Dollar rises as higher inflation puts pressure on the Fed

The British pound retreated while the FTSE 100 index bounced back after the relatively strong UK GDP numbers. The FTSE rose by 0.60% while sterling fell by about 0.10%. Data by the UK government revealed that the economy contracted by 1.5% on a quarter-on-quarter basis and by 6.1% on a year-on-year basis. It rose by 2.1% in March. Further, the construction, manufacturing, and industrial sectors continued to bounce back in March. In general, this performance is mostly because the UK reached a Brexit deal with the European Union in December and the fact that the country has made substantial progress with vaccinations. Therefore, there is a possibility that the Bank of England will start signaling its desire to taper in the next meeting.

The US dollar rose slightly after the much-awaited US consumer inflation data. According to the statistics agency, the headline CPI rose by 0.8% in April after rising by 0.6% in the previous month. The CPI rose by 4.2% on a year-on-year basis. Core CPI, which excludes the volatile food and energy prices, rose by 0.9% on a MoM basis and by 3% on a YoY basis. The YoY rate was higher because consumer prices crashed in April 2020 as the US government started to implement lockdowns. Still, some analysts, including Janet Yellen caution that the rising inflation is temporary. The data came at a time when the prices of most commodities like corn, gold, iron ore, and copper has kept rising.

The euro wavered after the relatively weak data from Europe. According to Eurostat, industrial production in the Eurozone increased by 0.1% in March. This was higher than the previous decline of 1.2% but worse than the expected increase of 0.7%. In Germany, the headline CPI increased from 0.5% to 0.7% on a MoM basis. It rose to 2.0% on a YoY basis. In France, the headline CPI declined from 0.6% to 0.1%. This performance is mostly because many European countries maintained some lockdowns to curb the spread of the virus in April. Therefore, since countries have boosted their vaccination efforts, there is a possibility that they will soon return to growth.

EUR/USD

The EUR/USD pair declined today after the mild data from Europe and the strong US CPI numbers. The pair is trading at 1.2095, which is slightly above the 61.8% Fibonacci retracement level. The RSI has moved to the oversold level on the hourly chart. It has also moved below the 25-day moving average. Therefore, the pair may retreat further, with the next target being the psychological level at 1.2000.

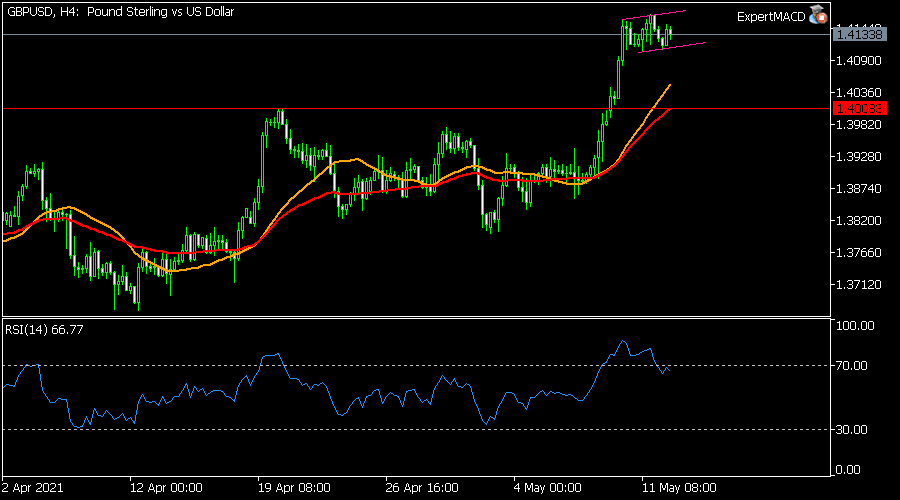

GBP/USD

The GBP/USD declined slightly after strong data from the UK. On the four-hour chart, the pair is still close to the highest level since February 25. Notably, the pair has formed a bullish flag pattern that is shown in pink. It is also slightly above the 25-day and 15-day moving averages. It is also above the important support at 1.4000. Therefore, the pair may soon have a bullish breakout since a bullish flag is a continuation pattern.

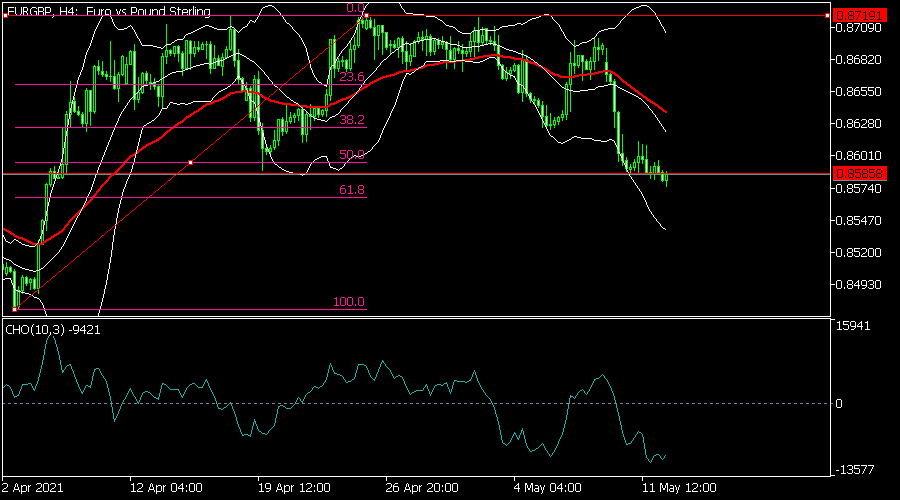

EUR/GBP

The EUR/GBP pair declined to a low of 0.8575, which was its lowest level since April 7. On the four-hour chart, the pair managed to move below the important support of 0.8585. It is between the lower and middle lines of the Bollinger Bands while the Chaikin Oscillator has moved below the neutral line. It is also approaching the 61.8% retracement level. Therefore, the path of least resistance for the pair is lower.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.