Ethereum rally to $3,700? Unlikely, say two derivatives metrics

Ether (ETH $3,514) traders experienced a shock when its price approached the $3,500 mark on June 11, leading to $90 million in ETH leveraged longs being liquidated within 48 hours. Although the decline was largely influenced by macroeconomic developments, including a revised outlook by the U.S. central bank and data on U.S. jobless claims, Ether investors have now turned bearish, as indicated by two specific metrics.

Federal Reserve’s projections partially explains the ETH price weakness

On June 12, the U.S. Federal Reserve (Fed) disclosed its interest rate projections, revealing that four officials foresee no changes until the end of 2024. The remaining 15 officials were divided, expecting either one or two cuts by the year’s end. This proved somewhat disappointing for risk-on investors, as it reduced the incentives to move away from fixed-income assets. Nevertheless, Fed Chair Jerome Powell emphasized that the labor market and price stability would remain key drivers of monetary policy decisions.

The U.S. Labor Department reported on June 13 that the number of Americans filing for new unemployment benefits had surged to a 10-month high of 242,000 the previous week. Oliver Allen, senior U.S. economist at Pantheon Macroeconomics, commented to Yahoo Finance, "High long-term rates, tight credit conditions and a gradual softening in demand are starting to weigh more heavily on businesses, and on small companies in particular."

Weak macroeconomic indicators are generally favorable for risk-on assets like Ether, as they could compel the Fed to consider interest rate cuts sooner if economic weaknesses persist. However, there's no certainty that investors will turn to alternative assets like cryptocurrencies in a challenging economic climate, and the lack of a U.S. spot Ether exchange-traded fund (ETF) only adds to the uncertainty.

According to Fox Business journalist Eleanor Terrett, Gary Gensler, Chair of the U.S. Securities and Exchange Commission, has indicated that it could take up to three months to approve the S-1 filings for individual Ether ETFs. This delay is partially why investors are becoming increasingly cautious about purchasing bullish ETH derivatives, alongside other factors such as a decline in decentralized applications activity.

Ether derivatives show softer demand for bullish positions

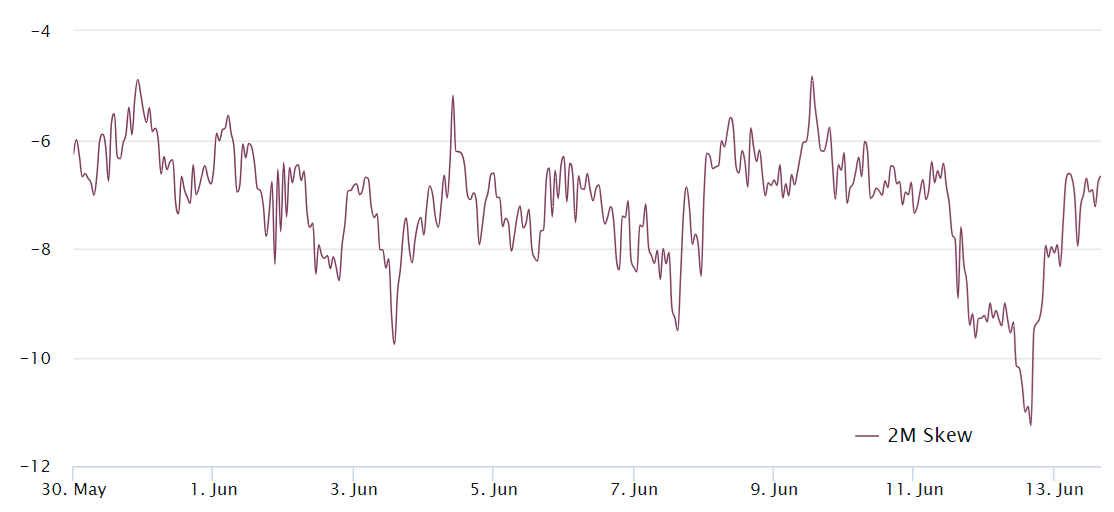

The delta skew measures the relative demand for bullish versus bearish options. A negative skew indicates a higher demand for call options (buy), while a positive skew suggests a preference for put options (sell). Neutral markets typically exhibit a delta skew ranging from -7% to +7%, signifying balanced pricing between call and put options.

Ether 2-month options 25% delta skew. Source: Laevitas.ch

Between June 11 and June 12, the Ether 25% delta skew entered the bullish territory as it dropped below -7%. However, this optimistic sentiment faded on June 13 after Ether failed to hold above the $3,600 mark, leading traders to price in similar probabilities of positive and negative ETH price movements.

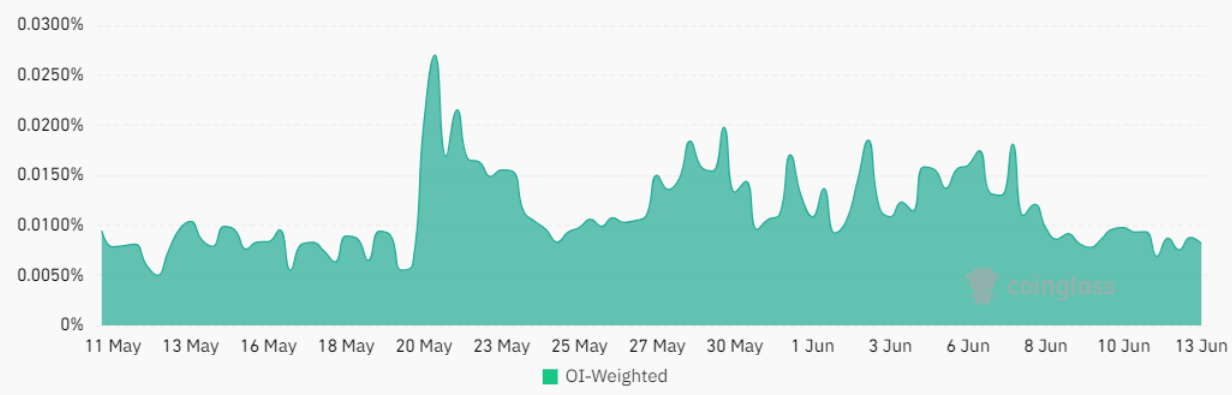

Retail traders often opt for perpetual futures, a type of derivative that closely tracks the price movements of the underlying spot markets. To manage balanced risk exposure, exchanges enforce a fee every eight hours, known as the funding rate. This rate becomes positive when buyers (longs) demand more leverage and turns negative when sellers (shorts) require additional leverage.

Ether perpetual futures 8-hour funding rate. Source: Coinglass

Currently, the Ether perpetual funding rate has stabilized at 0.01% per 8-hour period, translating to 0.2% per week. Such a rate is generally considered neutral, particularly since periods of heightened activity can drive the weekly cost for leveraged long positions up to 1.2%. Notably, the funding rate was at 0.035% per week on June 6, indicating that sentiment has deteriorated over the past week.

Given that Ether derivatives were unable to maintain elevated optimism levels, despite the potential catalyst of an upcoming U.S. spot ETF and macroeconomic data indicating a weakening job market, the likelihood of ETH surpassing $3,700 in the near term appears diminished.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.