In its weekly note to clients, Morgan Stanley argues that the cross-currents of negative flow dynamics and upward pressure from risk appetite may keep EUR without a clear trend in the near term.

Here are MS' explanation for some of these cross-currents along with their structural strategy to trade the EUR over the course of their year.

4 cross-currents in play:

"First, EUR inflation rates have continued undershooting expectations. Indeed, inflation momentum itself has fallen fast in recent months, leading some to question whether the ECB’s recent stimulus efforts will be enough. Of the G4, Europe faces the slowest core inflation momentum as pointed out by our inflation strategists Global Inflation Monitor. 5 year inflation swaps have declined by almost 20bps taking inflation expectations back to levels last traded in October. Nominal rate expectations have come down in line with falling inflation rates increasing opportunity costs of holding EUR liquidity.

Second, while the ECB disappointed markets by failing to increase monthly asset purchases, it did cut interest rates even further into negative territory. We think reserve managers are particularly sensitive to negative rates as they violate the principle of capital preservation. The IMF’s latest COFER data show that reserve managers continue to bring the EUR share of their portfolios down. The start of the new year and fresh liquidity has given reserve managers a window to resume their structural diversification out of EUR.

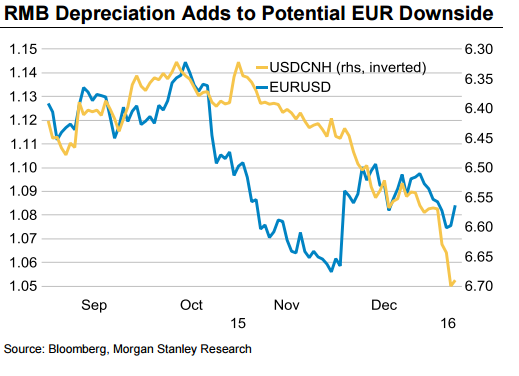

Third, the RMB has declined not only against the USD, but as well in TWI terms. This has increased global deflationary pressures where trade to China is significant and where there are open economies impacted by the evolution of global trade. EMU falls in these categories, so when the RMB moves the EUR tends to follow.

Finally, the EUR is now better suited for funding. On the funding side we differentiate between maturity neutral funding and what is widely understood as the carry trade. Carry trade funding involves investors monetising interest rate differentials but accepting maturity mismatches between generally shorter funding and longer investment time horizons. Hence carry trades are less stable than maturity-neutral funding situations," MS clarifies.

What is the trade?

MS likes short EURJPY as a structural trade over the course of the year.

"In the the end, we would not go so far as to say that the EUR’s lower beta to risk is permanent; it has only been a few days of activity. But there are certainly structural weights on the EUR that are not apparent in JPY. For this reason our forecasts still imply another 10% of downside in EURJPY this year," MS projects.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.