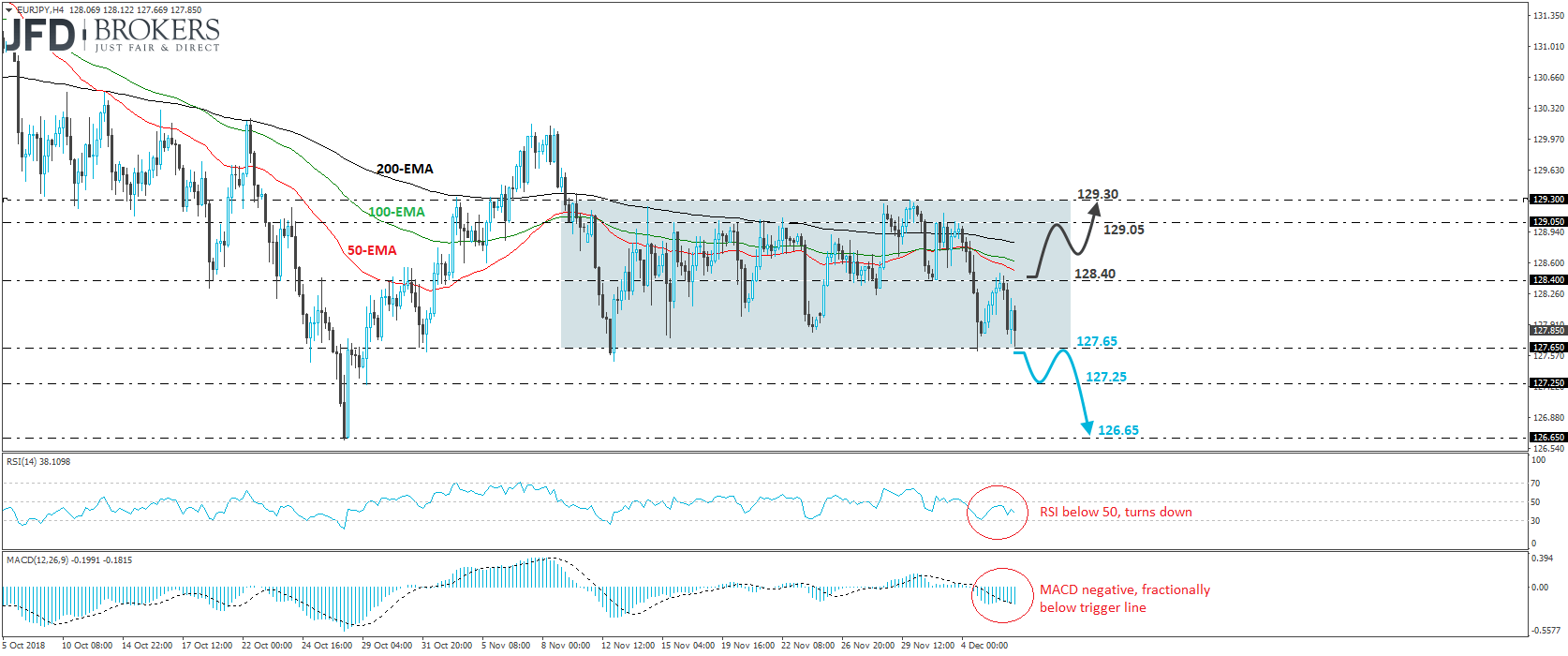

EUR/JPY traded lower on Thursday, after it hit resistance fractionally above the 128.40 barrier, marked by the inside swing low of the 30th of November, on Wednesday. That said, the slide was stopped once again by the 127.65 barrier, which is the lower end of the sideways range that’s been containing the price action since the 9th of November. Bearing in mind that the pair continues to trade within that range, we will adopt a neutral stance for now.

However, given that the rate is also trading near the lower end of the range, we see more chances for a downside exit rather than an upside one. If the bears prove strong enough to overcome the 127.65 hurdle soon, then we may see them driving the battle towards our next support of 127.25, defined by the low of the 29th of October. Another dip below 127.25 could carry more bearish implications, perhaps opening the way for the low of the 26th of that month, at around 126.65.

Shifting attention to our short-term oscillators, we see that the RSI, already below 50, has turned down, while the MACD lies within its negative territory and has just touched its toe below its trigger line. These indicators detect negative momentum and support our view that a downside exit out of the range is more likely than an upside one.

Now, in case we see a rebound above 128.40, we would take it as a signal that traders want to keep the pair within the range for a while more. We could then see a recovery towards the 129.05 level, the break of which could aim for the upper bound of the sideways range, at around 129.30.

The content we produce does not constitute investment advice or investment recommendation (should not be considered as such) and does not in any way constitute an invitation to acquire any financial instrument or product. JFD Group, its affiliates, agents, directors, officers or employees are not liable for any damages that may be caused by individual comments or statements by JFD Group analysts and assumes no liability with respect to the completeness and correctness of the content presented. The investor is solely responsible for the risk of his investment decisions. Accordingly, you should seek, if you consider appropriate, relevant independent professional advice on the investment considered. The analyses and comments presented do not include any consideration of your personal investment objectives, financial circumstances or needs. The content has not been prepared in accordance with the legal requirements for financial analyses and must therefore be viewed by the reader as marketing information. JFD Group prohibits the duplication or publication without explicit approval.

72,99% of the retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Please read the full Risk Disclosure: https://www.jfdbank.com/en/legal/risk-disclosure

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of key US data

EUR/USD trades in a tight range above 1.0700 in the early European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays above 156.00 after BoJ Governor Ueda's comments

USD/JPY holds above 156.00 after surging above this level with the initial reaction to the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.