The dollar fell after the US president criticized the Federal Reserve and its rate hikes policies. In an interview with CNBC, the president said that the rate hikes were not beneficial to the country. He compared the rate hikes with those of the competing countries. The EU has maintained low-interest rates and pledged to start hiking in summer next year. He followed up the interview with a series of tweets criticizing the Fed’s tightening policy and blaming China and the EU of manipulating their currencies.

Other central banks like the BOJ, BOC, and RBA have all maintained low-interest rates. Chinese yen has fallen to the lowest level in years. A stronger dollar makes it more difficult for the US to export because of the price of its exports. However, the Fed is unlikely to change its tightening policies, which could lead to a higher dollar.

There was unease in the markets today after Donald Trump threatened to impose tariffs on Chinese goods worth $505 billion. In the interview with CNBC, the president argued that China had taken advantage of the US with its high tariffs, intellectual property theft, and other anticompetitive practices. He also argued that China had no choice but to lower its barriers because it does more business with the US than the US does with it. Such tariffs would be a major blow to the existing world trading order and may usher in a full-blown trade war. Meanwhile, in Germany, Angela Merkel said that the US tariffs on European cars would be a threat to the livelihoods of many people.

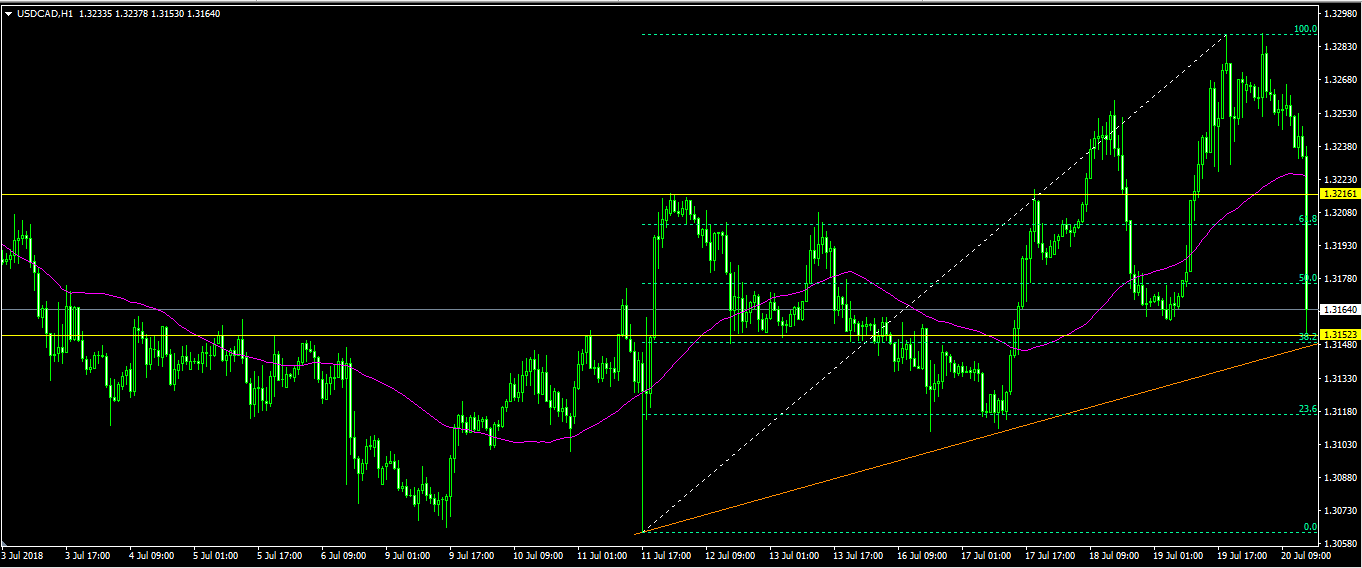

The Canadian dollar jumped against the US dollar after Statistics Canada released the consumer price numbers for the month of June. In the month, the CPI rose at an annual rate of 2.5%, which was higher than the expected 2.4%. In May, the CPI rose by 2.2%. The core CPI, which excludes the volatile food and energy products rose by 1.3%, which missed the consensus forecast of 1.4%. It was unchanged from that of May.

