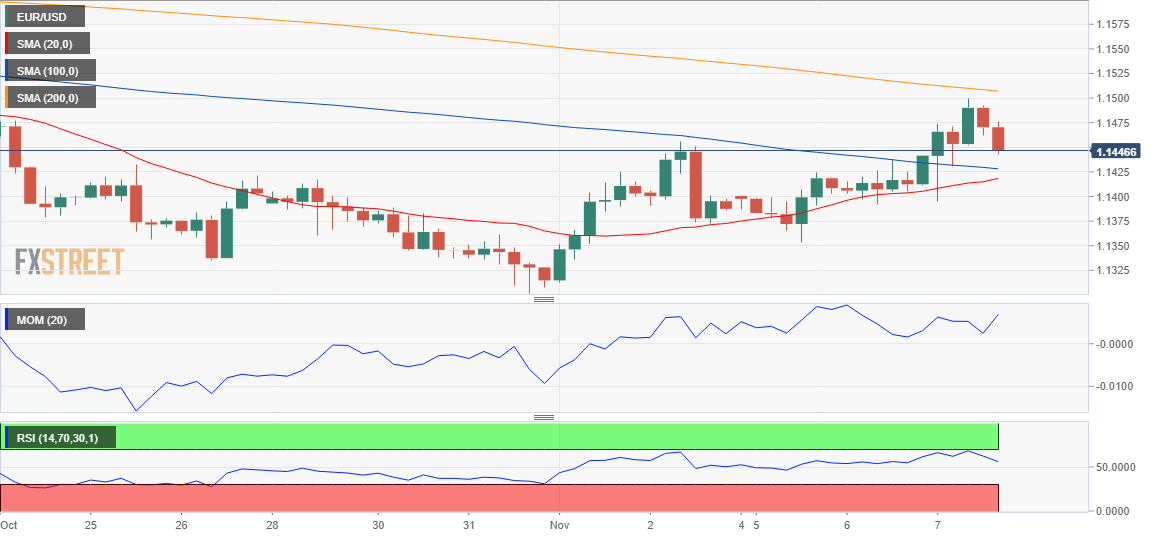

EUR/USD Current price: 1.1446

- US mid-term elections granted Democrats the House majority, Republicans retained Senate.

- US Federal Reserve having a "non-live" meeting this Thursday, not expected to surprise.

US Mid-term elections came and went and the result was quite alike to what market players have anticipated. Democrats took the House, getting at the time being 220 seats, while Republicans reaffirmed their majority in the Senate with 51 places. The turnout was the highest in almost 5 decades, as high as 47% while the Houses will have a record number of female representatives. The dollar reacted negatively to the result, but equities welcomed the shift. US indexes rallied to fresh monthly highs while the EUR/USD pair hit 1.1499 before retreating some, as investors are now focused in the next macroeconomic hurdle, the US Federal Reserve meeting. The central bank will unveil its latest decision this Thursday, although this is one of those considered a "non-live" meeting, which means there won't be updated forecasts, neither a press conference afterward. The EU Commission will release earlier in the day fresh growth forecast, although the market's reaction to the documents tends to be limited.

The EUR/USD pair advanced up to the 38.2% retracement of the September/October slide, a major resistance level around 1.1500 that once broken, could maintain the pair on the upside during the next few sessions. From a technical point of view, and according to the 4 hours chart, the pair retains the positive tone, despite the latest pullback from the key resistance, as it seems comfortable above the 20 and 100 SMA, although still below the 200 SMA, currently around 1.1520. Technical indicators have lost their upward strength, but stabilized in overbought levels, indicating that buyers are still controlling the pair. Given that the US Federal Reserve is not expected to surprise, sustained gains above the mentioned 1.1520 level, should open the doors for an extension beyond the 1.1600 figure.

Support levels: 1.1425 1.1390 1.1350

Resistance levels: 1.1485 1.1520 1.1560

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD clings to small gains above 1.0700 ahead of data

EUR/USD trades marginally higher on the day above 1.0700 on Tuesday after EU inflation data for April came in slightly stronger than expected. Market focus shifts to mid-tier US data ahead of the Fed's policy announcements on Wednesday.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. Investors await macroeconomic data releases from the US.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.