The art of the lie

S2N spotlight

It seems like the most important character trait for a successful politician is the ability to lie with a straight face. I loosely include big business executives in this category.

About 30 years ago I was working for the property division of the world’s largest mining company. We had developed a massive residential estate, probably 5000 homes, and there was an issue with a long perimeter wall collapsing. The residents were up in arms demanding the developer make good the “defective” wall. I recall our department receiving instructions from the big brass, under no circumstances to accept responsibility.

We went to the “town hall” meeting in the hall of the town we built. It was packed. My boss got up and made such a compelling speech accepting no responsibility that I thought the audience was going to actually pay the world’s largest mining company compensation for wasting their time. I remember it like yesterday; some people will do or say anything to get ahead.

The reason I bring this up is because we are witnessing liars selling a tariff story that they really don’t believe. I am not going to go into the merits of the Trump tariffs. A system reset is needed, no question; the fiscal deficit is unsustainable. However, it is very clear there is no roadmap, and not all are as all-in as the president.

On Sunday we started hearing whispers that the Treasury Secretary, Scott Bessent, was not fully across all parts of the liberation day announcement. Yesterday Elon Musk and Peter Navarro, the real Tariff Tzar, were involved in a very public spat, with Musk starting to distance himself from the trade wars. Navarro called Musk a car assembler, not a car manufacturer.

We are going to continue to see chaos in the markets and in the administration. So far the administration has been a lot more stable than the first administration. Will it continue? I personally don’t think so. With the amount of pressure being channelled towards the White House and its policymakers, I foresee cracks turning into fissures.

Look at the Average True Range (ATR) for the S&P 500 emini futures yesterday. I removed the average as I simply looked at the range of one day. In points, yesterday saw the biggest points move in 25 years and the 3rd biggest % move. That says a lot.

Silver also had a massive reversal day.

The one that I found most interesting was the bond market. The 10-Year Treasury Note hit a low of 3.972% and then reversed to 4.21%. It doesn’t feature as prominently as other big % moves, as those were mainly when interest rates were close to 0%. Yesterday was pretty big in my book.

