EUR/USD

4 hour

The EUR/USD broke below the long-term support trend line (green), which could be explained via a continuation of wave C (blue) or alternatively a wave 3 if price expands below the 161.8% Fibonacci target.

1 hour

The EUR/USD is building a bear flag chart pattern (purple).A break below the flag could see price head towards the Fibonacci targets. A break above resistance could see price invalidate wave 4 (orange).

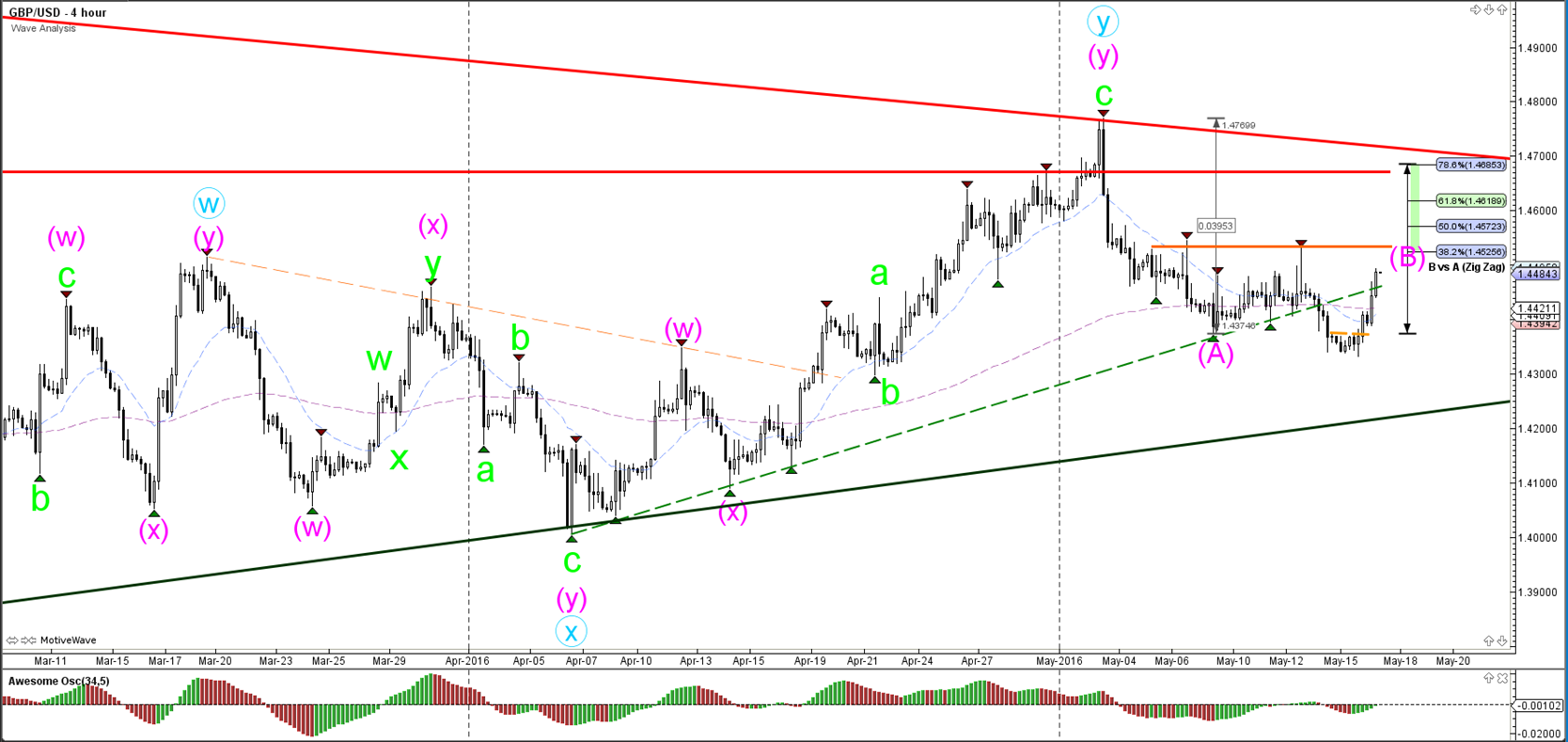

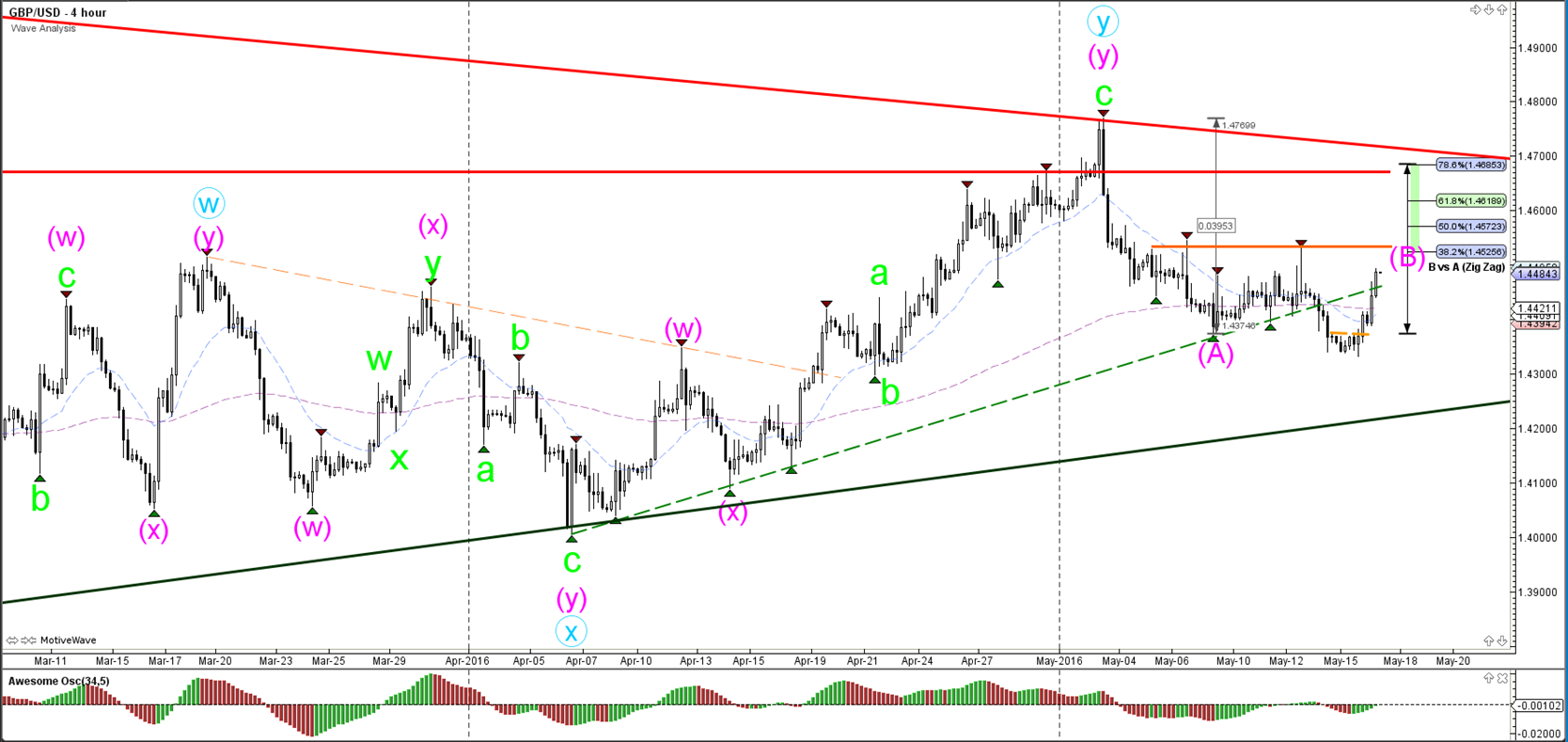

GBP/USD

4 hour

The GBP/USD rally has shown strong bullish momentum, which makes it unlikely that price is in a bearish wave C (pink). The wave B (pink) has therefore been put back on the chart and the Fibonacci levels are potential resistance levels.

1 hour

The GBP/USD was unable to break below the 127.2% Fibonacci level of X vs W. The break above resistance (orange dotted) trend line has seen price rally quickly. Now price is near resistance again and the Fibonacci levels are areas where price could struggle or turn.

