EUR/USD Current price: 1.1462

- US government partial shutdown becoming an accelerator to an economic slowdown.

- December US core inflation figures in line with the Fed's medium-term target.

The EUR/USD pair gave back half of its weekly gains last Friday, closing around 1.1460, amid a sudden return to the greenback. There was no particular catalyst triggering dollar's recovery, although profit-taking ahead of this week events and renewed fears of a global economic slowdown, played their part. These last were fueled by market talks suggesting that China plans to downgrade this year's economic growth target. Market's attention these days will focus on the Brexit's deal vote in the UK Parliament, and the US partial government shutdown, now officially the longest on record, and with no expectations that it would be solved anytime soon. The American currency was also supported by December CPI, as despite headline monthly inflation fell 0.1%, amid lower oil prices, the core readings, which exclude the volatile food and energy components, was up 0.2% MoM and 2.2% YoY, steady above the Fed's medium-term target.

The US government partial shutdown means that multiple macroeconomic figures won't be out until things normalize, with the US calendar pretty much empty this Monday. It also means the government keeps losing money, and while just around 25% of government offices are closed, the accumulated losses in the past 3 weeks are of about $3.6B, according to Trump’s own chief economist, spurring concerns about an economic slowdown. Adding to the doom and gloom feared by the market, about 800,000 federal workers didn't get their paychecks last Friday. That said, the greenback could benefit from runs to safety, but lacks strength of its own to rally.

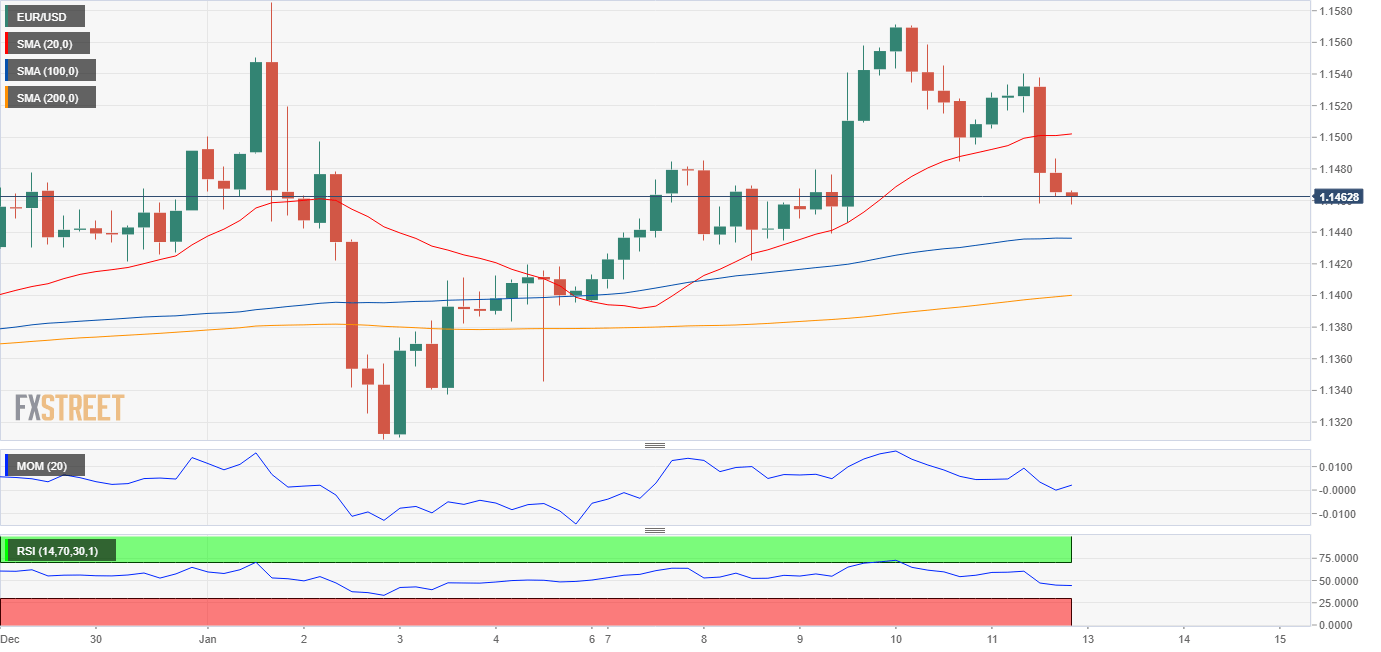

The EUR/USD pair tested and retreated from the 23.6% retracement of its 2018 decline, which reduces chances of a sustainable recovery ahead. In the daily chart, it's now trading a handful of pips below a flat 100 DMA, still above a mildly bullish 20 DMA currently at around 1.1410. Technical indicators in the mentioned chart, technical indicators have turned sharply lower within positive ground, now nearing their midlines, indicating an increasing risk of a bearish extension. Shorter term, and according to the 4 hours chart, technical indicators have also turned sharply lower, with the Momentum now pressuring its mid-line and the RSI already into negative ground at 44. In this last chart, the pair accelerated south after breaking below its 20 SMA, also a sign of mounting downward pressure.

Support levels: 1.1420 1.1385 1.1340

Resistance levels: 1.1500 1.1530 1.1570

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bank of Japan keeps interest rate steady, as expected

The Bank of Japan (BoJ) board members decided to hold the key interest rate steady at 0%, following its April monetary policy review meeting on Friday. The decision came in line with the market expectations.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.