EUR/USD Forecast: A test of 1.1000 in the offing?

- EUR/USD rose to five-week highs near 1.0900.

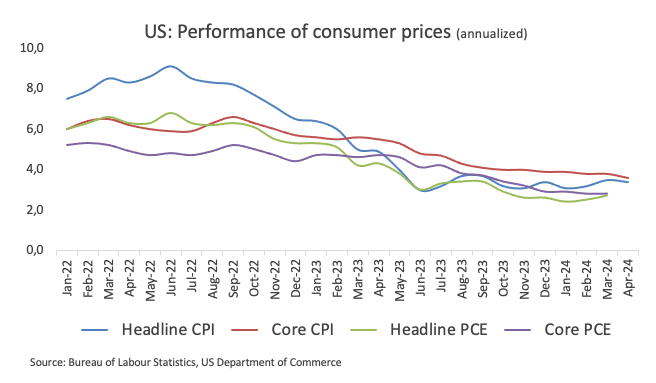

- The US Dollar sold-off in the wake of a weaker US CPI.

- US headline CPI rose by 3.4% YoY in April.

The ongoing negativity surrounding the US Dollar (USD) spurred yet another positive response in EUR/USD, this time lifting it to surpass five-week highs near the 1.0900 barrier on Wednesday.

The intense decline in the Dollar coincided with a generally negative session in US yields across various durations, all exacerbated after US inflation data tracked by the CPI showed another downtick in consumer prices in April.

This scenario continues to anticipate the Federal Reserve (Fed) embarking on its easing cycle in September, in contrast to a potential earlier onset of interest rate cuts by the European Central Bank (ECB), likely in June.

Regarding the latter, the CME Group’s FedWatch Tool indicates a 70% probability of lower interest rates in the US by September.

This idea was reinforced after Federal Reserve Chief Jerome Powell expressed his expectation of US inflation continuing to decrease through 2024, echoing last year's trend. He also indicated that it seemed unlikely for the Fed to implement further interest rate hikes.

Somewhat in contrast to Powell’s views, Minneapolis Federal Reserve Bank President Neel Kashkari reiterated on Wednesday his uncertainty regarding the level of restrictiveness in current monetary policy. He emphasized that borrowing costs "probably need to remain at their current level for a while" as US central bankers assess inflation.

Meanwhile, the unchanged monetary policy landscape underscores the divergence between the Federal Reserve and other G10 central banks, particularly the European Central Bank (ECB).

Regarding the ECB, recent statements from policymakers have suggested an increasing likelihood of the bank initiating its easing process in June, although uncertainties remain about the ECB’s future decisions beyond the summer. In this regard, de Guindos mentioned earlier on Thursday that the ECB exercises caution in predicting any trends beyond June.

Looking ahead, the relatively subdued economic fundamentals in the Eurozone, combined with the resilience of the US economy, support the ongoing Fed-ECB policy divergence narrative and favour a stronger Dollar in the longer term, especially given the growing probability of the ECB reducing rates well before the Fed.

Considering this perspective, the potential for further weakness in EUR/USD should be considered in the medium term.

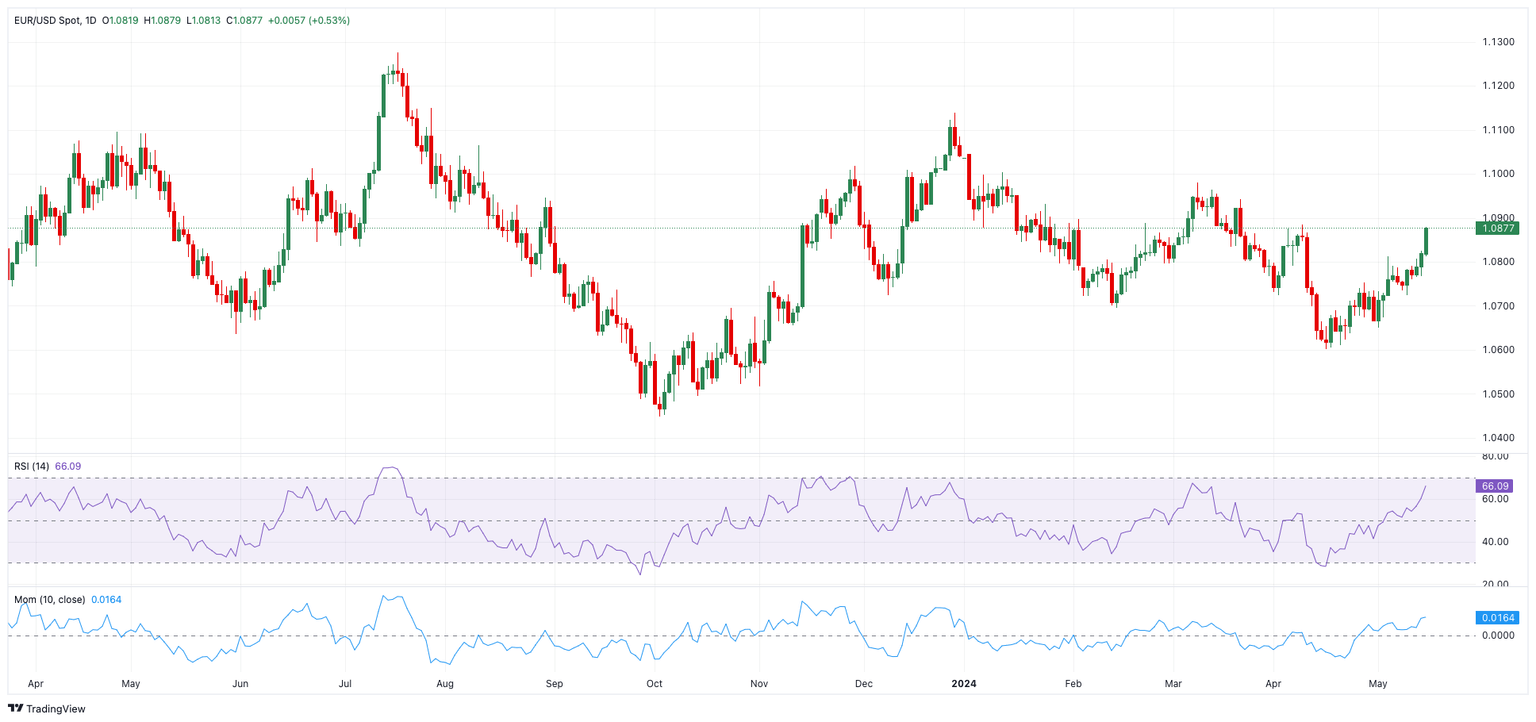

EUR/USD daily chart

EUR/USD short-term technical outlook

On the upside, EUR/USD is now projected to encounter first resistance at the April high of 1.0885 (April 9), seconded by the March top of 1.0981 (March 8), and the weekly peak of 1.0998 (January 11), all before the psychological 1.1000 level.

In the other direction, a break below the May low of 1.0649 (May 1) might bring the 2024 bottom of 1.0601 (April 16) back into focus, followed by the November 2023 low of 1.0516 (November 1). Once this zone is passed, the pair may target the weekly low of 1.0495 (October 13, 2023), then the 2023 bottom of 1.0448 (October 3) and the 1.0400 round milestone.

So far, the 4-hour chart shows a consistent upward trend. Against this, there is an instant uphill challenge at 1.0885 followed by 1.0942. Meanwhile, the initial contention emerges at 1.0766, followed by 1.0723. The relative strength index (RSI) climbed beyond 81.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.