The following are the intraday outlooks for EUR/USD, USD/JPY, and EUR/GBP as provided by the technical strategy team at SEB Group.

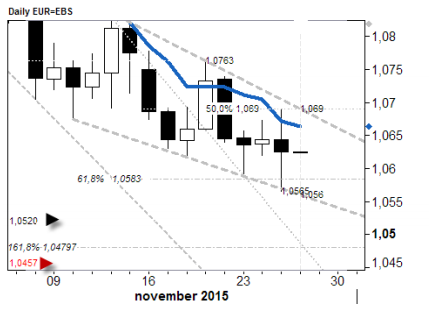

EUR/USD: Still in the 'Wedge'. The mid-body point attracted selling as thought and the market remains below the bearishly sloped (Fibo-adjusted) 1.065 8day "Tenkan-Sen" line now at 1.0665. But support at lower end of the wedge (1.0665/60) was also respected. A break outside 1.0560 or 1.0690 is now needed to show the way short-term. Current intraday stretches are located at 1.0540 & 1.0700.

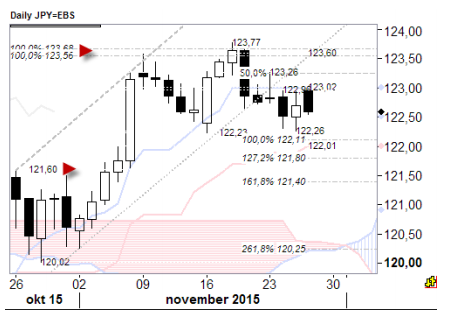

USD/JPY: Should be able to test the low-122s. With two important resistance pockets at 122.96\02 and 123.26. the move down from the 123.77 high should at least have some fuel left and test the 122.11"Equality point" (with numbers around it at 122.26/122.01 also worth keeping in mind). The next lower set of refs are located at 121.80/60 and levels there should not be forgotten either. A move over 123.26 would be renewed bullish for a fresh high, topping the 123.77 score.

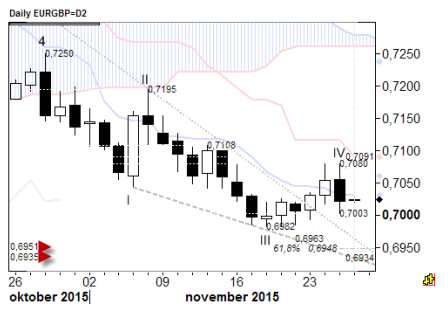

EUR/GBP: Bearish print exposes 0.6982 again. The market U-turned near the still bearishly sloped 21day "Kijun-Sen" line (0.7091). This ended up with a bearish daily candle added,which exposes the recent low of 0.6982. But multiple supports at/above the Jul low of 0.6935 ought to shore up losses later. First key short-term resistance is located at 0.7080\0.7108.

'This content has been provided under specific arrangement with eFXnews.'

eFXnews is a financial news and information service. Articles and other information distributed in this service and published on this site are provided in general terms and do not take account of or address any individual user's position. To the extent that some of these articles include suggestions as to various possible investment strategies which users might consider, they do so in only general terms without reference to the personal factors which should determine any user's investment decisions to buy or sell a specific security or currency.

The service and the content of this site are provided and distributed on the basis of “AS IS” without warranties of any kind either, express or implied, including without limitations, warranties of title or implied warranties of merchantability or fitness for a particular purpose. eFXnews and its employees, officers, directors, agents, and licensors do not also warrant the accuracy, completeness or timeliness of the information in any of the articles and other information distributed in this service and included on this site, and eFXnews hereby disclaims any such express or implied warranties; and, you hereby acknowledge that use of the service and the content of this site is at you sole risk.

In no event shall eFXnews and its employees, officers, directors, agents, and licensors will be liable to you or any third party or anyone else for any decision made or action taken by you in your reliance on any strategy and/or advice included in any article and other information distributed in this service and published in this site.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.