Chart of The Week: EUR/GBP Price Analysis, bullish to 0.9060, although pullback to support first?

- EUR/GBP is bullish, holding above key levels.

- There is the risk of a pullback prior to the onward extension.

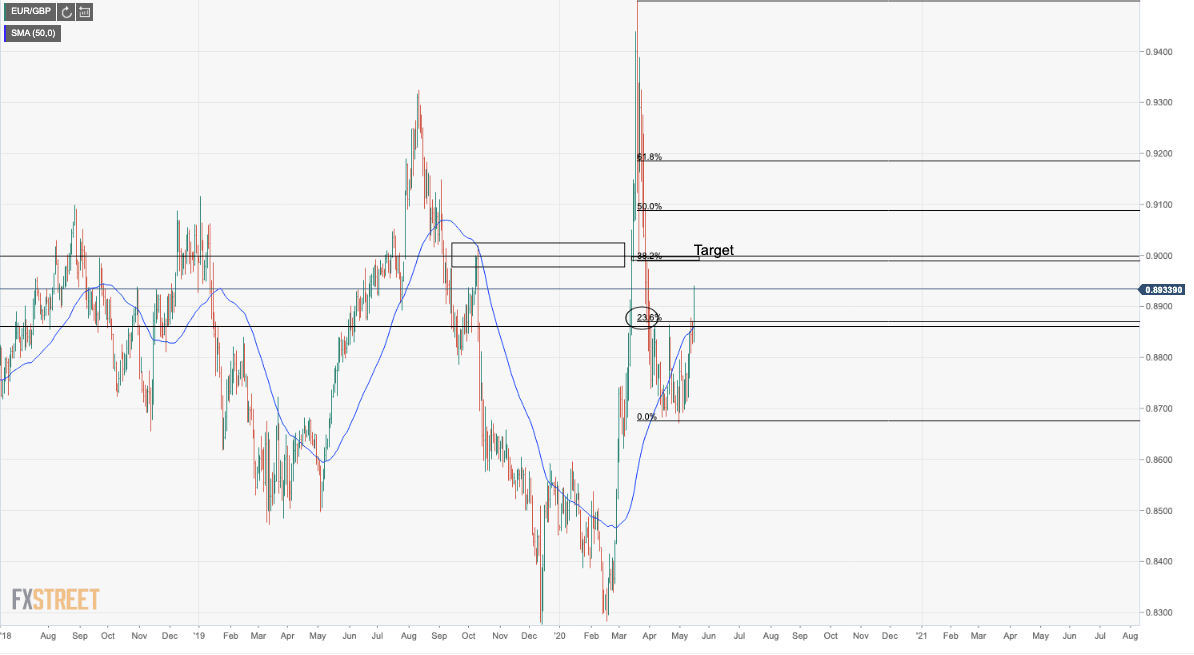

EUR/GBP has been on the advance and running through stops. The price has advanced from a low of 0.8667 to a high of 0.8939 since February with sights on the 0.90 handle having now cleared a key resistance area in the 0.8860s.

There is the risk of a pullback prior to the onward extension with a test below 0.89 the figure, bringing back the prior 0.8864/65 resistance level into the target. Considering the close above here, an upside bias remains favoured, technically. However, below there, 0.8700 and then the April lows of 0.8671 come into play.

EUR/GBP monthly chart

The Fibonacci lining up with key levels provides confluence for which traders like. We have a 38.2% key target around the round 0.90 level. To the downside, 23.6% comes in as potential support:

Zooming in, the daily chart and 50-day moving average line up with the 23.6% and prior highs as offering a convincing support target.

4-HR chart

The support zone is a compelling pullback level, that should it hold, bulls will be inclined to stay with the trade into the 0.90s. 0.9060 comes as a key level in the 0.90 handle.

Meanwhile, fundamentals support a weaker pound in the open for this week: Ministers move coronavirus teams back to no‑deal Brexit planning – Sunday Times

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.