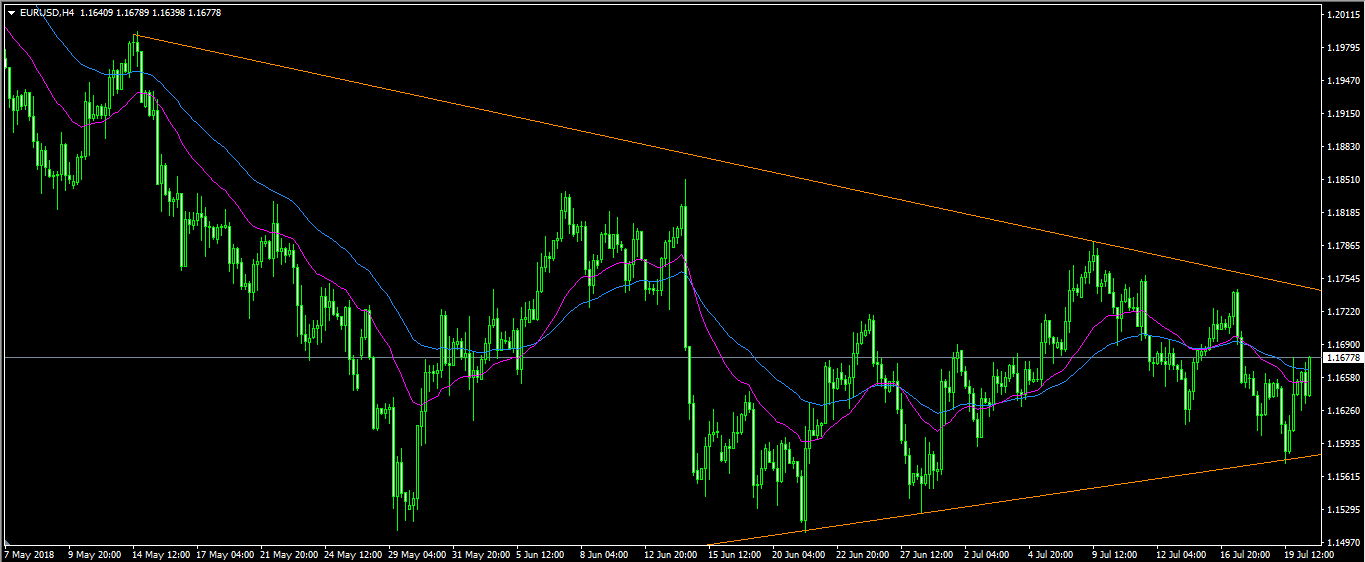

The EUR/USD pair traded slightly higher today following the comments from the US President. It is now trading at 1.1670. On the chart below, the pair is forming a symmetrical triangle and the price seems headed to the important resistance level of 1.1745. However, because the president does not influence the monetary policy decisions, the pair could reverse and test the important support level of 1.1575.

USD/CAD

The USD/CAD pair fell sharply after Canada’s CPI number beat the consensus forecast. It is now trading at 1.3160, which is the lowest level since yesterday. The increasing inflation coupled with recent positive economic numbers could mean a rate hike soon from the BOC. The current price is above the 50-day EMA and is at the 38.2% Fibonacci Retracement level. Further downward movements will likely take the pair to the important 1.3810 level, which is also the 23.6% Fibonacci Retracement level.

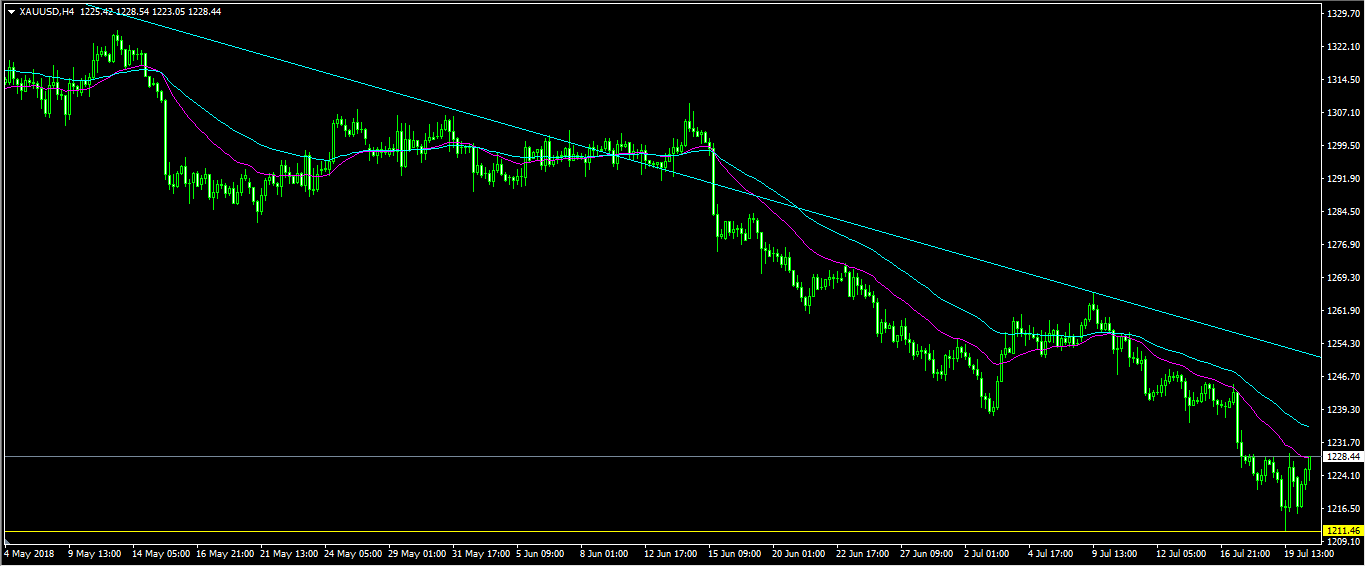

XAU/USD

Gold felt some relief today after Trump’s comments on interest rates brought the dollar lower. The XAU/USD is now trading at $1227, which is higher than the weekly low of $1210. In the past months, gold – together with other metals – have fallen mostly because of the stronger dollar. The price is in line with the 25-day EMA and lower than the 50-day EMA. It is unlikely that the Fed will follow Trump’s advice on easing, which means that the downward trend on the pair will likely resume.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.