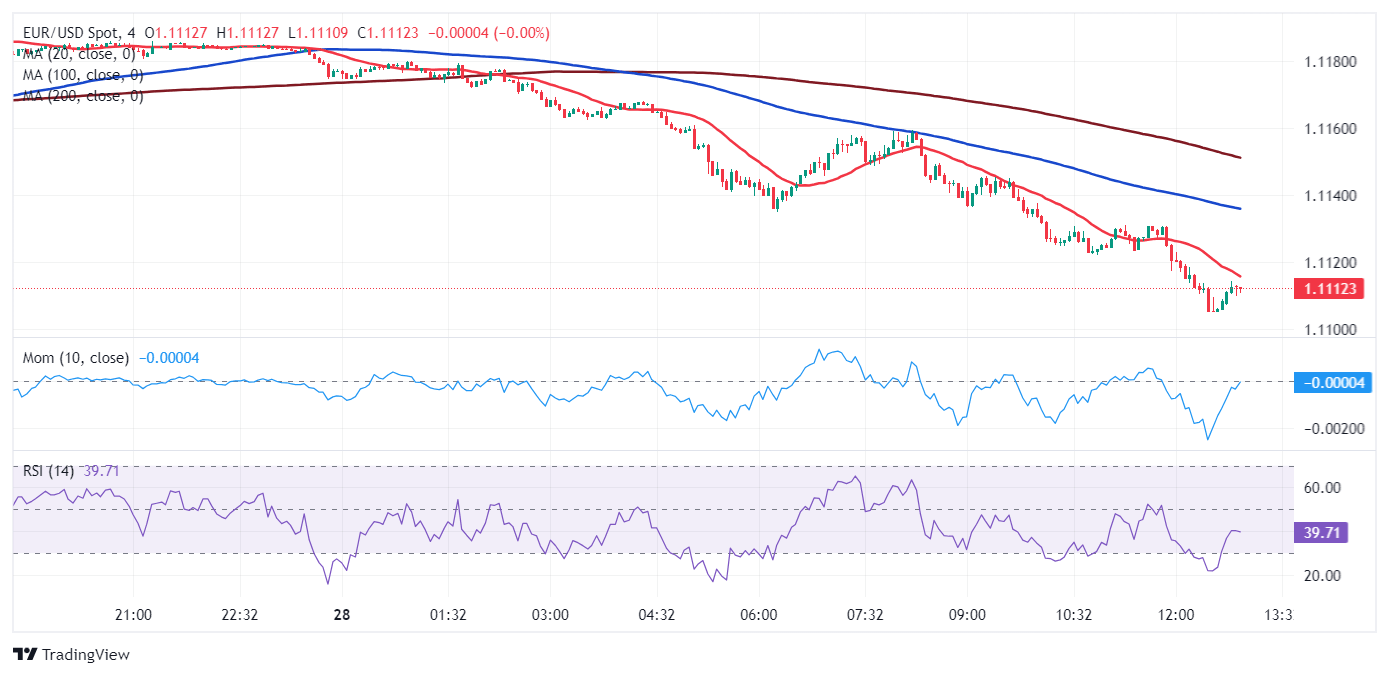

EUR/USD short-term technical outlook

From a technical point of view, the daily chart for EUR/USD shows the bearish momentum is building up, although given that the pair has already lost roughly 100 pips, the odds for additional slides seem limited. Technical indicators head firmly south within positive levels, retreating from overbought readings but still above their midlines, supporting a downward extension but far from indicating the pair has set an interim top. Finally, EUR/USD keeps developing far above a bullish 20 Simple Moving Average (SMA), while the 100 and 200 SMAs offer modest upward slopes well below the shorter one, suggesting bulls are still dominating the wider perspective.

In the near term, and according to the 4-hour chart, the risk skews to the downside. Technical indicators have pierced their midlines with strength and are currently approaching oversold readings. At the same time, the pair has broken below a flat 20 SMA, while the longer ones are losing their upward momentum far below the current level. A clear break below the 1.1100 mark could spur additional selling, although it is possible bulls will take their chances around the level.

Support levels: 1.1100 1.1065 1.1020

Resistance levels: 1.1150 1.1190 1.1240

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.