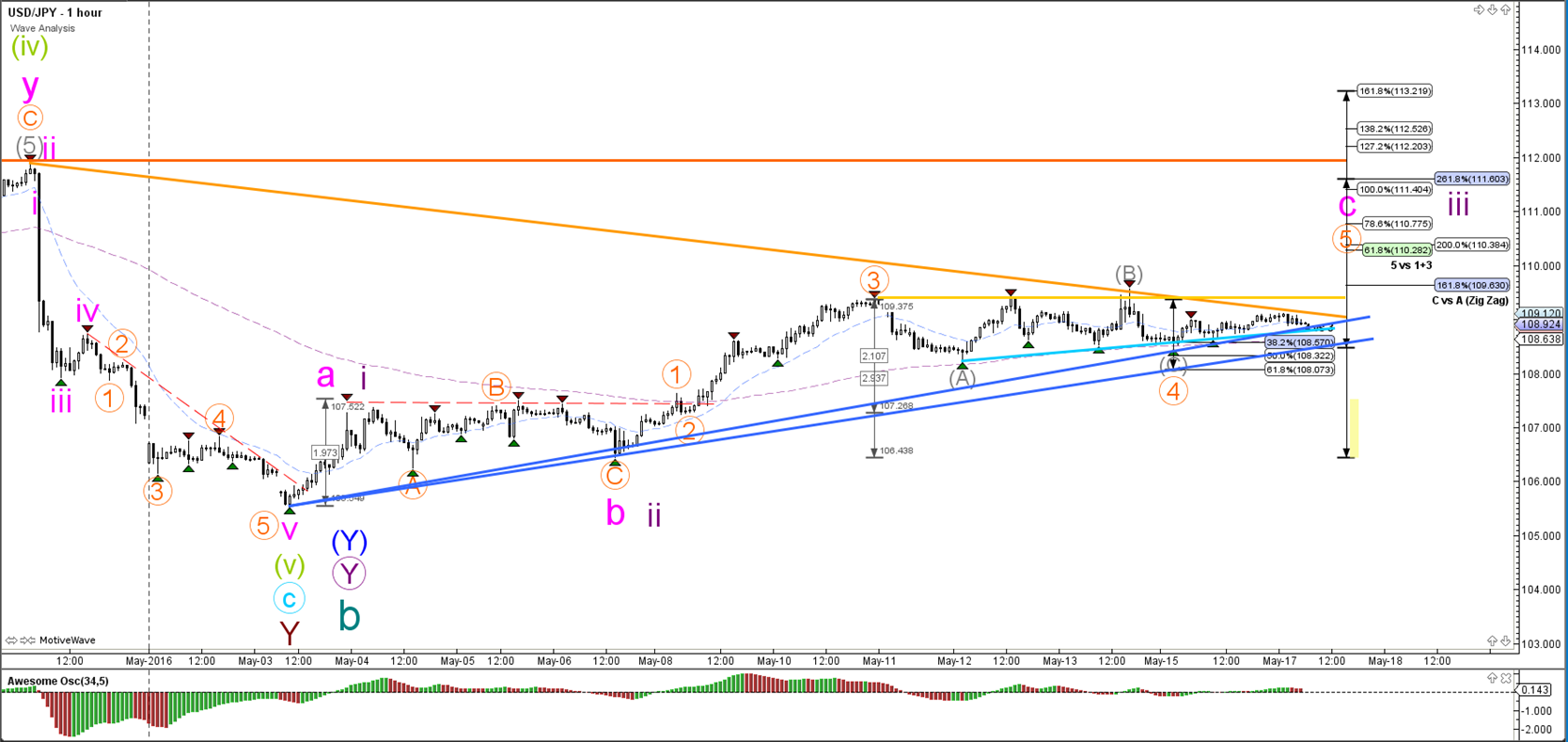

USD/JPY

4 hour

A potential USD/JPY break above the 161.8% Fibonacci target favors a wave 3 (purple) whereas a bearish break below the support trend line (blue) makes a wave C (pink) more likely.

1 hour

The USD/JPY is moving sideways between support (blue) and resistance (orange). The indecision zone is marked by these trend lines and has become quite large in the meantime. A breakout with a strong 4 hour candle close is therefore preferred to avoid false breakouts. This means a bearish candle with a close near the low and a bullish candle with a close near the high.

Elite CurrenSea Training Program(s) should not be treated as a recommendation or a suggestion to buy or sell any security or the suitability of any investment strategy for Student. The purchase, sale, or advice regarding any security, other financial instrument or system can only be performed by a licensed Industry representative; such as, but not limited to a Broker/Dealer, Introducing Broker, FCM and/or Registered Investment Advisor. Neither Elite CurrenSea nor its representatives are licensed to make such advisements. Electronic active trading (trading) may put your capital at risk, hence all trading decisions are made at your own risk. Furthermore, trading may also involve a high volume & frequency of trading activity. Each trade generates a commission and the total daily commission on such a high volume of trading can be considerable. Trading accounts should be considered speculative in nature with the objective being to generate short-term profits. This activity may result in the loss of more than 100% of an investment, which is the sole responsibility of the client. Any trader should realise the operation of a margin account under various market conditions and review his or her investment objectives, financial resources and risk tolerances to determine whether margin trading is appropriate for them. The increased leverage which margin provides may heighten risk substantially, including the risk of loss in excess of 100% of an investment.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.