Boris Johnson has been named the new Tory leader and therefore soon-to-be the new UK Prime Minster. He will officially start his new job tomorrow. Johnson beat Jeremy Hunt convincingly, securing 66% of the vote. The pound, which has taken a battering over the past couple of months, was actually coming off its lows before the announcement was made and when the news hit the wires, it hardly reacted. The market's reaction suggests the hard-line Brexiteer‘s success over Jeremy Hunt was already priced in. Mr Johnson's victory is likely to trigger further MP resignations with the Chancellor Phillip Hammond already declaring that he will step down and David Gauke has resigned as Secretary of State for Justice. BoJo has a lot of work today in a short period of time. He doesn't have too much time until October 31 Brexit deadline, and with the long summer recess coming up. But for now, there is at least some certainty in that we know for certain who the new PM will be.

As far as traders are concerned, I think the most important takeaway points are: (1) BoJo's victory was already priced in, and (2) the legal framework is in place to prevent a hard Brexit. With that in mind, the pound may not go down too much further from here. In fact, it could end up pushing higher in the early days of Johnson's leadership. Even so, ongoing Brexit uncertainty will likely cap the gains for the pound in the medium term. Therefore, don't expect the moon, but equally don't be surprised if the pound were to spike higher and show some bullish price action for a while.

Market participants are now looking ahead to the upcoming European Central Bank meeting on Thursday. Fresh Eurozone PMIs will be published tomorrow and German Ifo will come in on Thursday morning. These may trigger some volatility in the euro, although which direction the single currency will head to will almost certainly depend on the ECB. The central bank has been pushing out its rate hike expectations, but the markets will now be wondering whether it will instead talk up the prospects of loosening – rather than tightening – its monetary policy, and soon. With the Fed set to cut rates in the last week of July, and other major central banks having already loosened their policies or turned dovish, the ECB could very well prepare the markets for more stimulus or even negative interest rates. The euro could drop sharply if that turns out to be the case, while if the ECB is not as dovish as many expect them to be then watch out for a short squeeze rally.

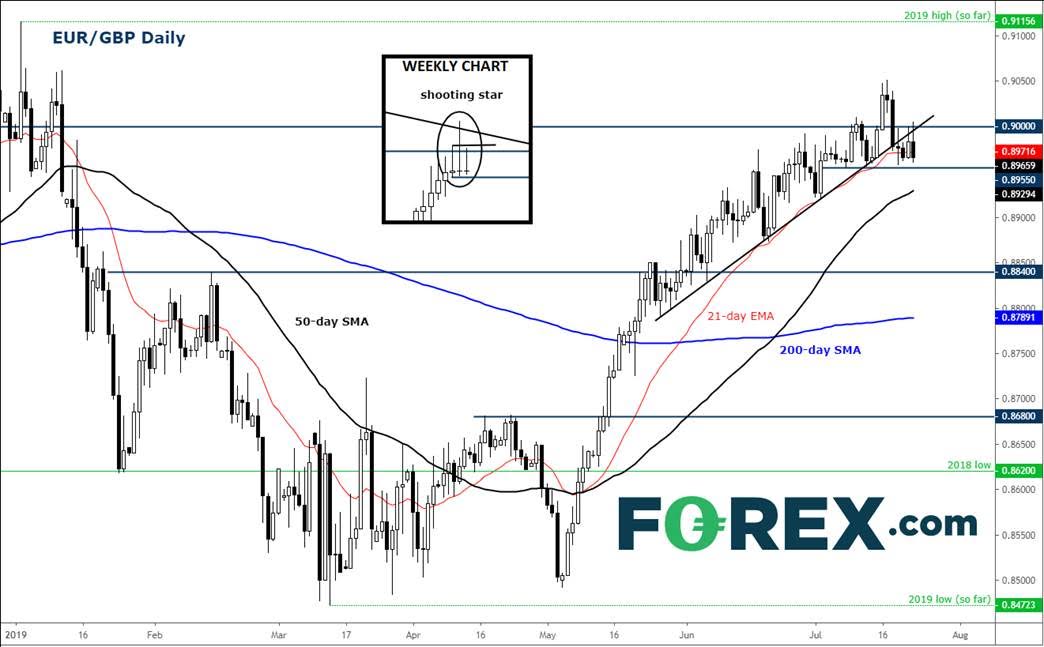

Clearly the pound and then the euro will all be in focus over the coming days. The EUR/GBP may already have created a top after it printed a shooting star/gravestone doji candle on the weekly around the psychologically-important 0.90 handle where it also met a long-term bear trend. With rates potentially reversing here, traders may wish to watch horizontal support at 0.8950/55 closely now. A break below this support level could trigger further technical selling for the rest of the week - especially if the move is supported by a more-dovish-than-expected ECB on Thursday.

Figure 1:

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Pepe price forecast: Eyes for 30% rally

Pepe’s price broke and closed above the descending trendline on Thursday, eyeing for a rally. On-chain data hints at a bullish move as PEPE’s dormant wallets are active, and the long-to-short ratio is above one.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.