S2N observations

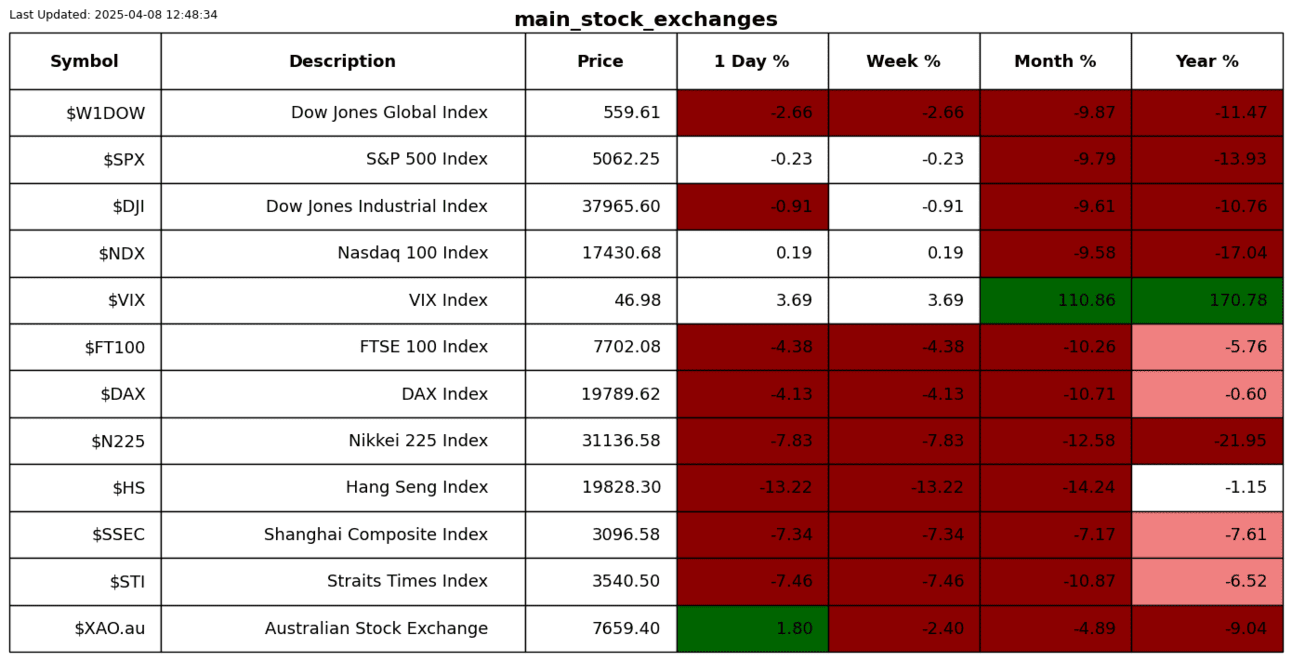

After yesterday’s -13% down day on the Hang Seng, I thought my long Hang Seng, short S&P 500 trade was blown up. It turns out it is still on, but I am nervous and not sure about it anymore, as things are now in the hands of 2 politicians. It has been a very profitable one. Do we close out and move on? I will let the dust settle a little.

Have you ever wondered what the S&P 500 did over the next 30 days after being down 10% or more in 2 days? No need to wonder; here you go. An average of 6 is not statistically significant in case you thought you could draw any signal from this.

I was interested to see if trading volume last week was anything to take note of. Turns out it wasn’t anything exceptional, if you look at the S&P 500 ETF. If this is going to turn into a proper bear market, I would expect to see a sustained pickup in volume.

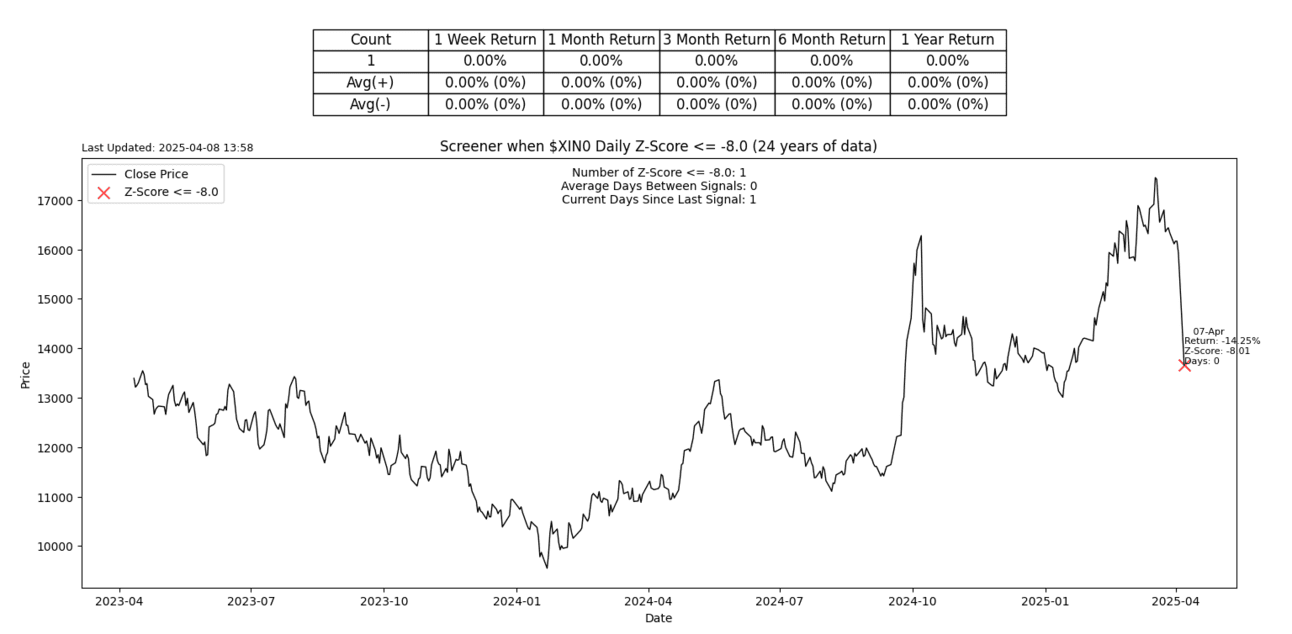

S2N screener alert

The 2 biggest movers yesterday were the Hang Seng and the China 50 Indexes; both registered negative 8 Z-scores. Those are seriously rare moves.

S2N performance review

S2N chart gallery

S2N News Today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.