Dollar and gold continue to shine even as sentiment improves [Video]

![Dollar and gold continue to shine even as sentiment improves [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/DollarIndex/dollars-roll-gm178824866-25196405_XtraLarge.jpg)

Market Overview

There is an almost daily swing on market sentiment as traders grapple with the bigger picture implications of COVID-19. The dissemination of newsflow out of China is looking to be more positive. Although the total number of deaths has topped 2000, the numbers of daily new cases and deaths are now falling. Furthermore, the official information is that Chinese businesses are getting back to work following weeks of shutdown and quarantine. Traders are faced with a dilemma of whether they can rely on the official data. Levels of pollution and electricity usage have been often used as more reliable gauges in the past and will need to be watched as to whether they marry up with the official data. It does seem as though knee-jerk reactions to bad news (Apple’s revenue warning being the latest) tend to last for a day or so before traders refocus on the dovish leanings of central banks and a continued tendency to “climb the wall of worry”. For markets, there is a more settled outlook to sentiment forming today. Through all of this, the dollar remains a go-to destination of capital choice, whilst gold is also playing strongly. What is interesting though, is that sentiment on the oil markets has turned a corner, with an appetite to buy into weakness now increasingly prevalent.

Wall Street closed lower last night with the SP 500 -0.3% at 3370. However, with US futures looking perky today, around +0.3% back higher, this is allowing a decent Asian session (Nikkei +0.9%, Shanghai Composite -0.3%). European markets are taking this positively, with FTSE futures +0.7% and DAX futures +0.6% pointing to decent early gains today. In forex, there is a positive risk skew to majors, with JPY underperforming and a rebound for AUD and NZD. Once more we see EUR supported early in the European session, but can the cycle of sell-offs be broken and be translated into a recovery? In commodities, gold continues to climb higher by +$3 (+0.2%), whilst oil is also supported and is over half a percent higher.

The key data on the economic calendar kicks off with UK CPI at 0930GMT. Headline UK CPI is expected to fall by -0.4% in January but this would still mean a year on year improvement to +1.6% (from +1.3% in December). Core UK CPI is expected to drop by -0.6% on the month but the year on year reading is expected to increase slightly to +1.5% (from +1.4% in December). Into the afternoon, the focus is on inflation for the US, but this time it is the PPI, or factory gate inflation. US PPI is at 1330GMT and is expected to see headline PPI increase to +1.6% in January (from +1.3% in December), whilst core PPI is expected to pick up to +1.3% (from +1.1% in December). US Building Permits at 1330GMT are expected to increase slightly to 1.450m (from +1.420m in December). US Housing Starts are expected to fall to 1.425m (from 1.608m in December). The FOMC minutes for the January meeting are at 1900GMT where the focus will be on what the Fed had to say about the impact of the Coronavirus and inflation.

There are also a couple of Fed speakers to watch out for today. Neel Kashkari (voter, big dove) speaks at 1445GMT whilst Robert Kaplan (voter, centrist) speaks at 1830GMT.

Chart of the Day – German DAX

The fate of German equities seems to be somewhat decoupled from that of a sluggish German economy. The outlook for the DAX remains strong as it has been hitting all-time highs in recent days. The question is whether yesterday’s downside gap from 13,754 changes this. The fact is that cash DAX does gap around a lot, and it would appear that the technical analysis saying that “gaps close” for some reason does not seem to apply to the DAX. What does seem to be more relevant is that the DAX is paying attention to old pivot areas. So the support at 13,576/13,640 is the first basis that the bulls need to work from. This comes as the momentum indicators have taken note of yesterday’s slip, but with little real impact yet. The RSI has ticked back below 60 once more and Stochastics crossed lower, so these need watching now. Could this now begin a near term retracement again? Our base case is for weakness to be bought into on the DAX and the pivots of old breakout levels are supportive. With yesterday’s session opening at the low, the selling pressure never really took hold and that is a positive coming into today’s session. We look for support at 13,576 to hold and the bulls build once more for further moves on the all-time high of 13,795. The main support band near term is at 13,360/13,425.

WTI Oil

The development of this recovery is increasingly encouraging for the bulls. Throughout January we saw intraday rallies consistently being sold into. This has now completely flipped around, where we see intraday weakness as a chance to buy. A run of higher lows is now forming. The reaction of the bulls to first a drop to $50.60 and now during yesterday’s session to $50.90 shows there has been a change of sentiment on oil. There is a base pattern now completing above $52.15 which implies around $2.80 of further recovery towards the resistance band $54.75/$55.00. The conviction in the move is aided further, by an impressive turnaround in momentum, where MACD lines are moving higher following a bull cross, as are Stochastics. The 23.6% Fibonacci retracement (of $65.65/$49.30) around $53.15 is a barrier to overcome, but there really does seem to be some more steel to the bulls now. We are buyers into weakness and back a recovery towards $54.75/$55.00.

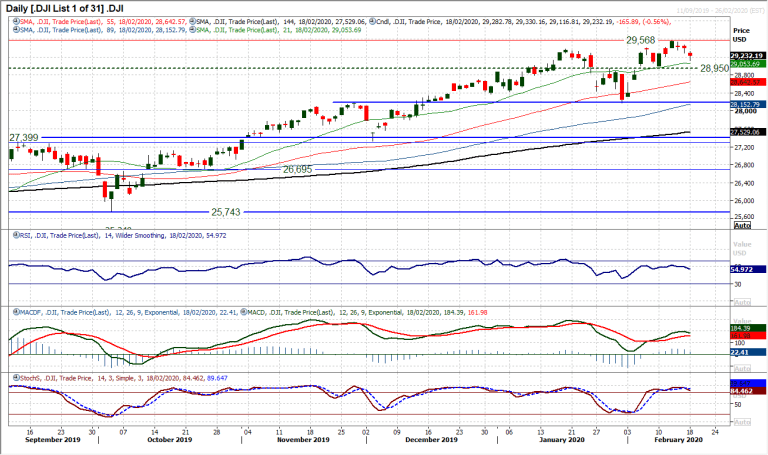

Dow Jones Industrial Average

After a run of three consecutive sessions lower, the bulls will be wondering whether this is a mild unwind or a more considerable corrective move. The pivot support band 28,950/29,000 will be a key gauge now for the near to medium term outlook. With US futures suggesting the formation of support initially today, the reaction to any early gains will also be a signal. Daily momentum indicators are just beginning to tail off and if an intraday rally is sold into today, then this correction could continue to gather pace. The hourly chart is suggesting that this recent move has unwound stretched momentum and has helped to renew upside potential, but it is a fine balance now. A breach of 28,950 would be a corrective signal and the bulls would be looking to use yesterday’s low of 29,116 to build from. Resistance is at 29,400 to be breached for bulls to regain outright control. We still see weakness as a chance to buy for further pressure on the all-time high of 29,568.

Other assets insights

EUR/USD Analysis: read now

GBP/USD Analysis: read now

USD/JPY Analysis: read now

GOLD Analysis: read now

Author

Richard Perry

Independent Analyst