Key highlights

- EUR/USD started a decent increase and climbed above 1.0750.

- A key bullish trend line is forming with support at 1.0700 on the 4-hour chart.

EUR/USD technical analysis

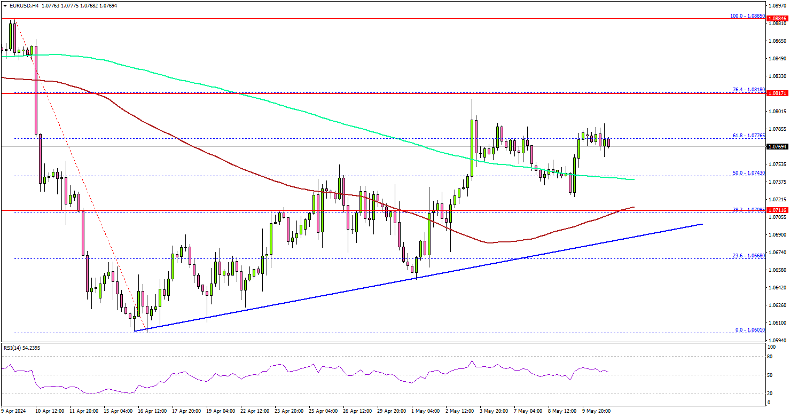

Looking at the 4-hour chart, the pair surpassed the 50% Fib retracement level of the downward move from the 1.0885 swing high to the 1.0601 low. It also settled above the 100 simple moving average (red, 4-hour) and tested the 200 simple moving average (green, 4-hour).

The bears are now active near the 1.0800 level. The first major resistance is near 1.0820 or the 76.4% Fib retracement level of the downward move from the 1.0885 swing high to the 1.0601 low.

A clear move above the 1.0820 resistance might send it toward the 1.0865 level. Any more gains might call for a move toward the 1.0920 level in the near term.

Immediate support is near the 1.0740 level and the 200 simple moving average (green, 4-hour). The next major support is at 1.0720. There is also a key bullish trend line forming with support at 1.0700 on the same chart.

If there is a downside break below the 1.0720 support, the pair might test 1.0665. Any more losses might send the pair toward 1.0600.

Titan FX is registered and regulated in New Zealand under FSP388647. Our global headquarters and operational hub is located in Auckland, New Zealand.

Recommended Content

Editors’ Picks

AUD/USD Price Analysis: Sideways trend continues unfolding

AUD/USD is in a down-leg within a narrow trading range. The pair is probably in a sideways trend with the odds favoring an extension of that trend. A decisive break above or below the top or bottom of the range would generate follow-through targets.

EUR/USD: Central banks’ decisions will keep taking their toll

The EUR/USD pair slid below the 1.0700 mark for the first time in over a month on Friday, as the US Dollar surged on the back of risk aversion. The dismal mood prevailed throughout the week, with a short-lived exception on Wednesday when softer-than-anticipated United States inflation brought a breath of fresh air.

Gold gains ground as traders dial up Fed rate cut bets for September

Gold registered limited gains this week, supported by safe-haven flows and soft inflation data from the US. In the absence of high-impact macroeconomic data releases ahead, investors will pay close attention to technical developments in XAU/USD and comments from Federal Reserve officials.

Bitcoin active addresses hit lowest level in five years, BTC ranges below $67,000

Bitcoin, the largest asset by market capitalization, has noted a decline in its active address count per data from Glassnode. A decline in active addresses is typical at a time during a surge in Bitcoin transaction fees.

Week ahead: RBA, SNB and BoE next to decide, CPI and PMI data also on tap

It will be another central-bank-heavy week with the RBA, SNB and BoE. Retail sales will be the highlight in the United States. Plenty of other data also on the way, including flash PMIs and UK CPI.