Ether surges helped by institutional investors and DeFi usage

The sell-off of US stocks accelerated as market worries about inflation continued. The Dow Jones lost more than 470 points in the regular session while the S&P 500 index declined by 40 points. The situation continued in the futures market, where the main indices are in the red. Similarly, Asian indices also declined to a monthly low, with the Nikkei 225 and Hang Seng declining by more than 1%. The ongoing sell-off is largely down to inflation fears as prices rise. Broadly, most commodities like lumber, copper, and iron ore have surged to record highs as demand continues to rise. Therefore, the US inflation numbers to be released today will be closely watched. If they show that prices rose faster than expected, it could push equities lower.

The British pound retreated slightly during the Asian session as traders waited for the latest UK GDP numbers. Economists expect the data to show that the UK economy contracted by 6.1% in the first quarter after falling by 7.3% in the previous quarter. The Office of National Statistics (ONS) will also publish the latest manufacturing and industrial production data for March. Other key numbers will be the latest trade balance, business investments, construction output, and industrial production, among others. The Sterling has been on an upward trend this week after the recent parliamentary election in Scotland and after the strong housing and retail sales numbers. Andrew Bailey, the Bank of England (BOE) governor will testify today, which could also affect the currency.

The top focus among traders will be on the latest US consumer inflation numbers. Economists polled by Reuters expect the data to show that the headline CPI rose by 3.6% on a year-on-year basis. This number will mostly be because the CPI crashed in April last year as the pandemic started. Therefore, most traders and analysts will focus on the month-on-month (MoM) data. Analysts also expect that the core CPI rose by 0.3% and 2.3% on a MoM and YoY basis, respectively. Other key numbers to watch today will be crude oil inventories by the EIA and real earnings numbers.

GBP/USD

The GBP/USD retreated to 1.4117, which was slightly below this week’s high of 1.4168. On the hourly chart, the pair formed a double-top pattern near the highest level this week. It is slightly above the neckline of this price action. Further, the price has moved slightly below the 25-day moving average. It is also slightly above the 23.6% Fibonacci retracement level. Therefore, since a double-top is typically a reversal pattern, the pair could continue retreating today as traders eye the 23.6% retracement at 1.4080.

EUR/USD

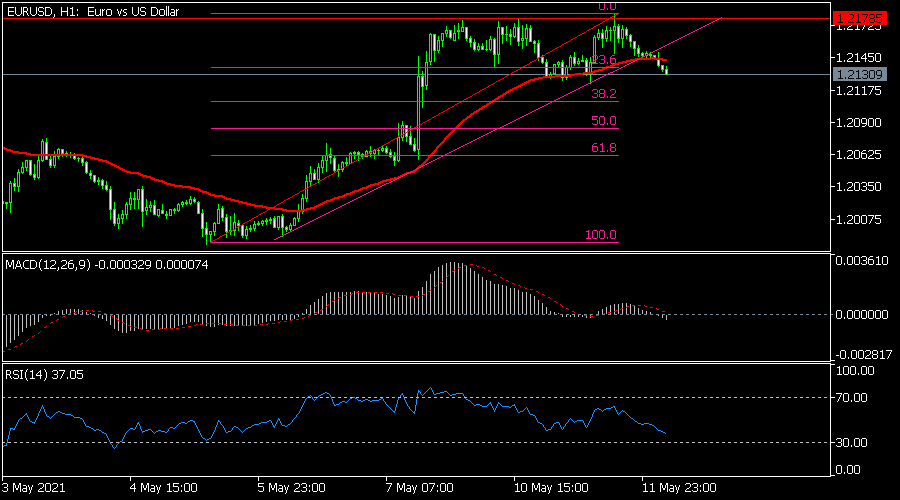

The EUR/USD rose to a high of 1.2178 this week where it formed a triple-top pattern whose neckline is at 1.2130. On the hourly chart, the pair has moved below the 25-day moving average and the ascending trendline. At the same time, oscillators like the Relative Strength Index and MACD have continued to retreat. It has moved below the 23.6% Fibonacci retracement level. Therefore, the pair may keep falling, with the next target being the 38.2% retracement level at 1.2110.

ETH/USD

The ETH/USD pair bounced back after it retreated on Tuesday. It surged to an all-time high of 4,250. On the four-hour chart, the pair remains above all moving averages and the Ichimoku cloud. Oscillators like the RSI and Stochastic are also hovering at the overbought level. It has also formed an ascending channel pattern that is shown in pink. Therefore, the pair may keep rising as bulls target the next psychological level of 4,500.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.