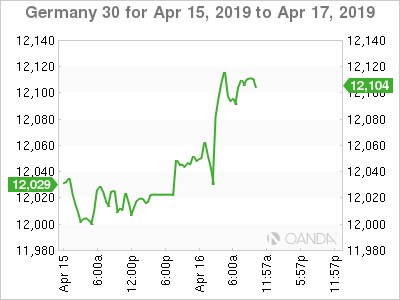

The DAX index has posted strong gains on Tuesday. Currently, the DAX is at 12,106, up 0.72% on the day. Earlier in the day, the index touched its highest level since October 1. In economic news, German ZEW Economic Sentiment improved to 3.1, beating the estimate of 0.9. The all-eurozone indicator followed suit, rising to 4.2, above the forecast of 1.2 points. On Tuesday, the eurozone releases CPI and OPEC members hold a meeting in Vienna.

The well-respected German ZEW economic sentiment survey is a key gauge of investor confidence and can have a strong effect on market direction. This was the case on Tuesday, as a strong score has sent the DAX higher. The indicator has been mired in negative territory for the past 12 months, and finally climbed into territory in April. The score of 3.1 points to slight optimism on the part of institutional investors and analysts. The eurozone indicator showed a similar trend, climbing to 4.5 points, its first gain since May. The improvement in investor mood is attributable to the Brexit extension, which will give the parties time until October to try to reach a resolution to the deadlock. The ZEW said that investors were hopeful that the global economy would develop “less poorly” than expected. At the same time, eurozone growth remains weak and Germany is expected to cut its growth forecast for 2019, a result of a drop in exports.

The economic slowdown in China has rocked equity markets worldwide, but there are signs that the world’s second largest economy is moving upwards. There was relief on the weekend, as China’s trade surplus surged to USD 32.64 billion. Last week, Chinese CPI posted a gain of 2.3%, its best gain in 5 months. A key test is on Tuesday, with the release of Chinese GDP. Third-quarter growth edged lower to 6.4%, and the estimate for Q4 stands at 6.3%. Although these are very strong growth rates, the downward trend has investors worried, and a weak GDP reading could send equities lower.

Commodities Weekly: Gold pressured by risk bulls

Economic Calendar

Tuesday (April 16)

-

5:00 German ZEW Economic Sentiment. Estimate 0.9. Actual 3.1

-

5:00 Eurozone ZEW Economic Sentiment. Estimate 1.2. Actual 4.5

Wednesday (April 17)

-

4:00 Eurozone Current Account. Estimate 33.2B

-

5:00 Eurozone Final CPI. Estimate 1.4%

-

5:00 Eurozone Final Core CPI. Estimate 0.8%

-

5:00 Eurozone Trade Balance. Estimate 16.8B

-

All Day – OPEC Meetings

Previous Close: 12,020 Open: 12,030 Low: 12,022 High: 12,116 Close: 12,106

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD advances toward 1.1200 on renewed US Dollar weakness

EUR/USD is extending gains toward 1.1200 on Friday, finding fresh demand near 1.1150. Risk sentiment improves and weighs on the US Dollar, allowing the pair to regain traction. The Greenback also reels from the pain of the dovish Fed outlook, with Fedspeak back on tap.

Gold hits new highs on expectations of global cuts to interest rates

Gold (XAU/USD) breaks to a new record high near $2,610 on Friday on heightened expectations that global central banks will follow the Federal Reserve (Fed) in easing policy and slashing interest rates.

USD/JPY recovers to 143.00 area during BoJ Governor Ueda's presser

USD/JPY stages a recovery toward 143.00 in the European morning following the initial pullback seen after the BoJ's decision to maintain status quo. In the post-meeting press conference, Governor Ueda reiterated that they will adjust the degree of easing if needed.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.