EUR/USD breaks support at 1.1620/00

EUR/USD, USD/CAD, GBP/CAD

EURUSD breaks support at 1.1620/00 so this is now working as resistance. It is difficult to trade the pair as the daily ranges are small & we are mostly trading sideways.

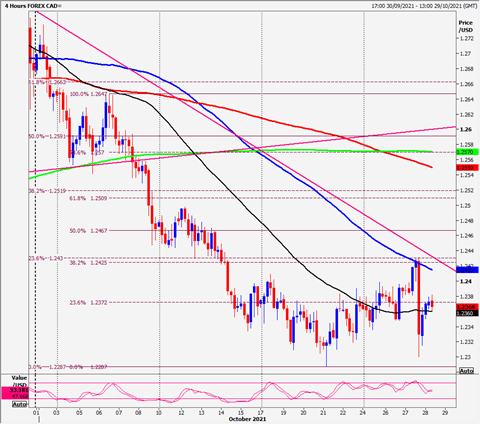

USDCAD shorts at first resistance at 1.2420/40 this trade worked perfectly on the collapse to 1.2370 & as far as first support at 1.2300/1.2280. Longs here also this trade worked perfectly on the bounce to 1.2370 for an easy 120 pip profit on the day.

GBPCAD shorts at first resistance at 1.7050/70 handed a quick & easy 150 pip profit yesterday.

Daily analysis

EURUSD holding below first resistance at 1.1610/20 targets 1.1580 & 1.1540/30. A break below 1.1520 is an important medium term sell signal.

A break above 1.1620 however can target resistance at 1.1665/75. Next we look for a test of minor resistance at 1.1690/99. Exit longs & try shorts with stops above 1.1720.

USDCAD same levels apply for today with first resistance at 1.2420/40. Shorts here stop above 1.2450. Be ready to buy a break above 1.2450 targeting 1.2510/30.

Shorts at 1.2420/40 target 1.2370 then support at 1.2300/1.2280. Longs here need stops below 1.2270 for a sell signal.

GBPCAD shorts at first resistance at 1.7050/70 worked perfectly on the collapsed to our targets of 1.6950/40 & 1.6910/1.6890 for an easy 150 pip profit yesterday. Ultimately we are looking for the target of 1.6870/60, perhaps as far as support at 1.6800/1.6780.

We can try shorts again at first resistance at 1.7050/70 but must stop above 1.7090. A break higher is a buy signal targeting a selling opportunity at 1.7155/75 with stops above 1.7195.

Author

Jason Sen

DayTradeIdeas.co.uk